News+: South Africa’s renewables procurement programme

With the news that the first round of renewables projects under South Africa’s renewables procurement programme have finally reached financial close after months of delays, sponsors, investors, and lawyers alike must be breathing a collective sigh of relief.

For a while, it looked like the country’s ambitious plan to successfully hit financial close on 28 renewables projects all at the same time was set to fail: the closes were supposed to happen in June, and by July, IJ reported that financial close for the projects had been postponed “indefinitely.”

Come autumn, there were still no announcements, and the successive second and third rounds looked as if they were to be pushed back as well. But late last week, the news that the first round's financial closes were finally happening began to filter through to IJ. Sponsors and advisors contacted us with closed term sheets as the South African government announced that it had finally signed on a plethora of power purchase, legal and financial agreements. So what had taken it all so long?

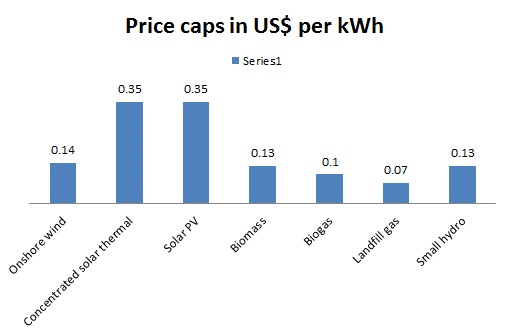

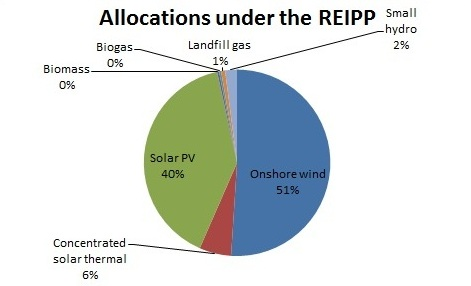

The groundbreaking Renewables Independent Power Producer Procurement Programme (REIPPP) was never going to be simple. The South African government launched the initiative only last year – and structuring the introduction of a long project pipeline, more or less from a standing start, is a complex process. The competitive bid process for the targeted 3,725MW of capacity that underpins the programme is organised by the South African Department of Energy and is split into five rounds. IPPs submit bids for each round, with the rounds taking place at roughly six-monthly intervals which are to be completed by 2013. The cost of the projects - calculated in MWh – is, as ever, a key factor in the decision-making. Caps were imposed on the prices per MWh that developers can submit, with bids automatically disqualified if they exceeded this ceiling, with different technologies having different caps. The renewable technologies permitted under the scheme are the seven listed below, alongside the amount of MW the South African government is seeking from each, and their respective price caps:

So what do the deals look like? Details of the individual financial closes are still filtering through and with the project information we have so far, financing looks to be heavily dominated by South African lenders and development banks, but with guarantees and equity coming from abroad on some projects.

The first project to announce its financial close was the 100MW, US$259 million Dorper wind farm. The project’s sponsor is a consortium led by Japanese company Sumitomo. Equity investors are Sumitomo (60 per cent), Dorper Wind Development (15 per cent) and Black Economic Empowerment (25 per cent). Sumitomo’s involvement in Dorper makes it the first Japanese company to participate in a wind power generation project in South Africa.

The project was financed on a 70:30 debt:equity ratio and was funded in Yen due to the sponsor's domicile. Total equity committed to the project was ¥6 billion (US$74.8m). Equity was provided, according to a government term sheet seen by IJ News, by “a number of leading equity funds” and “debt providers identified from pervious projects” alongside the project sponsors. Total debt committed to the project was ¥14 billion, according to Sumitomo. Debt was provided by the following banks:

- Nedbank

- Standard Bank

- Rand Merchant Bank

- FMO

- Industrial Development Corporation

- Development Bank of South Africa

- ABSA

- SMBC

Euker Hermes is guaranteeing ¥12 billion of the debt. The financing was signed on the 31st October and the offtake agreement with Eskom, a South African-owned utility company, on 5 November.

Another consortium consisting of SolarReserve, the Kensani Group, and developer Intikon Energy, closed a R5.15 billion (US$586m)financing for two 75MW solar PV projects last week: for the Letsatsi and the Lesedi solar PV projects, located in the Free State and Northern Cape respectively. Rand Merchant Bank acted as MLA and bookrunner for the projects' debt funding. Equity for the projects was provided by the IDEAS Managed Fund (managed by Old Mutual Investment Group South Africa), Kensani Capital Investments, GCL-Poly Energy Holdings, SolarReserve and Intikon, with Rand Merchant Bank providing equity.

Mainstream closed three of the Round One projects last week too, but there is less information available on these deals, worth a collective €500 million. Debt for all three projects came from The Development Bank of South Africa (DBSA) and South Africa’s ABSA Bank, Mainstream confirmed to IJ News. ABSA Bank provided the senior debt. The developer declined to comment on the debt to equity ratio and the terms of the deal.

Why the delays? It appears that a whole host of issues were at play, not least the scale of the project and the fact that for some local developers, it was the first time they had been involved in such large financings. The government undoubtedly had their role to play too, with the originally strictly-enforced deadlines becoming increasingly flexible.

Going forward, Round Two is already well underway. With the experience gained from Round One, it can only be hoped that this time round, the deadlines are met. Nick Buckworth of Shearman & Sterling is hopeful that the lessons of the previous round mean that sponsors, government and investors alike will be able to move the project timelines along more quickly. “There was a systemic delay across the whole of the programme. It's important that whatever the cause, that delay is ironed out for the second and third rounds. I think everybody will be more confident with Round Two.” Buckworth added that the second round may see some new international faces join the financing of the projects, after the South African-bank dominated first round. "If you start to get larger scale projects in Round Two there will inevitably be a need to broaden the sources of liquidity."

Standard Bank’s Head of Power & Infrastructure SA Advisory and Coverage, Ntlai Mosiah said that the bank is now working on Round Two deals. "We have already committed a total of R6.1-billion of debt out of a total R19-billion to preferred bidders on the second bidding window. The second programme is smaller than the first and will have a total of 19 projects. Standard Bank is supporting preferred bidders on five of these projects," he said.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.