News+: Telecom M&A in vogue?

Like the heatwave that scorched the UK, the infrastructure M&A market was a rather dry affair this summer.

Few sizeable on-market deals closed and many of the larger processes, particularly the ongoing divestments by European energy utilities, were delayed until Europe's return from its leisurely annual vacation.

But one area of notable activity was telecommunications infrastructure.

In the shadow of the Verizon bonanza that saw the US telecoms giant buy out partner Vodafone’s stake in a mobile venture for US$130 million – the biggest corporate acquisition in history, funded by the biggest ever bond issuance – a number of towers, masts and base station assets quietly changed hands on both sides of the Atlantic.

Sell and lease back

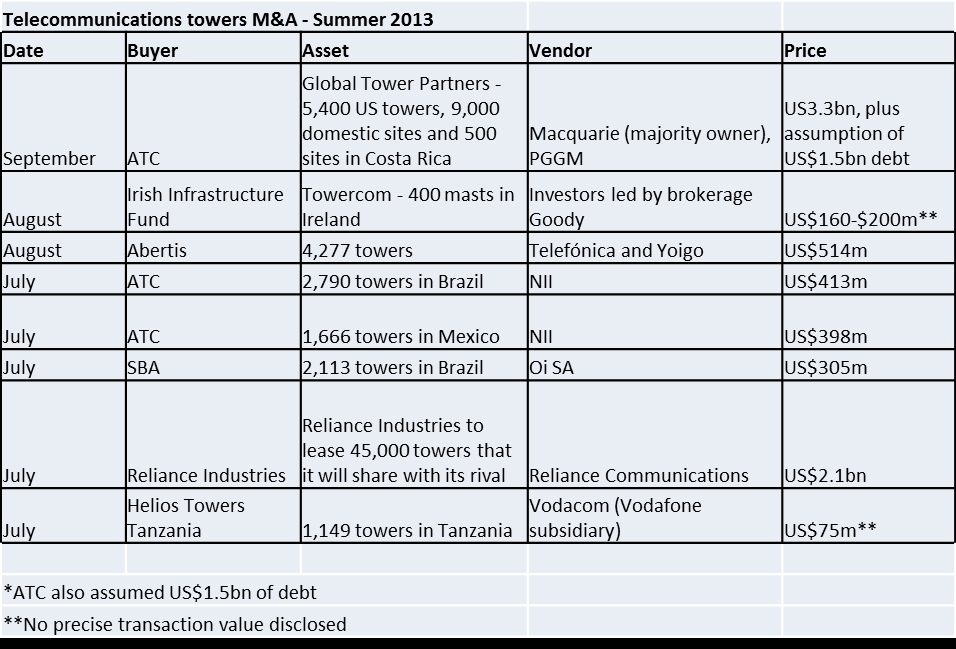

Most prominent was infrastructure fund manager Macquarie's sale of its US wireless communications towers business, Global Tower Partners, to dedicated tower business American Tower Corporation (ATC) at the start of September. The US$3.3 billion deal grew ATC’s assets by a quarter. Clients of the GTP towers include AT&T, Sprint, T-Mobile and Verizon.

It must have been a summer of long nights in the ATC deal-broker offices: prior to the Global Towers deal, it snapped up 2,790 towers in Brazil and 1,666 in Mexico for a combined US$811 million. These assets it will subsequently lease back to mobile phone-operating subsidiaries of vendor NII Holdings.

The transactions fall into the trend of telcos either selling off their hard, passive assets to financial investors, who then lease them back to a number of operators on a shared basis, or simply opting to share with rival operators. This allows them to concentrate on commercial and profit-making activities while cutting costs.

“Much of that M&A is simply buying tower assets from telcos,” says Matt Walker, analyst at telecommunications consultants Ovum. “Some telcos need cash, to lower debt and cope with flat to down revenues. Selling towers can seem a quick and easy way to raise funds. [Others] are increasingly convinced that the towers are not a strategic asset.”

Historic high

Data from Ovum shows that in Q3 2013 tower M&A deals were at an historic high with deals worth an aggregate US$7.5 billion, more than double pre-crisis levels.

The US has been at the vanguard of this shift and one innovation there has been the structuring of holding towercos, like ATC, as Real Estate Investment Trusts (REITs). These listed vehicles are largely tax-exempt and can ultimately provide an exit for an investor like a close-end infrastructure fund, although the company will need to persuade the Inland Revenue Service that its line of business really is real estate.

Source: Ovum

Although towers do not carry the same cachet as marquee assets like airports or power distribution grids, nor any of the political controversy of energy and water utilities, they are nevertheless still prized by some investors.

The dearth of quality brownfield assets in other sectors is one factor driving infrastructure funds towards towers, says Nick Elverston, head of global telecommunications, media and technology at law firm Herbert Smith Freehills (HSF), as is the need for portfolio diversification.

But the structuring of the assets is key, as he explains: “Long-term contracts gets the stability that an infrastructure fund typically wants. It’s just like a power station – if there is a long-term offtake agreement you have more certainty around revenues.

“Towers aren’t quite utilities and aren’t always regulated so depending on the infrastructure fund and their risk appetite, may be seen as a little bit too exciting”.

Barriers to entry

Industry players expect to see more deal flow in Europe, India and Africa, which with its booming population and rapidly growing consumer base is seen as ripening for transactions. A subsidiary of ATC is already the largest independent owner and operator of shared wireless assets in South Africa.

Yet despite the high barriers to entry frequently cited as an attractive feature of the towers business, Matt Walker of Ovum warns that hard infrastructure is not immune from the fast pace of technological innovation characteristic of the communications industry.

“In theory [towers and masts] provide a stable source of income with limited volatility, and represent an infrastructure that could be more valuable as networks grow and more providers enter,” he says. “In practice, the design of mobile networks is changing, with the growth of small cells, so the big macro base stations operated by most tower companies may be less important going forward.”

Accelerating deal flow

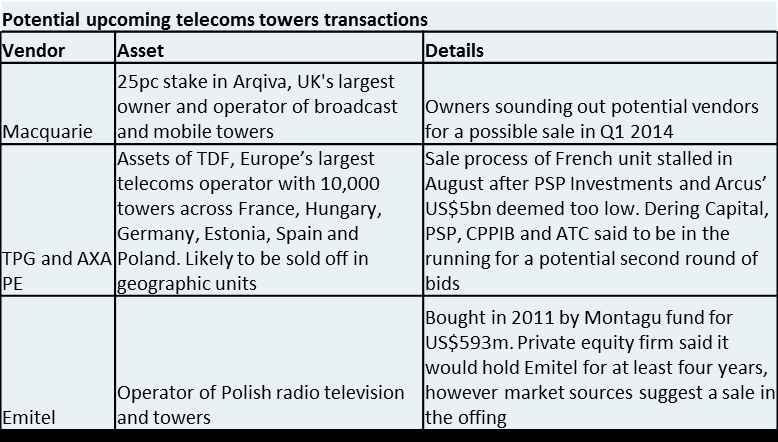

In the medium-term there is plenty flowing down the deal pipeline. Macquarie will soon put on the block its 25 per cent stake in Arqiva, the UK’s largest telecommunications firm that operates masts leased out to all of the major mobile operators and TV stations. Meanwhile the owners of international broadcasting masts operator TDF are mulling a new round of bids for its French division, valued at US$5.1 billion, after the deal stalled this summer due to disagreements over asking price.

With the market still maturing “the jury is really still out on whether the pricing is good,” says Randolf Nijsse of Netherlands-based Communication Infrastructure Fund. “It is definitely the case that substantial multiples are being bid,” he adds. The next few deals are likely to solicit even more interest.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.