Data Analysis: Nepal's tempting hydropower sector

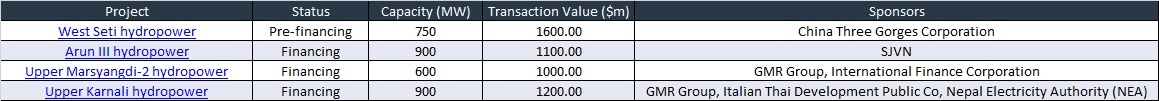

Nepal’s hydropower sector is about to shift from moribund to growing. Four large projects have recently entered the pre-financing or financing stages.

About $4.8 billion in total investment will have to be found for these projects. This won’t be a straightforward task for the projects’ sponsors, though development finance institutions (DFIs) are expected to be heavily involved.

The four projects, if built, would add 3,450MW to the Nepali grid. Much of the power will be sold to India, though some will be kept locally. While having 83,000MW of theoretical hydroelectric potential, of which 42,000MW is economically viable, Nepal's actual annual hydropower output barely exceeds 700MW, according to the World Bank.

But Nepal, which is home to over 6,000 rivers and rivulets, is on the verge of a hydropower breakthrough after the country signed, in late 2014, a long-awaited power trade agreement with India. Investors have since begun lining up to invest in Nepali hydropower projects. Indian firm GMR, for example, is developing the $1.6 billion 900MW Upper Karnali hydropower project.

In April 2015 the Investment Board of Nepal cleared The China Three Gorges Corporation to build the $1.6 billion 750MW West Seti hydropower project. Financing for these projects will feature DFIs. The International Finance Corporation (IFC) is likely to take equity or debt stakes in several projects.

Kosep and Daelim are likely to source financing for their $539 million Upper Trishuli hydropower project from a number of DFIs, including:

- ADB

- FMO

- DEG

- Proparco

Indian and Chinese banks are likely to feature on projects sponsored by their respective domestic firms.

The projects still require some governmental approvals. The Nepali government’s response to the April 2015 earthquake at Kathmandu, however, may slow the approval processes.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.