Data Analysis: Western European PV investment plummets from 2010 levels

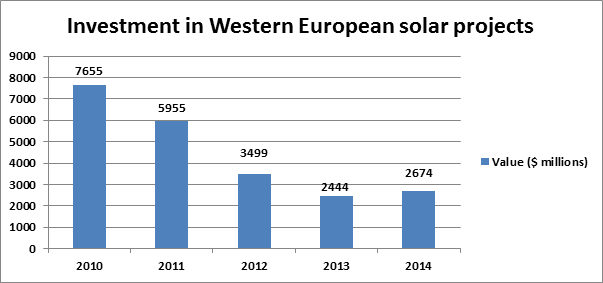

Overall investment in French, German, Italian, Spanish and UK solar projects has fallen almost every year since 2010 – from $7.7 billion in 2010 to $2.7 billion in 2014, according to IJGlobal data.

Reductions in solar subsidies account for much of the fall, with Western European governments peeling back support either gradually or abruptly. James Watson, chief executive officer of the European Photovoltaic Industry Association (EPIA), noted that the schemes “were slowly exhausted or wound down as the money was spent.”

“Private investment in the sector is picking up, but not at the rate required to close the gap on the decrease in public investment,” Watson added. “Although privately financed projects are still being built and the amount is growing day by day, growth is not as strong as it was four years ago.”

France, Germany and the UK offer leading support systems

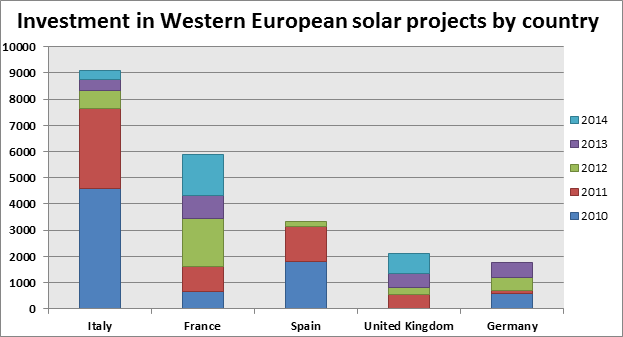

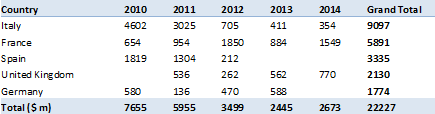

Investment in French and UK solar rose from 2013 to 2014 – $883 million to $1.5 billion in France, and $561 million to $770 million in the UK, respectively. France has closed the most regional solar investment since 2010, at $5.9 billion.

Italy and Spain, meanwhile, were regional leaders in 2010 and 2011. Of the five countries surveyed, Italy closed the second most solar project investment between 2010 and 2014 – $4.6 billion. But Spain’s annual investment fell off after 2011, and Italy’s after 2012.

Investment levels in both countries dropped after the governments introduced retroactive subsidy rules. Italy cut its feed-in tariff (FiT) due to the unexpectedly high levels of growth in the industry.

Spain closed £1.8 billion of solar project investment in 2010, and then £1.3 billion in 2011. In 2012 Spain cut the FiT for new projects, and investment plummeted – $211 million that year, and none since.

Project finance suffered broadly in Spain amidst the Eurozone crisis, though activity has picked up recently in other sectors. The prospect of new leadership in 2016, following scheduled elections in December 2015, may help towards restoring investor confidence in Spanish solar.

France, Germany and the UK have maintained more predictable and transparent support regimes, and thus more consistent levels of solar project investment.

“Germany’s legislation gave a schedule indicating what the feed-in tariffs would be and when they would ramp up and, most crucially, when they would ramp down,” Watson said.

Growth in UK solar investment has been sluggish, though annual investment levels since 2011 are fairly steady. The Renewable Energy Association (REA) attributes this sluggishness to falling solar photovoltaic (PV) development costs – as much as 70% over that period. Indeed, the country’s growth in solar capacity has been strong. Installed UK solar capacity has increased from 40MW in 2010 to over 5,000MW in 2014.

Further growth is expected in UK solar PV as technology costs near parity – without subsidies – against thermal fuels.

The leading solar lenders

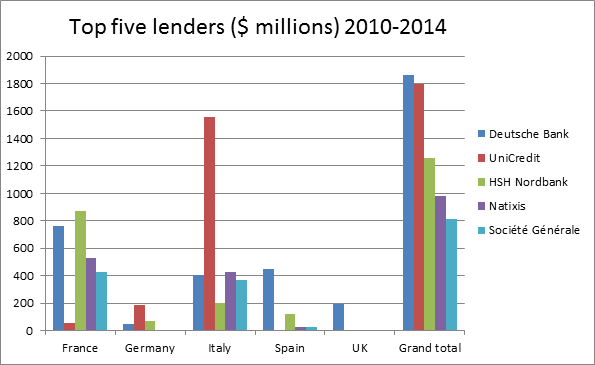

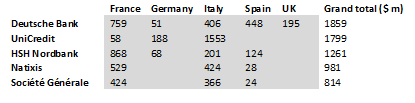

The five leading solar lenders did the majority of their deals in Italy and France between 2010 and 2014, with Deutsche Bank and UniCredit’s total investments far exceeding their peers.

Deutsche lent a total of $1.86 billion, of which $759 million supported French projects. Italy and Spain made up a further $406 million and $448 million, respectively.

UniCredit came in close behind Deutsche with just under $1.8 billion deployed, and weighted its lending heavily towards Italy.

Other major lenders in the sector included French banks Natixis and Société Générale, which focused the majority of their investments within France. German commercial bank HSH Nordbank’s investments in the sector also suggested a preference for France, investing $868 million of $1.26 billion in the country.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.