News+: India's first non-banking infrastructure debt fund

IJ News takes a closer look at the ICICI-led Indian infrastructure debt fund and asks whether it will be capable of attracting capital – from both home and overseas.

Last month IJ News reported that work on India’s first non-bank infrastructure debt fund (IDF) was in full swing with managers already scouting for its first investments.

Led by the country’s largest commercial bank, ICICI, Infradebt is starting with US$55 million in seed capital. However this is a long way off its target size of US$2 billion and serious questions remain as to whether it can realistically attract such a heady figure.

India’s government has an infrastructure investment target of US$1 trillion by 2020 and anticipates 40 per cent coming from the private sector. With infrastructure and power companies overleveraged and banks rapidly approaching sector exposure limits, IDFs were conceived as a novel way of channelling capital into projects.

Regulation strictly lays out the form they can take as well as their investment horizons.

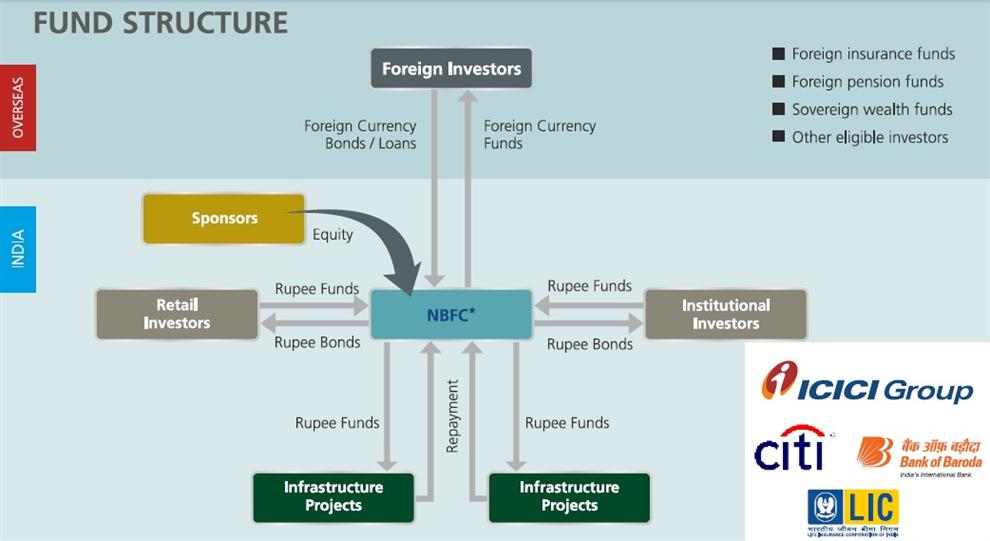

Mutual fund IDFs will be nominated in rupees and so are largely irrelevant for foreign investors, whereas non-bank financial company (NBFC) IDFs can be nominated in both rupees and other currencies.

Structure of India Infradebt Fund

(Source: ICICI)

Unlike a traditional, unlisted closed-end infrastructure fund, NBFCs like Infradebt have a capital structure more akin to that of a corporate, with the majority of bondholders receiving first-loss protection from a pillow of equity shareholders. With a mandatory 15 per cent capital ratio, and 50 per cent risk weighting for investment assets, this translates to a minimum capital requirement of 7.5 per cent. Infradebt intends to issue its first bonds within the next 18 months.

The resulting cash is pooled and the fund can buy up a project’s debt from primary lenders, in theory freeing them up to recycle capital for new projects, or refinance it up to 85 per cent. As the fund can only hold securities, any loans purchased must be transformed into bonds – in effect the securitsation of pooled assets.

ICICI has identified operational PPP projects with capex of US$10.44 billion and a further US$44.3 billion currently under construction, suggesting a healthy pipeline of future investments. And to incentivise investment the government lowered withholding tax on income earned through these bonds from the normal 20 per cent to five per cent.

Under law the fund can only lend to mature public-private partnership (PPP) concessions already in their first year of operation; this restriction inevitably curtails the returns it can expect to yield.

Vinod Kothari, an accountant in India, said that funds like Infradebt will aim for returns of around 10.5 per cent to 11 per cent. As project cashflows will be in rupees, the fund will need to take out currency hedges at a cost of around five to six per cent.

“That still leaves a rate of return of four to five per cent in US dollars, which, I think is quite impressive,” he added.

A lawyer with an international law firm is not convinced. “Given the nature of the underlying asset, by sticking money on deposit in India you are close to what an IDF can deliver with a lot more security”.

Bonds have a three-year lock-in but during this period non-resident investors can trade among themselves. Yet as they are unlisted, a question mark hangs over who will operate any over-the-counter trading; and so unless the manager assumes this responsibility liquidity is likely to be minimal.

A survey of the Indian corporate bond market, by way of comparison, provides little reason for optimism. According to analysts IFMR Capital there is an “absence of secondary markets for corporate bonds in India”, while the wholesale debt market – which covers a variety of instruments such as treasury bills, public sector bonds, loans, mutual trust units and securitised debt – has notably failed to develop in recent years.

Yet as the fund will target institutional investors, who tend to follow a buy-and-hold strategy to match their long-dated liabilities, this issue of liquidity could be a red herring. But without market makers or brokers, there is little to convince foreign investors they can exit in the not unimaginable scenario of a considerable depreciation of the rupee.

Volatility in the rupee as measured against US dollar, 2008 - 2012

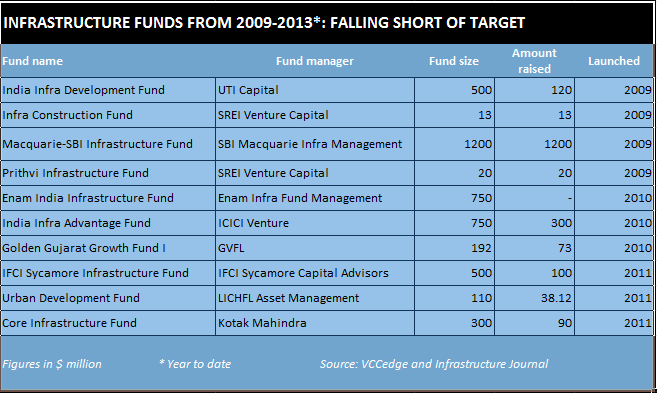

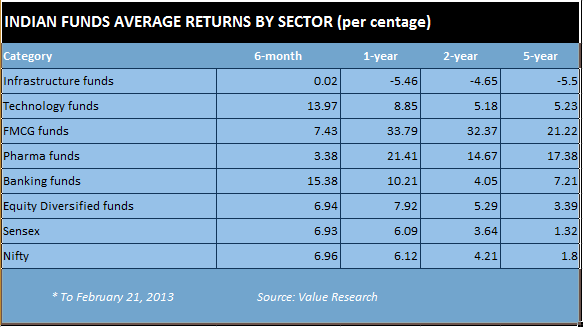

The travails of India-focused infrastructure equity funds opens a window on how fundraising might pan out. That the majority of vehicles launched since 2009 have failed to meet their target (with the notable exception of the Macquarie-SBI fund, which in any case largely invests in infrastructure companies rather than projects) does not bode well, and this presumably is in no small way linked to their dismal performance over the past five years compared to other kinds of investment funds.

India infrastructure equity fundraising attempts since 2009

Macroeconomic factors that have hampered fundraising on the above funds could imaginably strike their IDF counterparts as well. Volatility in the rupee, economic slowdown and an unresolved nationwide power crisis have given investors the jitters over the last year, adding to the chill winds that from 2010 onwards blew across from Europe and America’s financial storm.

Returns on investment funds in India by sector average

This has merely compounded a sectoral problem, namely, the overleveraging of infrastructure companies. Delays to the coming on-stream of a large number of infrastructure developments started in the last two years – largely caused by log-jams in obtaining environmental clearance, land acquisition disputes and a lethargic bureaucracy – have meant many projects are not yet generating revenues.

In turn, developer capital remains locked up in pre-operational stages assets. This is problematic as sponsors must contribute a minimum 30 per cent of NBFC IDF’s equity. Until the emergence of a buoyant secondary market in infrastructure assets, some industry figures say that solutions for debt financing are a distraction when there may not be enough sponsor equity to launch projects in the first place.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.