Portugal’s privatisations drive ahead

Several years after EU bailouts forced a number of Europe’s struggling economies to launch privatisation programmes, Portugal stands out as an exception in southern Europe in running broadly to schedule. Following Greece and Ireland’s emergency loans, Portugal agreed to the terms for a €78 billion (US$108bn) EU bailout in 2011 from the troika – the International Monetary Fund, European Central Bank and European Commission. Under the terms, the government agreed to raise €5 billion by the end of 2013.

Up for grabs

The next sell-off already underway is Empresa Geral de Fomenta (EGF), which the government approved for tender at the end of January. Potential bidders have until 24 March 2014 to express their interest and obtain the tender documents. This non-binding round will be followed by binding offers.

EGF through its 11 subsidiaries manages the collection, transport, treatment and recovery of municipal solid waste, for 65 per cent of the national population with revenues in 2012 of €150 million. The state is selling 100 per cent of the asset.

Bidders circling include several internationals. Brazil’s Odebrecht and Solvi are reported bidders. Meanwhile the domestic bidders are EGEO Group, Mota-Engil and DST Group. Spanish infrastructure company Ferrovial has said it is monitoring developments but has yet to form a position. China’s Beijing Enterprises Water Group emerged as a bidder early on, but issued a statement on 13 February to say that it will not be bidding alongside Hong Kong-listed Sound Global, or at all.

Citigroup and Banco BiG are financial advisers to the government, which has established holding company Parpública to manage the privatisations.

Exceeding expectations

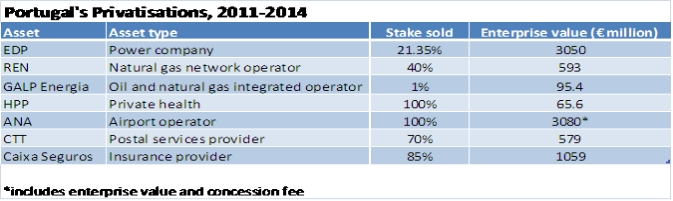

The rumours of international interest in EGF provide further encouragement for a programme that has so far raised about €8.1 billion from seven state assets since the 2011 bailout. Manuel Rodriguez, the Secretary of State for Finance, says that “so far the state has exceeded its revenues target set at the start of the programme by 45 per cent.”

Portugal’s privatisation programme has been running at a smooth pace alongside some of its southern European neighbours. Portugal’s revenues have exceeded expectations and not suffered the level of standstill seen elsewhere.

For example in Greece, the government downsized its target for revenues twice in 2013. With bailouts equal to €240 billion and an ambitious target to raise €24 billion by 2020, the government has so far only had €2.6 billion paid cash come in. The sale of DEPA, the natural gas company folded last year after Russian energy giant Gazprom pulled out at the final stage. The asset sales progressing and at shortlist stage include the rail operator Trainose, the rolling stock ROSCO and the operation concessions for the state’s 21 airports. On 5 March 2014 Greece issued the initial request for tenders for the port concession-holder Port of Piraeus Authority.

Portugal’s economy rebounds

The Portuguese government has implemented its Economic Adjustment Programme which runs from 2011 on to May 2015 to turn around the macro-economy since the crisis. Its aim is to protect the government’s balance sheet from external market pressures through stabilization, deleveraging of the banking sector and better fiscal control over PPPs and state-owned enterprises, says Rodriguez.

Statistics demonstrate Portugal’s success in steadily reducing its deficit, which stood at 6.4 per cent in 2012. Now the European Commission forecasts a four per cent deficit in 2014 falling to 2.5 per cent by 2015. Year-on-year GDP growth was -1.6 per cent in 2013 and the Ministry of Finance forecasts an increase to +1.2 per cent in 2014. The current account balanced in 2013 for the first time in over 40 years.

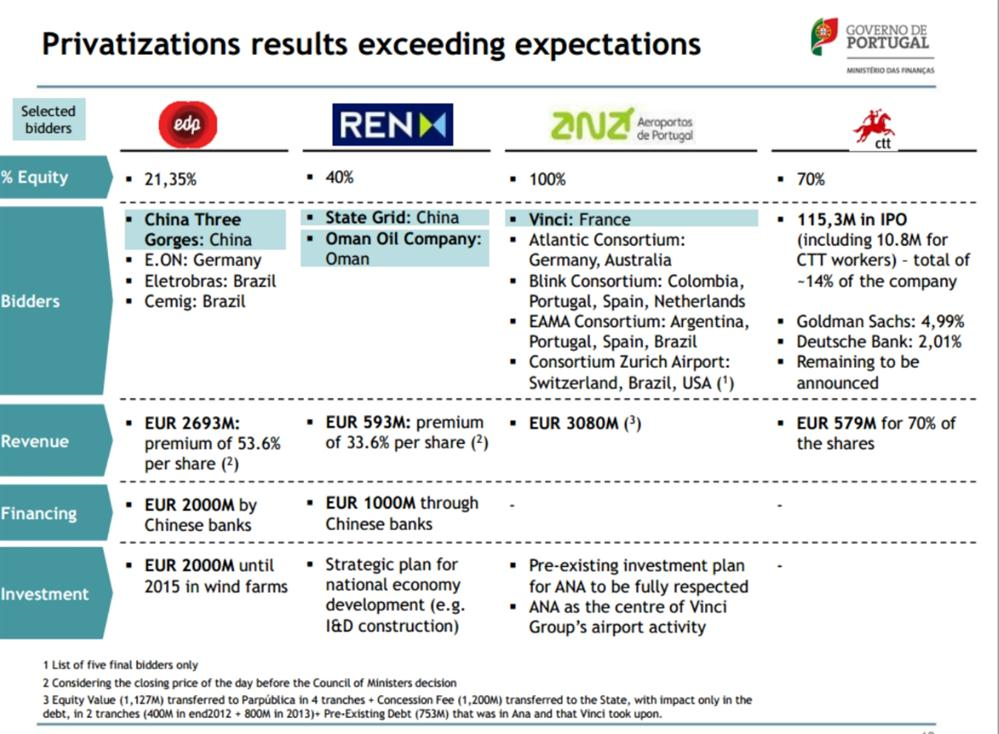

Airport operator ANA

The largest privatisation in Portugal so far was the sale of the national airports operator ANA, which Vinci bought for €3.8 billion inclusive of enterprise value and a €1.2 billion concession fee. Vinci won the competition in February 2013 and closed the acquisition in September. ANA holds a 50- year concession for Portugal's 10 airports and, according to Rodriguez, the sale of ANA ended up being one of the most successful airport operator privatisations in the world, with a bid for more than 16x EBITDA.

A comparison can be made with the Spanish airport operator, AENA. Spain’s privatisation programme stalled in early 2012 when the Conservative government shelved a privatisation drive that the Socialist government launched in 2011. The largest sale on the cards is AENA, which operates 46 airports.The Spanish government resuscitated the sale again in May 2013 with Lazard and N+1 advising AENA, following a refinancing of AENA’s debt.

Today the Spanish government’s plan is to launch an IPO for 60 per cent of shares in the next few months, and the company valuation target is likely to be in the region of €10 billion. Investors began reviving Spanish equity markets last year once the country emerged from recession, as demonstrated when Bill Gates bought a six per cent stake in Spanish construction giant FCC in October for over €100 million. However the AENA sale will need to push ahead this year to become a success story before the 2015 General Election causes another halt.

Coming up in 2014

Portugal’s privatisation of EGF will be followed in 2014 by that of debt-saddled TAP, the national air carrier, which has a market leading position for traffic between Europe and Brazil, and a strong presence in West Africa. The government suspended the sale of TAP in December 2012, after it decided not to award the asset to sole bidder Sinergy Aerospace.

According to Sergio Monteiro, Secretary of State for Infrastructure, Transport and Communications, reviews and tender documents are in process this year for a number of the state’s transport assets. The state plans to issue tender documents in the middle of 2014 for operating the Lisbon bus company Carris, the city’s underground and the Transtejo Ferry service. This year should also see tenders out for concessions to operate two ports, the port of Lisbon and the port of Porto. The government has been reviewing the privatisation of the rail sector, in which it fully owns rail infrastructure manager Rede Ferroviara Nacional and freight and passenger train operator Comboios de Portugal. There are plans to launch rail tenders in the second part of the year.

Source: Ministry of Finance, Government of Portugal

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.