Party’s over – time to go home

It’s late. You’re in taxi territory. The nibbles are finished or looking dubious. And you’ve just realised you’re the only one at the party who’s not staying over. It’s time to go home.

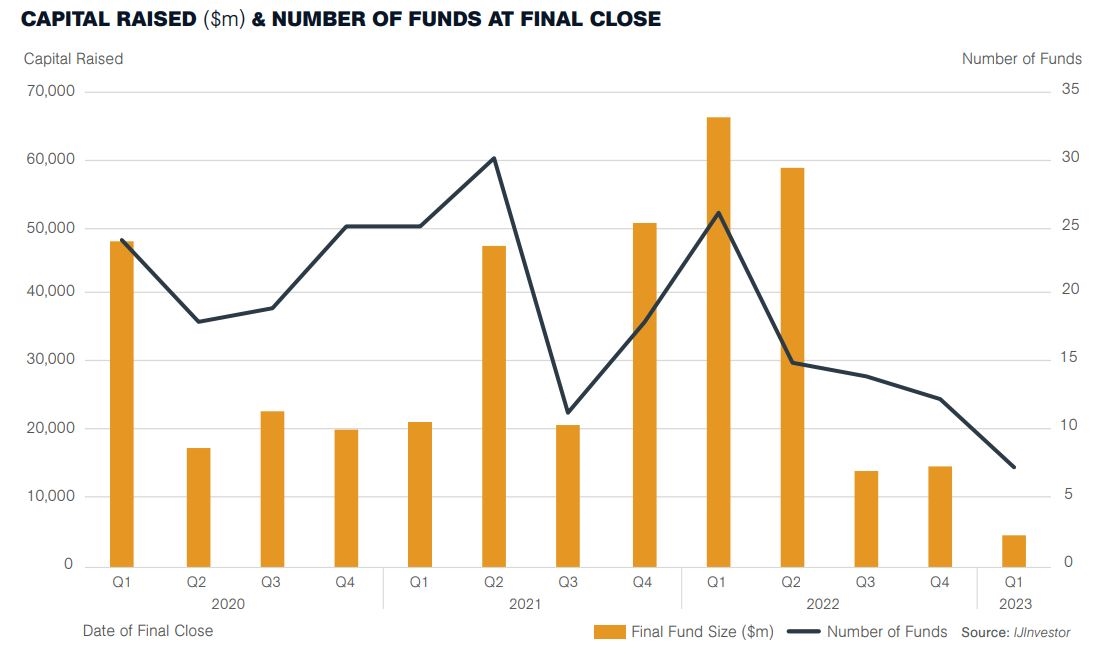

Having this week published the IJ funds and investors report, that’s kinda the way it feels when running an eye over the fundraising chart for close-ended infrastructure funds – the party’s over.

Whenever we write up these reports, we draw comparisons with the corresponding quarter from the year before and elicit a gasp of horror / nod of satisfaction (delete as appropriate) at the findings.

It’s all a bit dumb – and we know it. We all look at the charts and smile as it heads up to the top right. It’s satisfying. It tells us that we’re doing something right. And everyone loves a big number… especially if it’s bigger than the year before, and the one before that – ad origin.

However, when that top right bar shoots down to bottom right, frowns start to appear. That’s when start taking note of the time, look around the room to see who’s still there, and then reach for Uber.

Last year (full-year 2022) glasses were raised to capital raising which hit an all-time high for infrastructure and energy with almost $147 billion raised (close-ended infra funds) – up from $140 billion in 2021.

But now we work into 2023 with a dismal showing for the first quarter, smiles are starting to fade as we tot up a measly $4.5 billion in the global kitty.

Truly, it sounds like the market has fallen off a cliff. But as always, the devil’s in the detail… and it’s not as bad as it sounds. In fact, it’s more of a continuation of a theme.

Let’s take it through the last couple of years that have built up to this quarter’s poor showing, running through our findings on a quarterly basis:

- Q1 2021 – $20.9 billion

- Q2 – $47 billion

- Q3 – $21.2 billion

- Q4 – $50.6 billion

Pretty impressive performance as we emerged from lockdown and all the chats with LPs resulted in cash changing hands in the brave new, post-pandemic world.

That head of steam kept things moving along nicely into 2022, but only for the first half:

- Q1 2022 – $66.2 billion

- Q2 – $58.6 billion

- Q3 – $14.2 billion

- Q4 – $14.9 billion

The head of steam clearly petered out at the mid-point of 2022 with the second half pulling in just a paltry $29 billion.

So, when viewed in the light of progress in H2 2022, Q1’s $4.5 billion isn’t quite as stinking a result as it appears at first glance.

Sign of things to come

Talking to folk around the market this week, the jury’s well-and-truly out over the longevity of this downturn for fundraising for close-ended infrastructure funds.

IJGlobal’s view is that we can expect this to continue for the medium term… and by that we’re talking about 1 year minimum. As to a return to a record-breaking full-year at more than $147 billion – that’s going to be a while.

One infra fund veteran was very much of this view, celebrating the arrival of a “cooking off period” that will “teach a few of the irrationally-exuberant children a few lessons”. Strong words… and that’s from IJ where we love wheeling out strong words.

This source was of the view that the slump will last through to 2025… which is pretty much IJ’s thinking on the matter.

Not everyone agrees. Some are more of the mind that it’s a blip… the merest dip in the ever-upward quest to push the limits of our chart designers. But if it’s such a blip, why are we hearing that fund managers are hitting a bit of a go-slow on hiring? Having said that, recruitment sources say that 2022 was a record year for infra funds… and that continues to include IR hires.

Positivity remains the order of the day – and why not. Pop a Valium and smile wider. After all, as one source says: “All the infrastructure needed to deliver net zero / sustainability objectives won’t finance itself!”

Another source is a bit more nuanced: “Energy and infra continue to be big themes for LPs as they are great ways to play the energy transition and inflation protection theme. However, I think LPs are also being much pickier on GPs who can demonstrate a differentiated strategy rather than just a cost of capital shootout. LPs are now looking for some alpha and they’re moving away from GPs who they perceive as just providing beta exposure.”

Yet another opines: “The denominator effect is clearly an issue that doesn’t resolve itself until public markets come back / above Q3-4 2021… or, dare I say, private markets mark to market.” This source continues: “If you want to be pessimistic another factor for asset allocators is maybe infra just doesn’t look that great in a market where public bond yields are attractive… which they have not been for a decade.”

The majority of people asked lean towards this being a blip and that happy days will be ours once again without leaning too heavily on the Valium prescription.

Says one: “Inflation is starting to stabilise and fall across the UK, the US and the EU. Once the rate rising cycle is reversed – likely Q1 2024 – sovereign yields will fall, widening the spread to infra, thus making the sector attractive again for investors.”

That view is shared: “For private infra, the issue is that with public bond market valuation downwards, private markets – that haven’t revalued yet – are now a bigger proportion of people’s portfolios. Private equity markets are also naturally more illiquid. So, once those revaluations come through in the next 6 -9 months, that should be the trigger for reset and normal service should resume.”

Fills glass (half empty). Looks at pill in palm. Sighs. Pops pill. Smiles. Onwards and upwards. Poop, poop!

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.