Data Analysis: Financing in Australia's cooler renewables climate

The news this week that the Australian federal government has finally reached an agreement with the opposition Labor party over the renewable energy target (RET) should breathe some life into the country's dormant renewables market.

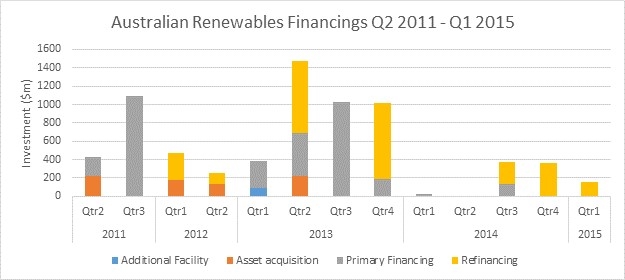

Data from IJGlobal show that financings for greenfield renewables projects in Australia have practically disappeared since the Abbott administration came to office in the third quarter of 2013. From that period onwards, three out of the subsequent six quarters witnessed no new investment, while the other three saw a fraction of earlier quarterly investment.

During this period, deal flow has comprised almost exclusively refinancings. Sponsors of existing projects have sought to take advantage of better commercial terms that are available post-construction. M&A activity - previously a source of regular deal flow, especially among Asian developers - has also disappeared as investors have stopped looking at the market due to the policy uncertainty.

The largest spike in financing occurred in Q2 2013, before the new Abbott government came to office, when investment volumes for greenfield projects surpassed $1 billion. Sponsors of major projects, including the 20MW Royalla solar farm, the 149MW Portland wind project and the 106.8MW Taralga wind farm, rushed in early Q3 2013 to close financings -before the change of government and the anticipated decline in policy support.

Such a spike followed by a sharp decline in new investments is not unprecedented. The third quarter of 2011 witnessed a steep rise in investment followed by a decline. This occurred, interestingly, during a period when Labor - traditionally seen as friendlier to renewables investment than the Liberals - was in office.

The biggest reason for investor flight since the election has been the review of the country’s RET, which takes place every two years and sets out the amount of energy to be produced from renewable sources by 2020. This is the main determining factor among Australia’s utilities when deciding whether to enter into new power purchase agreements (PPAs), and thus affects investment volumes.

The Abbott administration is certainly not known for being enthusiastic about renewables. It pushed to reduce the RET target from 41,000GWh and finally agreed on a compromised target of 26,000GWh with Labor earlier this week. But one development that should give confidence is that it has scrapped the two-yearly review process.

Australia might not witness similar investment levels as before, but this should end the boom-and-bust culture.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.