Two Years of the IRA and Election 2024, US

Sponsored post by Nina Fahy, senior energy transition specialist at Rabobank

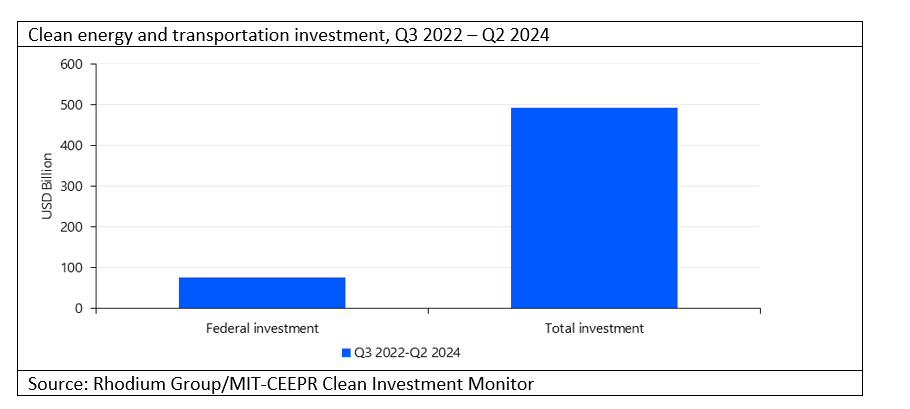

The Inflation Reduction Act recently celebrated its second anniversary and the figures tracking the actual investment to date appear to indicate the legislation’s early success. Nearly half a trillion dollars has been invested in total, with investments from the federal government largely comprised of tax credits and from private investment.

While the IRA was previously thought of as being highly partisan – indeed not a single Republican voted for it as it was passed through a reconciliation process – Republican legislators must consider their constituents and their economic interests when deciding its fate.

That consideration is encapsulated by a letter signed by 18 House Republicans which was sent to House Speaker Mike Johnson asking not to repeal the IRA credits. While that number enumerates public signatories, there may be more within the party that see the IRA’s benefits but do not want to publicly stand in favor of the legislation.

In reality, the fortunes of the IRA are unlikely to be a zero-sum game where the Act continues to exist or is repealed entirely. As the Affordable Care Act demonstrated – which survived dozens of repeal bills and challenges in the Supreme Court – once enacted, legislation is difficult to fully repeal.

However, that does not rule out certain provisions within the Act from changing form. Instead, the real risks to the IRA are around the excision of certain provisions, qualifications, or other changes that could occur. Below, we outline some of the major risk considerations to the IRA under a change in administration.

A key priority under a Trump administration will be an extension of the tax cuts introduced through the Tax Cuts and Jobs Act of 2017 that are set to expire in 2025. Thus, potential shifts in the IRA should be considered in the context of funding the extension of those cuts.

At an estimated $4.6 trillion, according to the Congressional Budget Office (CBO) for a 10-year extension, the search for net cost reductions will be at the fore. Though not all tax cuts may be extended, the scale of what needs to be “paid” for is quite large.

Republicans have already made several unsuccessful attempts to repeal certain provisions within the IRA with “Lower Energy Costs Act” and the “Limit, Save, Grow Act,” among others. Though unsuccessful, a review of what changes were included underscores potential areas at risk. The Limit, Save, Grow Act included elimination of the 48C, the tax credit for qualified clean commercial vehicles, and put limits on 30D for new clean vehicles.

Trump’s anti-electric vehicle (EV) rhetoric, despite its recent softening after his endorsement by Elon Musk, underscores the potential risk to EV-related provisions especially in the context of his – and broader Republican – stance on anti-China reliance. That anti-China rhetoric has also been echoed in Trump’s numerous promises of tariffs on Chinese goods if he were to return to office.

There are several attempts in progress to change various provisions with the legislation. While their timing so late in the legislative sessions makes them unlikely to be enacted, they do underscore provisions at risk. A joint resolution under the Congressional Review Act was passed in July to effectively remove the final rules for the 30D credit.

While the CRA is unlikely to survive a veto from President Biden, it does point to an area – sourcing requirements related to foreign entities of concern – that currently has sufficient momentum to be put back on the agenda when a new sessions starts, given its bicameral and bipartisan support.

The 45X advanced manufacturing production credit is currently available to any entity in the United States. A bipartisan group of senators brought forth the legislation, the “American Tax Dollars for American Solar Manufacturing Act,” to ensure foreign entities of concern would not be able to benefit from the credit. Despite its name, the bill would apply across any technologies relevant to the 45X credit.

In addition, accelerating the expiration date for technology-neutral tax credits could also be on the table under a new administration. The credits, which take effect starting in 2025, phase out at the later date of 2032 or when electricity GHG emissions are 25% below a 2022 baseline. Such an undefined limit (and thus higher spend) is likely to come under scrutiny.

In a broader sense, the recent overturn of the Chevron Doctrine, which has formed the basis of judicial deference to federal agency interpretation of ambiguous law for the past forty years, could have impacts on IRA guidance. To the extent that provisions within IRA guidance were not explicitly codified within the language of the IRA itself, they could be subject to change.

For example, the clean hydrogen 45V tax credit, which as of this writing still has no finalized guidance, and its “three pillars” – additionality, temporal matching and deliverability – governing a project’s qualification were not specifically delineated in the IRA.

While there are only weeks left until voters hit the polls, the resolution of any of these risks will have a longer time frame given the need for new legislative sessions to start and the real work of lawmaking to get underway. RaboResearch will continue to follow these policy developments on our clients’ behalf.

Nina Fahy, executive director energy transition research, will be moderating 2 years of the IRA: Examining the impact and evaluating lingering uncertainty.

Josh Dale, managing director energy transition coverage, will be moderating Exploring the trends in energy transition project finance.

Rabobank Group is a global financial services leader founded by farmers over a century ago. Today, Rabobank is one of the world’s largest banks focused on transitions – both in facilitating a future-proof food system and banking the global energy transition. We thrive on building long-term relationships with clients and stakeholders in one of the fastest-growing renewable energy regions in the world. Visit www.RabobankWholesaleBankingNA.com

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.