Biomass in the balance: the UK’s evolving climate for investment

The financing package for the 2,000MW Eggborough coal-to-biomass conversion in Yorkshire in the north of England, currently hangs in the balance. An eight-bank debt club has been agreed, but debt for the £750 million (US$1.2bn) project is now contingent upon the government reversing a decision to not award the project early support under its incoming Contracts for Difference (CfD) scheme. An equity injection from an Asian investor is also understood to be imminent, again subject to the subsidy agreement going ahead.

This time last year, biomass was starting to look like the UK’s renewables sector of choice. As industry warned that energy policy uncertainty was stifling project financings, the state, banks and institutional investors all took tickets in the US$915.7m coal-to-biomass conversion of the 3,960MW Drax power station in North Yorkshire.

“The Drax conversion will be the first project of many to be enabled by this radical, innovative new approach," chief secretary to the Treasury Danny Alexander said at financial close. He was talking about the use of the UK Treasury guarantee in particular, but the general mood surrounding the project was just as confident.

A year later the mood around biomass is less ebullient. At a conference in Amsterdam this month if anything, it appeared pessimistic. Chief executive of developer Eco2 David Williams said at the event that the focus had shifted away from biomass, both for large-scale and smaller projects. “This [UK] government is very, very focused on offshore wind, and I think that’s a mistake,” he said.

Other developers cited tightening banking rules, refinancing obligations, a lack of interested underwriters and high margins for the lack of interest in shovel-ready biomass projects that needed debt.

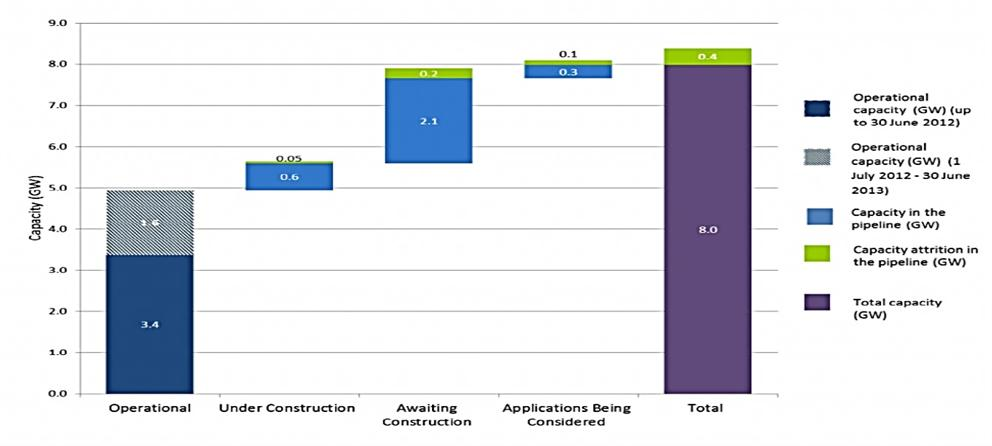

However, a look at the data shows that there are some encouraging signs of growth, primarily in the clear upward trajectory for deployment in the UK. The Renewable Energy Association (REA) estimates that as of June 2013, 4.9GW of biomass had been installed in the UK, up 1.6GW from a year before – a 22 per cent increase (however, these figures may be skewed by the scale of the Drax conversion).

The graph below shows how things currently stand (source: REA).

According to a DECC Public Attitudes Survey carried out in November, public support for biomass is at 60 per cent, higher than for gas and nuclear but lower than offshore wind (72 per cent), wave and tidal (71 per cent), and onshore wind (66 per cent). So it appears that the public, at least, is willing to take a punt on the industry. Yet as with so many renewables sectors throughout Europe, biomass is sensitive to the political machinations of the country it is built in.

The government's Electrcity Market Review has offered a strike price of £105 p/MWh for biomass conversion projects between 2014-2019. Eggborough chief executive Neil O’Hara said that the constraints of the state support system for energy generation meant that private companies had minimal control over their revenues, which are now subject to the CfD regime, carbon taxes and the capacity mechanism. “The UK electricity sector has effectively been re-nationalised on the revenue side of the business,” he said.

UK unions have now started to work together to write to the government and ask them to rethink their decision. Unite, GMB and Prospect are all supporting the plant owners. If the government decision is not changed, the plant looks set to close in 2015.

So while last year’s Drax close proved that banks, institutional and state investors are prepared to take a stake in biomass, the political support that is in place for it is far from clear. Indeed, the presence of the UK Treasury Guarantee on the Drax project may have done more to hinder than to help the long-term future of biomass financings, one lender told IJ News.

The deal was “unique in many respects,” and as such it is unlikely to be easily replicated, one lender suggested to IJ News at the conference. Eggborough’s chief executive pointed out to IJ News last week that debt funding for that project was secured under the support of the RO regime, and not under the incoming CfD. Eggborough’s sponsors met with bankers on the understanding that the project would be developed under the CfD regime, O'Hara said.

Biomass developers must be realistic when sourcing debt, lenders said this month. One project finance chief at a European bank said that “although the onus is on financiers to truly understand the market in which they want to operate, there is also an onus on developers to be realistic about the risk profile they’re presenting.

“We don’t expect miracles; 30 year supply contracts and the like, but at the same time, if you’re wanting us to take risk on biomass supply and technology, you need to expect that the response will be potentially no. Or yes - but here’s the cost of my capital. The real discussion is around what developers’ expectations are.” Debt with margins of four per cent is unrealistic, a South African lender said.

And so UK biomass appears to have found itself at a crossroads – with degrees of poltical and public support, but without the momentum and high profile that other renewables sectors such as offshore wind are currently enjoying. This month's biomass conference in Amsterdam demonstrated burgeoning interest from the industry however, in the Brazilian and Asian biomass markets. If the climate turns cold in the UK and Europe, biomass' story may well continue in Latin America.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.