News+: RBS lending long again

Royal Bank of Scotland's hiatus of more than a year from long-dated project finance lending appears to be drawing to a close at last. Last month IJ News reported that the UK bank, whose last infrastructure loan of more than ten years' duration came in February 2012, has earmarked a significant pool of capital for tenors of up to 30 years.

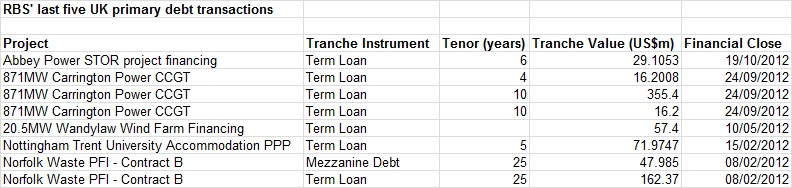

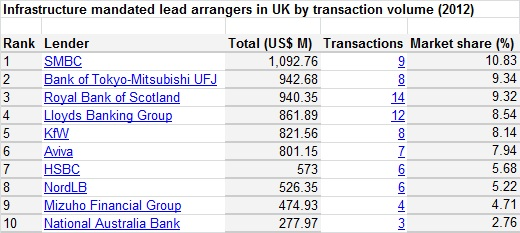

After topping the table of overall UK lending in 2011 with US$1.11 billion spread across 15 transactions, RBS dropped to third place last year, writing cheques for US$940.35 million across 14 deals. Its five most recent greenfield deals revealed little appetite for long-dated debt over that period; indeed, its last long outing was a 25-year term loan to a waste PFI in the February.

Now, motivated by the desire to remain “relevant” to the UK’s infrastructure financing landscape, the bank is to assess projects of "national significance" for its new-found kitty.

But just how true is all the talk of long-dated debt disappearing from the market? And, crucially, who will RBS be up against?

Figures from Infrastructure Journal’s database show level of activity among UK lenders and give an idea of their maturity appetite going forward. Perhaps surprisingly, the overall quantum of infrastructure lending in the UK – for both primary developments and acquisitions – was actually up a notch in 2012, standing at US$10.08 billion compared with US$9.72 billion 2011.

That banks are lending on shorter terms due to the stricter capital charges imposed by Basel III on risk-weighted assets has become something of a truism in recent years. However, privately bankers complain that the gloomy picture painted isn’t a fair reflection of reality.

According to “the spreadsheet” of one banker, more than 20 institutions have lent on long maturities to UK projects within the last 18 months. True, some of these have since exited the space, while others’ lending is highly relationship-based and sometimes conditional on a compatriot sponsor leading the project or winning contracts.

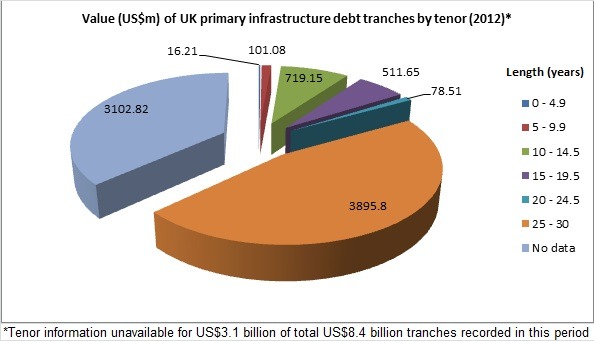

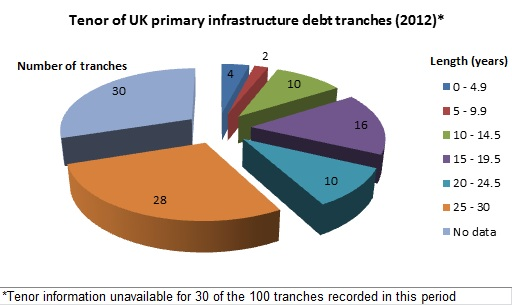

On the primary development side in the UK, there were 32 lenders in all – including commercial banks, insurers, public authorities and developments banks – which provided 100 term or long-dated mezzanine debt tranches across 35 transactions. For those on which we have data, the median tranche tenor was 19 years and eight-and-a-half months.

Fourty-one of those 100 tranches were on maturities longer than 15 years. Expressed in volume, US$3.974 billion - or almost half - of the total US$8.425 billion capital loaned was on maturities of more than 20 years.

All of this indicates the lending market in 2012 was not as short-term as one might presume.

However, it is worth noting that the average tenor was dragged up by two well-known Japanese institutions, who appeared unfazed by the need for capital buffers. Another distortion was the unusually long tenor of 29 years granted by a clutch of banks who provided more than US$3 billion in debt to the first phase of the Intercity Express Programme last July. Indeed, more than a third of all lending to UK primary infrastructure projects was on this single deal.

A closer inspection of the primary development term loan tranches shows that RBS is likely to be vying with a number of lenders who continued to lend long last year, though on a more selective basis. They include insurer Aviva, Nord LB, Bayern LB and the omnipresent Japanese banks – SMBC, BTMU, Mitsubishi and Mizuho. There is every reason to think that national competitor Lloyds, which did debt of more than 20 years on two deals, is looking over its shoulder.

The impact of RBS’ re-entry into the long-dated space will “probably not be huge”, says one banking figure, who stresses that there are still relatively few funding opportunities in greenfield infrastructure. And with the emergence of a panoply of products aiming to give institutional investors exposure to long-term debt – including RBS’ own construction period guarantee which is likely to figure in bids on upcoming PFI projects this year – we may start to see a market slanted in favour of the borrower.

Thanks to Muhabbat Mahmudova and Osama Shah for help with data manipulation.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.