Bangladesh powers up greenfield CCGT

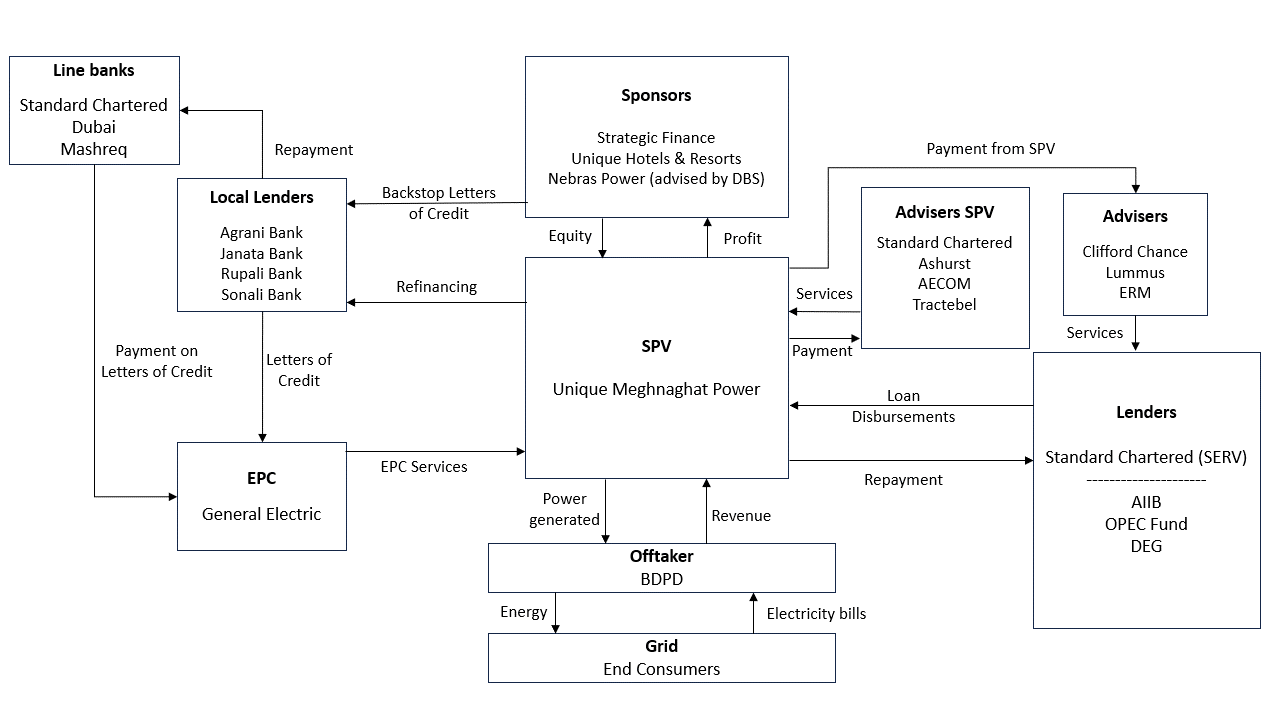

The 584MW Unique Meghnaghat combined cycle gas turbine (CCGT) project recently began commercial operations in Bangladesh.

The $613 million project, which was commissioned in January 2024, is one the largest gas fired power plants in Bangladesh.

“We have managed to finance and commission a private infrastructure project of this size in a record amount of time, despite the challenges posed by a once-in-a-century pandemic and other ongoing crisis,” Unique Meghnaghat Power’s (UMPL) managing director Chowdhury Nafeez Sarafat (pictured right) told IJGlobal.

The project is owned by a consortium of:

- Strategic Finance (SFL) | 38.76%

- Unique Hotels & Resorts | 37.24%

- Nebras Power (Quatar) | 24%

GE Capital Global Energy Investment also holds 20% ordinary shares but without economic interest.

The project is Bangladesh-based SFL and Unique Hotels & Resort’s first power plant in the country and also Nebras’ debut into the Bangladeshi market.

General Electric is the EPC contractor and supplier of the turbines, while the Bangladesh Power Development Board (BPDB) is the offtaker.

Unique challenges

“What made the financing for this project unique, was addressing the 3 key challenges of refinancing sponsor’s debt, convincing lenders to finance an asset already under construction and to do so in an illiquid market like Bangladesh,” says Jean-Louis Neves Mandelli (pictured right), a partner at Ashurst.

While the process for the takeout started in August 2022, the construction of the project had to be kicked off sooner than later to meet the commitments to the off-taker.

“We knew that any financing from international lenders could take years to be disbursed, especially in a market like Bangladesh, which could potentially delay the project’s commissioning,” said Anupam Hayat (pictured left), the chief financial officer of UMPL.

To finance the construction, UMPL’s Hayat said the sponsors planned to open letters of credit (LCs) guaranteeing payment to GE for its EPC work on the project.

These LCs were initially backed by sponsor equity, according to Hayat, but would later be guaranteed by the 3-year local currency facility, with the remainder of the facility directed towards Capex, local expenses, among others.

The LCs for the EPC were discounted and paid by offshore banks such as Standard Chartered Bank’s Dubai branch and Mashreq Bank.

“It’s remarkable that the financing managed to close on an asset that was under construction, and which required a complex refinancing of construction facilities, all at a time when Bangladesh was suffering from low US dollar liquidity,” Mandelli said.

As oil prices shot up post Russian-Ukraine war and supply chain issues during Covid-19, Bangladesh like many other developing countries faced shortage of US dollars.

“To refinance, sponsors had to reverse engineer everything - to determine how much was owed to the foreign LC issuing banks as well as to the various local lenders in Taka, to clear all the liabilities owed to them and discharge the security interests granted to them.”

The first disbursement of the $483 million loan signed in December 2023, was used to refinance UMPL’s local currency debt.

Hayat told IJGlobal that, “from the start, the intention was to finance the project with international lenders, and the solution we (the sponsors) came up with helped avoid liability in Taka, as any settlement on LCs done by the local banks would have made refinancing the debt with foreign currency much more challenging.”

The other challenge faced was the urgency to close the financing in an illiquid market before the project was commissioned. Any delay in closing the financing before commissioning would make it ineligible for the SERV-backed tranche.

The ECA backed tranche was a core component to the financing, as it provided cover for Standard Chartered enabling the bank to lend at a time where the Bangladeshi market was suffering from a lack of liquidity.

Mandelli said that the lender’s confidence in the sponsors and the commitment of the DIFs to Bangladesh was a key factor in achieving financial close, despite the illiquidity of the market.

Financing solutions

The project was financed by a $483 million non-recourse, 15-year facility, which the financial adviser StanChart helped arrange.

It was split into 4 tranches:

- ECA tranche (covered by SERV): StanChart | $270 million

- DFI/multilateral tranches

- AIIB | $110 million

- DEG | $45 million

- OPEC Fund | $38 million

SERV provided a 95% political and commercial risk cover for StanChart, as reported.

The $270m ECA tranche was priced 158bps over Sofr, compounded in arrear over 6 months per annum.

The AIIB and DEG-backed tranches were priced 418bps over SOFR, compounded in arrear over 6 months per annum. OPEC’s tranche also pays the same pricing.

The loan has an availability period till June 2024, and close to 80% of the loan was disbursed in December 2023, shortly after the financial close, UMPL’s Hayat said.

Hayat said that the remainder of the $483 million facility will be disbursed in May 2024, and proceeds will go towards the settlement of a $33 million letter of credit for an EPC contract, as well as the final settlement with GE.

Hayat said that the all-in fees for the facility were 2%, with total fees coming up to 150bps. The commitment fee was 75 bps.

The amortization of the loan would be done semi-annually over the next 14 years, with the first repayment coming up in March 2024. If the borrower was unable to make the first payment, Hayat said the shortfall would be made up with sponsor support. The second repayment will occur in September 2024.

The loan has an average life of 7 years.

Unique M&A

Another key event that occurred during the development of the project was the entry of Nebras Power as a sponsor in the project.

The Qatari firm acquired a 24% stake in April 2021 for about $85 million, marking its entrance into the Bangladeshi market.

UMPL’s Hayat, who closed the deal, said that this M&A component was a long process which took over 2 years to settle, but served to make the project unique.

“They (Nebras) came into a greenfield project and offered good terms to the shareholders, during covid no less, which is an uncommon occurrence in the market.”

Hayat explained that M&As in Bangladesh were often done at a holding company level, but this M&A was done on an SPV level on a greenfield power plant, making the transaction the first of its kind in Bangladesh.

Advisers

- Standard Chartered Bank – financial (SPV)

- Ashurst – legal (SPV)

- AECOM – technical (SPV)

- Tractebel – environmental (SPV)

- Clifford Chance – legal (lender)

- Lummus Consultants International – technical (lender)

- ERM – environmental (lender)

- DBS – financial (lender, Nebras M&A)

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.