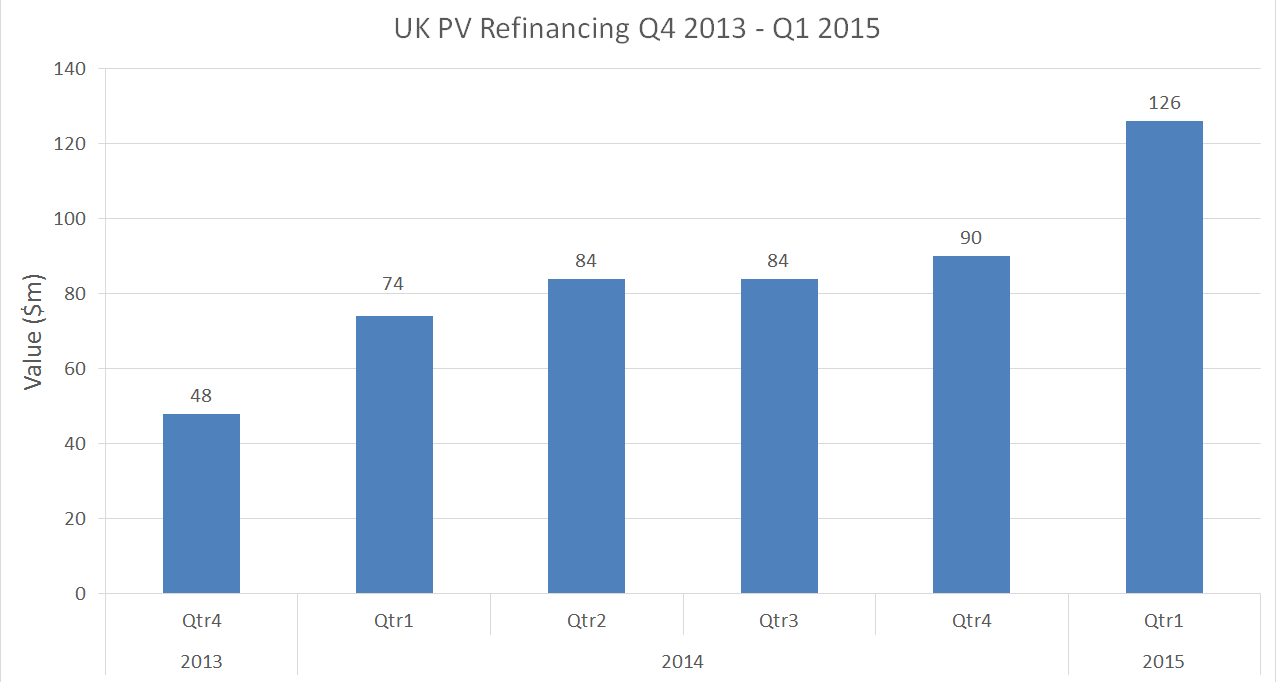

Data Analysis: UK PV refinancing volumes increasing

UK photovoltaic (PV) debt refinancing volumes have increased in almost every quarter since the fourth quarter of 2013, and reached $126 million in Q1 this year, according to IJGlobal data. Refinancings in Q1 2015 increased $36 million over Q4 2014.

Ten refinancings closed between Q4 2013 and Q1 2015 – all of which were portfolios deals, and none below $43 million. Sponsors often group small solar PV plants together to achieve a scale that improves the odds of bankability.

Across those six quarters, $506 million in solar PV portfolio refinancings closed.

The refinancing of A Shade Greener’s (ASG) 100MW portfolio of rooftop PV plants was the largest deal over the last six quarters. The deal closed in phases, with tranches closing in the first three quarters of 2014 and Q1 2015. The deal consisted of multiple debt tranches from Macquarie Infrastructure Debt Investment Solutions (MIDIS) and Gravis Capital Partners, totalling £180 million ($278 million).

Lightsource Renewable Energy was another key player in UK solar in the past year and a half. It refinanced about $97 million in projects. Lightsource’s deals included just under £30 million in debt from Investec to refinance a 38MW portfolio in Q4 2013. The developer closed another £40 million refinancing in Q1 2014, with RBS as mandated lead arranger, and finally a £27 million refinancing led by Investec in the final quarter of that year.

Also in Q4 2014, Primrose Solar closed £29 million in debt from M&G Investments. The proceeds refinanced 38.7MW of solar capacity across Glamorgan, Norfolk and Dorset.

Long-term, grandfathered government subsidies – including renewable obligation certificates (ROCs) – have encouraged much of the solar investment, notes Hugo Coetzee, a banking and finance partner at law firm CMS Cameron McKenna.

“There appears to be an increased appetite for solar financing and investment,” said Coatzee, who advised Gravis on the ASG portfolio refinancing. “UK solar projects are certainly popular with investors to the extent they benefit from historic subsidy levels as they are relatively easy to do due diligence on and are seen as a safe investment.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.