News+: Future’s bright for Mexico energy and infra P3s

Poised to become Latin America’s largest economy, having witnessed falling inflation rates and a strong currency, Mexico is fast becoming an interesting destination for international investors.

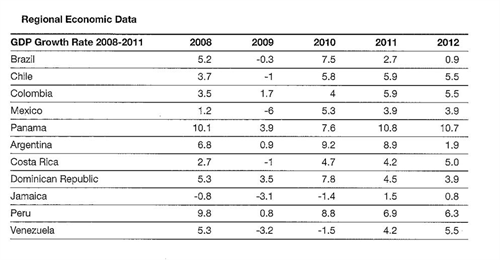

Economic growth has been strong over the last decade and continues. 2012 saw a GDP of 3.9 per cent and this is expected to grow at between 4 per cent and 5 per cent over the next few years. Manufacturing factories are being relocated from China to Mexico, as it’s now considered cheaper. Importantly, the new Mexican president, Enrique Peña Nieto, which marks the return of the Institutional Revolutionary Party (PRI) after a twelve-year hiatus, is committed to investing in infrastructure and energy sector reforms in order to boost the economy further.

Source: "Port projects in Latin America: Opportunities for UK based companies", commisioned and published by UKTI

Public investment into infrastructure is currently around 5 per cent of GDP and this is set to be boosted by Nieto’s National Infrastructure Program (NIP), to be announced in July. The NIP will outline the country’s strategic investment into infra for the next six years.

César Duarte, Chihuahua state governor and president of Conferencia Nacional de Gobernadores (CONAGO), said in an interview with local media "under Enrique Peña Nieto we could see an infrastructure investment up to three or four times larger than what we've seen in recent years”.

In order to meet this target Mexico will look to the private sector to fund an ambitious project pipeline spanning the energy, telecoms, transport and social sectors. Passed in January 2012, the country’s PPP law (Ley de Asociaciones Público Privadas) will help to implement the ambitious project pipeline.

Don’t miss the boat

Mexico’s port sector presents a good example of the increased investment opportunities in infrastructure. Many of the country’s ports are in need of modernisation and the government is looking to either expand existing ports or build new ones.

According to a study published by the UKTI and presented by John Hales, project manager of BE Group at an event in London, “Port projects in Latin America: Opportunities for UK based companies”, the government is considering creating a free trade area, known as Istmo de Tehuantepec corridor, which will mimic the Panama Canal. A rail line between Salina Cruz and Coatzacoalcos could be constructed which would allow for the transportation of goods from ship to rail, from the Pacific Coast to the Atlantic Coast. If confirmed, such a project would require extensive private funding.

The largest 16 ports are looked after by Administraciones Portuarias Integrales (APIs), which are autonomous and self-financing authorisations which offer long-term concessions to the private sector for the DBFOM of ports. According to the study, the 16 most significant ports handle 282 billion tonnes of cargo per year.

“With a coastline of 9,333km and 16 deep water ports, nine on the Pacific Coast and seven on the Gulf of Mexico”, Fernando Estandia, head of infrastructure at the British Embassy, emphasised the abundant investment opportunities in Mexico’s port sector, underscoring the country’s commitment to wooing foreign trade.

Estandia drew on recent port tenders won by private international companies, including the Mazatlán multipurpose terminal for US$40 million by Chilean company Sudamericana Agencias Aéreas y Marítimas (SAAM) and the Tec II container terminal in Lázaro Cárdenas for US$440 million by APM terminals, a subsidiary of Maersk.

Growing private sector investment is not confined to the port sector. The government of Mexico’s Guanajuato state is seeking federal support for a proposed MXP18.29 billion (US$1.5 billion) passenger rail project, including a train operating concession with an with an estimated investment cost of MXP4.2 billion, reflecting the increasingly vital role of private companies in transport projects in Mexico.

Estandia indicated the next most important infrastructure projects in Mexico would be the expansion of the Veracruz and Guaymas ports.

In 2012, Veracruz moved 19 billion tonnes of cargo, of which 37 per cent was in containers. The port is gradually reaching maximum capacity, thanks to increased car exports and cannot be expanded due to local planning laws. As such, a new port, Veracruz 2, will be built which will be a destination for larger vessels following the widening of the Panama Canal in 2015.

The Veracruz PPP project for US$3.36 billion will be 31 per cent publicly funded, and the remainder privately funded. Spanning 782 hectares, the expansion will create 45 new docks and two containers on 2,880m of waterfront.

Already having reached maximum land capacity, with nine bulk terminals and one general terminal, Guaymas will reclaim land from dredging. It will have the capacity to store 400,000 tonnes of copper materials and will see US$ 73.8 million of private sector investment, according to Estandia.

Both projects will be officially launched in July 2013 as part of the National Infrastructure Programme.

Good conditions for renewable P3s

In contrast to the infrastructure sector, the Mexican energy sector remains relatively “closed” to private sector investment, says Estandia. Although Nieto has promised to challenge the state monopoly of the oil & gas sector, national oil company Pemex continues to own and control the country’s oil reserves.

Nevertheless, due to a lack of technical expertise in the country, a series of tenders will be put out for the operation of oil reserves in Villahermosa. Such projects are expected to be met with strong international interest, an international business developer at PwC told IJ Online.

She explains that Mexico is a fast emerging hub for renewables and targets 35 per cent of all energy production to be generated via renewables by 2024. Reforms introduced to the renewables sector are expected to facilitate private investment.

There are four different PPP models in the Mexican renewable sector:

1) Small-scale production: whereby companies can sell electricity (upto 30MW) to Comisión Federal de Electricidad (CFE) the state-owned electric utility

2) Self-supply: Industry parks can produce power alone and sell to industries or households

3) Co-gen: use steam or thermal energy that use co-gen facilities

4) Export: electricity can be produced in Mexico and exported

According to the business development manager, a British company is already analysing this formula, contemplating entering the sector.

Nevertheless, she describes this target as “hugely ambitious” given the current installed capacity is 10GW and remarked that option three presents vast opportunities in Mexico, but that option two was limited given CFE’s already cheap prices.

According to a report published in May 2012 by the Comisión Económica para América Latina y el Caribe (Cepal), “Public- Private Alliances in Renewable Energy in Latin America and the Caribbean”, the Mexican government’s initiatives in the renewable energy sphere are particularly welcoming to private investment through PPPs.

Initiatives include, fiscal incentives, investment in electricity distribution and machinery, as well as shared financial risks in pilot projects, amongst others.

Drawing on a study commissioned by the IBD Group, Cepal's report highlights that overall Mexico was ranked fourth best environment for PPP projects in infrastructure.

| Overall score | Legal framework | Institutional framework | Operational maturity | Investment climate | Financial assistance | Subnational agreements | |

| Score | 58.1 | 56.3 | 58.3 | 54.0 | 56.1 | 72.2 | 50.0 |

| Position | 4 | 4 | 4 | 3 | 6 | 2 (drew) | 2 (drew) |

Source: “Infrascope 2010 - Evaluando el entorno para las asociaciones público-privadas en América Latina y el Caribe” published by Economist Intelligence Unit for Multilateral Investment Fund of IDB Group

Ambitious or not, there is a sense of excitement and belief that reforms will be more easily put into motion, particularly in light of the Pacto por Mexico, an agreement signed by the three main political parties, aimed at passing reforms which in the past have been blocked by political stalemates.

As Mexico’s economy thrives and more companies look to expand their footprints in the country, the message Mexico is sending to the private sector is loud and clear: the future’s bright for infra and energy investment.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.