News+: Damning report for Severn Barrage project

The UK’s ambitious Severn Barrage tidal power project has been dealt a blow after a government report raised a series of doubts about the financing of the £25 billion (US$38.8bn) project, urging the government to consider “alternative pathways” to securing a low-carbon future for the UK.

Proposals to harness the strong tidal power between England and Wales have been mooted for centuries; in its current incarnation, the 6.5GW project would stretch 18 miles between Brean in England and Lavernock Point in Wales. It will generate on the ebb and flood of the Severn Estuary, the second largest tidal range in the world at 14 metres. It is an energy source capable of meeting some five per cent of the UK's annual electricity needs and drive one of the biggest power stations in the world with a minimum lifespan of 120 years, according to developer Hafren Power.

Arup, Bechtel, DHL, Mott MacDonald and URS are currently assessing the delivery model needed to manage the consent and environmental approval processes and the nine-year build. However, a report released yesterday by the UK’s Energy and Climate Change Committee, ‘A Severn Barrage?’, said it could not recommend the project in its current state.

“While a tidal barrage could offer decarbonisation and energy security benefits, the Hafren Power project in its current form has not demonstrated sufficient value as a low-carbon energy source to override regional and environmental concerns. Alternative pathways exist to meeting our 2050 carbon targets,” the report said.

The vote of no confidence from the influential, MP-led committee could seriously dent political and public goodwill towards the project. Finance is one of the key concerns raised by the report. The developer has been vague about the exact strategy it has to secure the £25 billion capital expenditure, stating that it will be privately financed and that this finance would come from a series of sovereign wealth funds, including global infrastructure and pension funds. Little data is available on the developer website about targeted investors or how the developer aims to attract that finance. Hafren chairman, ex-Rothschild global partner and managing director Greg Shenkman, told press in January that "I think you can assume that all the top 15-20 sovereign wealth funds are potential takers of this. What we have assumed purely for the purpose of planning is a 50:50 mix between debt and equity. This is just an assumption and certainly isn’t a guideline. It may well be that some of these sovereign wealth funds when they come in raise a significant amount of equity through the raising of debt as they can do that very cheaply."

These "assumptions" - and the sheer cost of private finance - is “a pressing concern” for the project, the report said. Giving evidence, E.ON had warned the committee that private sector discount rates would need to be applied to the project, while investors would need to be "prepared to commit very large capital sums for some years without seeing a return."

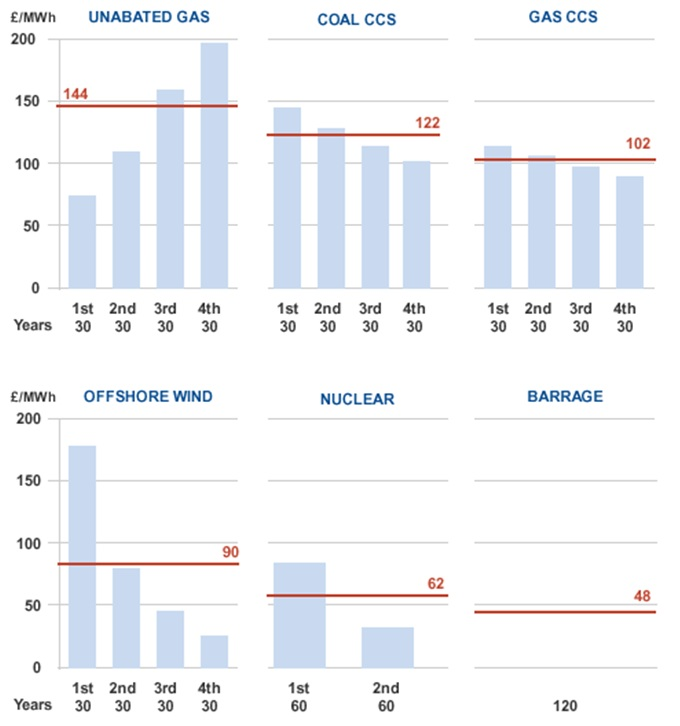

Hafren Power said that the levelised cost of energy (LCoE) - the average cost per MWh of electricity generated over the lifetime of a power plant - will be £48/MWh over the lifetime of the plant. Hafren Power's written evidence suggested a figure of approximately £160/MWh for the first 30 years, which would fall to £20/MWh for the remaining 90 years of the barrage's lifetime. The initial cost of the project puts it somewhere between the current development costs of offshore wind and nuclear, the developer said. With very few commerical tidal plants in operation, it is difficult to accurately project such figures, however. It should be noted, though, that France's La Rance tidal barrage has been successfully and cheaply producing energy since 1966. Hafren Power's own chart below projects the prices of the options currently open to the UK for its future energy mix.

The committee report also stated concerns around how the technology will slot in with the UK’s incoming ‘Contract for Difference’ (CfD) support mechanism, under which an agreed ‘strike price’ will levelise returns for energy producers. “Hafren Power's proposals will require massive support under the CfD mechanism and for a much longer period than alternative low-carbon technologies,” the report said. Hafren have said that the development would require CfD support for at least 30 years to make a commercial return, in comparison to the predicted 15 years granted to other clean technologies.

“We believe that the strike price for the barrage would have to be considerably higher than the £100/MWh which Hafren Power have ‘in mind’”, the report said. “Furthermore, the company say they would require this price to be guaranteed for 30 years, twice as long as an offshore wind project. It is unsatisfactory that such wide-ranging figures have been cited regarding the level of Government support required for a barrage. As a minimum, the strike price for barrage-generated electricity should not be higher than that for offshore wind, which is expected to be around £100/MWh by 2020.”

Hafren Power chief executive Tony Pryor said of the findings: “The report is unhelpful and frustrating – we all know we have a lot more work to do and we will do it.

“The Government has already told us it is not against the barrage and we are determined to press ministers and officials to engage fully. We believe the environmental and economic issues can be solved with everyone working together.

“Unlike smaller schemes, only a barrage can harness the full power potential of the estuary and do it economically. It will also be much cheaper and last much longer than offshore wind farms which have high levels of public subsidy.

“Britain needs more infrastructure projects, especially power generation. Our proposal delivers in spades – up to £25 billion in private investment, 20,000 construction jobs and a further 30,000 jobs supported, and the cheapest zero carbon electricity over its lifetime.”

The UK Renewable Energy Association’s Stephanie Merry, head of marine renewables, said of the report: “The Severn Estuary clearly has tremendous potential for helping to decarbonise our electricity system and increase the supply of home-grown, renewable energy […] however, it is clear that significant questions over the economic and ecological viability of the barrage project remain. The potential for marine energy in UK waters is significant […] and every effort should be made to bring forward economically and ecologically sound marine energy projects.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.