News+: Post-panamax promise

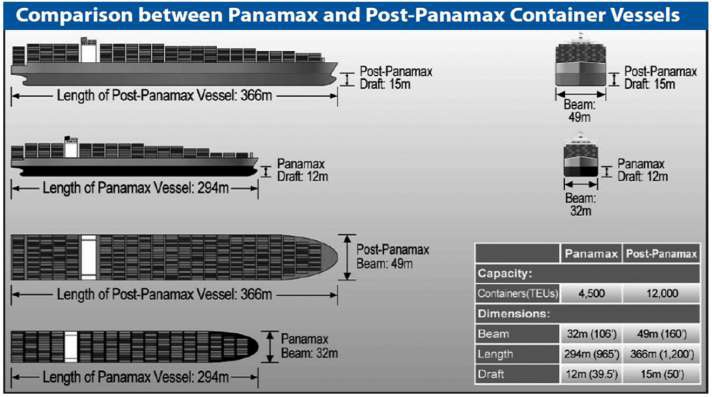

The expansion of the Panama Canal is revolutionising the world’s ports. As the project nears completion, albeit a little behind schedule, Colombia and Brazil are preparing their ports to accommodate the post-panamax vessels which bring with them the promise of prosperity.

At the UKTI’s Brazil & Colombia Ports Inward Mission conference held last month, key port authorities showcased their short-term and long-term port investment strategies aimed at improving efficiency in order to compete in the post-panamax era, in which trade flow through Central and South America is set to soar with megaships en route to the lucrative Asian market.

Source: UKTI

Presentations given by senior port executives suggest that preparation works are to be diverse. Millions have been spent and billions will be spent by both the private and public sectors to bring port projects to fruition which stretch far beyond the parameters of a container terminal. Delegates drew on a wealth of exciting investment opportunities into infrastructure across the sectors.

Colombia's burgeoning port economy

Colombia was relatively ahead of its time when it introduced a law in 1991 which allowed private-public concessions in the port sector. With its thriving import and export business, Colombia’s flourishing ports are a far cry from those which existed 20 years ago, when corruption deterred the private sector. However, there remains an urgent need for modern port infrastructure.

Port concessions typically last 20 years and at the end of this period, the construction works are handed over to the state free of charge. Colombia's busiest ports are Barranquilla and Santa Marta on the Caribbean coast and Buenaventura on the Pacific coast, its access to both the Atlantic and Pacific Coasts, is a significant advantage over its South American counterparts.

Recently it has been Colombia’s ambitious highway renovation program, Four Generations of Highways (4G), which has stolen the limelight in the infrastructure space, but in his session, Miguel Landinez Santos, port advisor for Colombia’s National Infrastructure Agency (ANI), highlighted vast investment opportunities in the private-public port concessions in Colombia.

The government envisages at least US$1.5 billion of investments to be made into concessions for some of its state-owned multipurpose and hydrocarbon, container and coal ports.

Source: Colombia's National Infrastructure Agency (ANI)

Landinez asserted that the port investments require foreign logistics intelligence and expertise in various construction segments, as well as general consultancy and advisory services.

Showcasing some key port projects in Cartagena, was Jose Luis Fuentes, president of the port of Mamonal. Fuentes highlighted how many port initiatives, such as a pier extension project (US$22m) and a coal and coking mechanised handling project (US$70.2m) have been financed by a combination of domestic and foreign banks.

New projects in the pipeline include unloading systems, storage solutions and a petcoke transport system with the capacity to handle 30 tonnes.

However, Colombia also enjoys a thriving private port segment which also presents significant investment opportunities.

Commenting on this sector, a senior executive for a global shipping company told IJ News, “The Macro fundamentals of Colombia are definitely pointing in the right direction, currently there are no public port projects on the way that would constitute new container ports, but there is significant private development in Colombia on the Pacific and the Caribbean side where we would be interested in playing our part”.

Brazil port reform

Three months on from the passing of Brazil’s port reform law, MP 595, port ownership in Brazil is now set to become increasingly privatised.

Historically the Brazilian port industry has been monopolised by concessionaires which have rolled on their contracts decade after decade. Ports in Brazil control 95 per cent of total imports and exports and move around 700 million tonnes annually. The five busiest ports are Santos, Itaguaí, Paranaguá, Rio Grande and Itaqui, but many of these terminals are approaching saturation and not equipped to handle the forecast growth in traffic.

As such, this year the federal government introduced a centralised R$52.4 billion (US$12.0bn) port revamp which will see concessions retendered and around 50 new private port terminals rolled out, overseen by the Secretariat for Ports (SEP).

According to Vinícius Luciano Toledo dos Santos, a specialist for the planning and development department of SEP, R$31 billion will be invested by 2014/5, and the remainder by 2017.

Bidding for the first new terminal leases in Pará and Santos is expected to begin later this month, which will be coordinated by the National Agency for Waterways Transportation (ANTAQ).

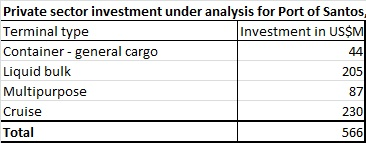

Jose Manuel Gatto dos Santos, head of planning at the Port of Santos, Brazil’s busiest port, said that around US$566 million of private sector investment into new terminals was currently under analysis.

Source: Port of Santos Authority

Meanwhile Leonardo Cerquinho Monteiro, director of Port Management of the Port of Suape, a hub port for one of the main shipping routes, which boasts the biggest shipyard in the southern hemisphere, a wind power cluster, oil refinery and bunge wheat mill, indicated that tenders for a second container terminal in berths six and seven was imminent.

However, while the green light for accelerated private investment into new port projects has aroused strong investor interest, rumours of a possible low return for the new tenders has concerned some potential bidders.

The overall sentiment from the event was that while both countries still have their work cut out in order to remain competitive in a post-panamax age, the investment opportunities their preparations offer the private sector really are plentiful.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.