News+: What's left in UK water?

The London Stock Exchange watched with only a dim sense of anticipation as the second hand struck five o’clock last Tuesday. In the end there was no final, dramatic bid for the UK’s second-largest listed water company, Severn Trent, by the LongRiver consortium of institutional bidders that wished to take the entity into private ownership.

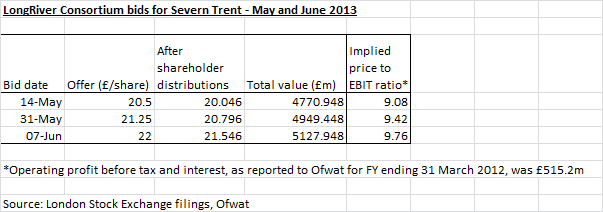

The trio of investors, comprising Canada’s Borealis, the Kuwait Investment Authority and UK public sector pension fund Universities Superannuation Fund, stood resolute in its refusal to increase its approach of £22 (US$34.5) per share – which equated to around £5.25 billion (US$8.23bn) in total.

That was their third pitch, up £1.50 per share on the original move in mid-May. Each was rejected out of hand by the Severn Trent board on the grounds that it failed to take into account the potential future revenues of the regulated company as well as the growth in market capitalisation of the business since privatisation in 1991.

Efforts to revive the bid by one strategic shareholder, Pictect Asset Management, who said on Monday afternoon it would be open to an approach of £23 per share, fell on deaf ears. Shares in Severn Trent were today trading around the £17.60 mark.

Senior management of the utility, which serves more than 4.2 million homes throughout mid-west England and Wales, said that the after taking into account a pre-agreed 45.51p dividend payment the real value of the bid fell to £21.54 per share; a premium deemed unacceptable.

The passing of the bid deadline, set by the UK Takeover Commission, means that the suitors cannot make another bid for six months.

As predicted by industry insiders, there was no hostile takeover attempt – a suggestion abounding in some quarters of the national press. One source close to the failed deal told IJ News that LongRiver would be unwise to try such a move, rare in the core infrastructure space, as it would effectively amount to the buyers calling on shareholders to cast a vote of no confidence against management. Such a tactic would require strong powers of persuasion. But it could also sully a buyers’ reputation in the sector and prejudice future transactions, the source added.

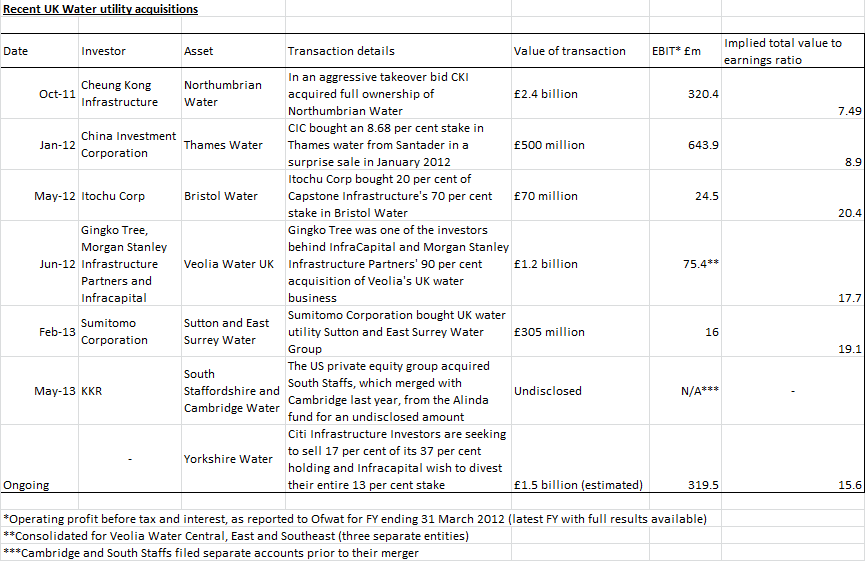

The abortive coup is further evidence that the UK’s water utilities are in high demand among international institutional investors. Over the past few years a number of water companies have changed hands as investor appetite for large-scale monopolistic assets with regulated revenues grows.

An implication of the Severn Trent stand-off is that the company was ‘overpriced’ by its owners. This is of course shorthand for buyers unwilling to pay what owners think they can get for highly-coveted assets. At the same time, it fuels the oft-repeated market perception that there is ‘too much capital chasing too few assets’. When looking at the ratio of implied price against earnings on recent deals, most occurred within the high teens.

Although no value was disclosed for KKR's acquisition of South Staffs from Alinda, a source told IJ News that it was a 'high multiple' of earnings - and perhaps the reason why the private equity firm didn't want it made public. In light of these figures, it is understandable why the Severn Trent board felt they could get a better deal for the business and its potential earnings.

However the implied total value of some companies may be distorted upwards by the transactions for smaller slices of equity. One advisor on such deals says: “Due to regulatory issues, smaller funds can buy sub-10 per cent pieces and they are often new entrants so pay prices for these slices, which implies a very high value for 100 per cent”.

Despite the impending conclusion of an Ofwat price review, which leaves a large question mark hanging over profitability, an advisor to the deal tells IJ News that the regulatory cycle is not as influential to the level of demand as one might assume – despite some analysts predicting the end of the wave of ‘mega-takeovers’.

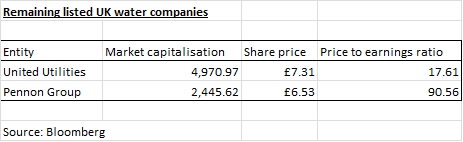

Outside of Severn Trent, there are two listed water companies left in the UK and the Severn Trent episode could push up their value in the minds of board members and shareholders. Abu Dhabi Investment Authority was rumoured two months ago to be considering a bid for Pennon Group while United Utilities have reportedly hired Goldman Sachs amid speculation of a possible takeover.

Pennon’s current price to earnings ratio is skewed by poor performance in the last half year that saw its profit margin, which had hovered steadily around 13 to 14 per cent over the previous two years, drop to -12 per cent. However this was caused largely by its Viridor waste outfit, whose profits fell by more a third, while its South West Water utility enjoyed a 7.5 per cent rise, and in the event of vendor interest it could imaginably be separated from the water business.

Potential sales processes are likely to see unsuccessful bidders on previous water sales processes jostling alongside the handful of private infrastructure funds in the European space with plenty of dry powder to deploy. Industry sources say given the large size of assets, more consortia of funds, sovereign wealth funds and pension funds are likely to form - as the ticket sizes are too large for any single investor. On the other hand, the Severn Trent tug-of-war could mean we have seen the top of the market in UK water utilities.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.