Bhola II gas-fired recapitalisation, Bangladesh

The recapitalisation of the Bhola II gas-fired power plant was another step in the maturation of Bangladesh’s project finance market. The transaction innovated the domestic project finance market for power by bringing in a larger club of commercial banks, including two first-time participants in Bangladesh’s project finance market, and a new international equity holder

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus ultrices urna eu consequat pulvinar. Suspendisse malesuada scelerisque iaculis. Cras ut facilisis arcu, posuere efficitur nisi. Fusce dictum tortor ac nibh rhoncus auctor. Praesent nunc felis, elementum vel orci quis, sodales tincidunt nisi. Vestibulum vestibulum vel erat quis feugiat. Nam nec pulvinar velit. Nunc feugiat felis lacus, non condimentum urna interdum vitae. In laoreet hendrerit commodo. Sed diam arcu, tincidunt quis augue ac, venenatis consequat dui. Quisque maximus venenatis erat, sed malesuada quam malesuada at. Aenean non quam a ex vulputate laoreet. Praesent eget neque convallis, rhoncus lorem a, venenatis metus. Maecenas sed malesuada purus.

Integer vel neque vel odio tempor laoreet. Praesent vel malesuada dolor, sit amet aliquam augue. Cras magna tortor, ullamcorper nec tristique ac, accumsan quis metus. Integer in magna sit amet leo vulputate vulputate. In pretium quam libero. Cras a pulvinar arcu, et rutrum orci. Proin euismod, justo quis scelerisque porttitor, purus odio dignissim ex, eu rhoncus lorem dolor sit amet mi. Pellentesque in massa vel mauris tempus euismod. Aenean efficitur vestibulum arcu ut elementum. Nam rhoncus ligula vel enim iaculis, quis luctus dui interdum. Nulla erat mi, lacinia eu orci ut, hendrerit fermentum lorem. Sed non gravida quam. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Nulla bibendum erat odio, pharetra lobortis eros blandit a.

In et ultrices ante. Vestibulum consequat libero quis quam tempor, efficitur accumsan lacus sollicitudin. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Phasellus ac est lacus. Quisque in interdum urna, non pulvinar sem. Duis tristique tortor vel urna commodo tincidunt sit amet ut sem. In sapien turpis, porta vitae neque in, varius egestas erat.

Interdum et malesuada fames ac ante ipsum primis in faucibus. Donec quis est vel ante facilisis efficitur. Pellentesque tincidunt odio eget lacinia vestibulum. Aliquam erat volutpat. Ut ac ipsum non nisi convallis eleifend et ornare lectus. Pellentesque diam nulla, dapibus quis convallis sed, posuere at urna. Proin tincidunt tincidunt nibh, id molestie est. Integer iaculis, leo sit amet pulvinar pellentesque, tellus elit vehicula ipsum, eget vulputate dui tortor vitae sem. Proin rhoncus venenatis tellus, vitae blandit ipsum malesuada sed. Morbi gravida magna hendrerit faucibus imperdiet. Ut bibendum a massa at efficitur. Donec egestas urna urna, sit amet mattis erat fringilla sit amet. Integer scelerisque enim sed odio semper molestie. Sed tincidunt malesuada nulla a fringilla. Nullam suscipit, justo nec facilisis efficitur, arcu mauris finibus lorem, ut egestas mi purus nec neque. Nunc nec euismod est, ac egestas neque.

Vivamus sit amet pretium quam, vitae fringilla dolor. In nec ligula arcu. Fusce a tortor leo. Sed blandit leo quis turpis sodales, eget tincidunt tortor ultrices. Fusce scelerisque eros quis quam vestibulum tempus. Praesent sodales aliquam nibh vel fermentum. Quisque vel diam sit amet sem convallis interdum. Proin ac velit molestie, malesuada tellus vitae, tempus est. Sed facilisis ut enim ac pretium. Mauris scelerisque fermentum risus, nec ultricies enim finibus vel. Aenean sem enim, dictum mollis aliquet nec, consequat nec nisl. Duis aliquam a lectus vitae ornare.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.

Request a demo nowExisting Subscriber?

If you are an existing subscriber please sign in to read this article in full.

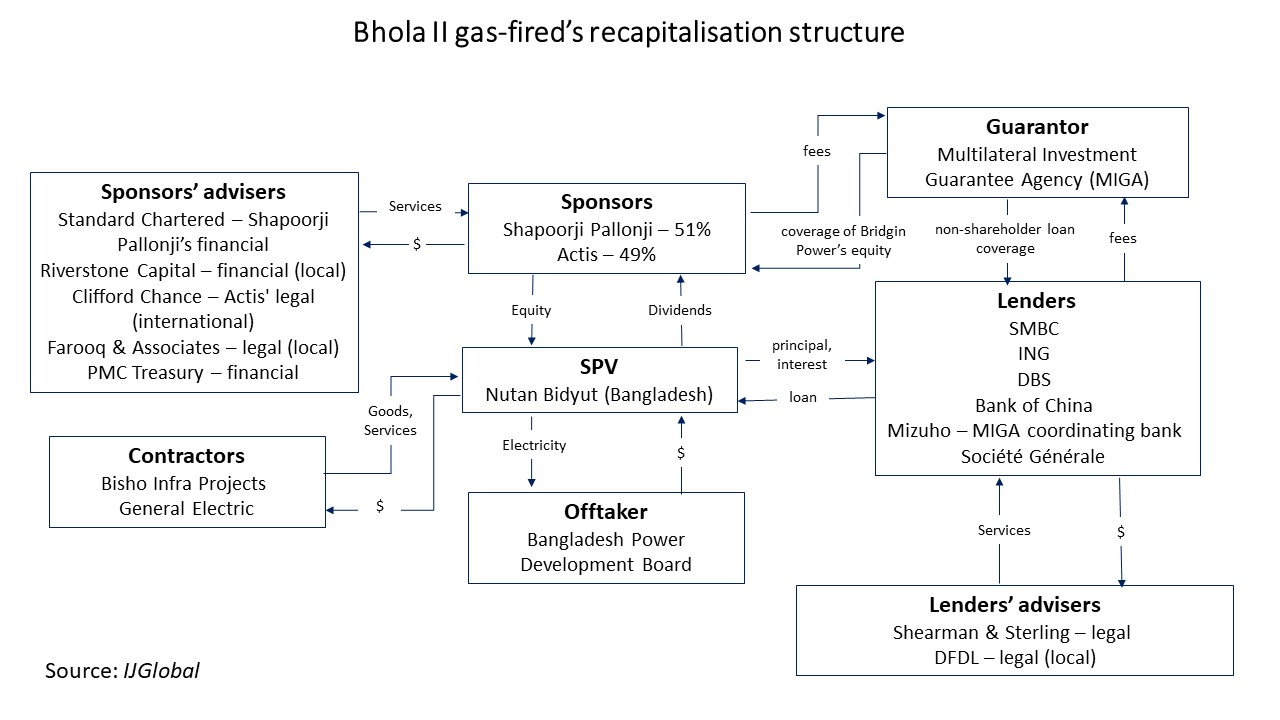

Sign InThe recapitalisation of the 220MW Bhola II gas-fired power plant in June 2022 was another step in the maturation of Bangladesh’s project finance market. The multi-prong transaction involved London-based investment manager Actis’ investment in the project company. It also had refinancing that saw a syndicate of commercial lenders replace development finance institutions (DFIs) as debt providers.

Bangladesh Power Development Board (BPDB) in April 2016 issued a letter of intent for the build-own-operate (BOO) project to Indian conglomerate Shapoorji Pallonji’s Nutan Bidyut (Bangladesh) as the special purpose vehicle to develop the $272 million gas-fired combined cycle power plant on Bhola Island adjacent to BPDB’s existing Bhola I power plant in Kutuba, Burhanuddin. The project company has been selling electricity under a 22-year PPA with BPDB since its commissioning in June 2021.

Bhola II was not the first time an all-commercial-bank club took over the debt financing of an IPP in Bangladesh. That distinction went to Clifford Capital and SMBC’s $140m 10-year refinancing debt package to Summit Gazipur II – the project company of the 300MW heavy fuel oil (HFO) power plant in Kodda, about 30km from the capital city of Dhaka. Clifford Capital provided more than 50% of the US dollar financing. Its tranche had a fixed interest rate of slightly more than 3%, with SMBC’s floating interest rate roughly comparable.

Bhola II’s recapitalisation innovated the domestic project finance market for power by bringing in a larger club of commercial banks, including two first-time participants in Bangladesh’s project finance market, and a new international equity holder.

Refinancing Bhola II

Bhola II has 2 gas turbine generators, 2 heat recovery steam generators and one steam turbine generator along with facilities for fuel gas transportation, compression and conditioning system, high-speed diesel storage, cooling water system and water treatment facility. Nutan Bidyut evacuates power through a gas-insulated switchyard of the plant to the existing 230kV air-insulated switchyard to Barisal substation through the existing 230kV transmission line. A roughly 5km gas pipeline from the Shahbazpur gas field connects to the project site.

DFIs were seriously considering providing primary financing for the power plant by November 2017 and financing approvals started arriving by February 2018. Shapoorji Palloonji brought in 2 DFIs from abroad and one domestic non-banking financial institution to finance the power plant.

The primary financing was on a 52:48 debt-to-equity ratio, far less levered than the average of 80:20 for Bangladesh’s power finance market, according to IJGlobal data.

The original financiers were:

- debt:

- Asian Infrastructure Investment Bank (AIIB) – $60m (22%)

- Islamic Development Bank (IsDB) – $60m (22%)

- IDCOL Bangladesh (IDCOL) – $22m (8%)

- equity:

- Shapoorji Pallonji – $130m (48%)

The new commercial lending syndicate that replaced the DFIs with a $200m loan was:

- SMBC

- ING

- DBS

- Bank of China

- Mizuho – MIGA coordinating bank

- Société Générale

The group included 2 commercial lenders that participated for the first time in a project finance transaction in Bangladesh.

IJGlobal understands the tenor was 18 years.

The refinancing gave Shapoorji Pallonji and Actis $58m more headway in debt than the original loan package.

“The refinancing was a multi-jurisdictional transaction with a bespoke refinancing structure to meet the requirements of the existing and new lenders, and was completed on an accelerated timeline,” lenders’ legal adviser Shearman & Sterling said.

Actis' investment

Actis’ acquisition of a nearly controlling equity interest in the project company and Multilateral Investment Guarantee Agency’s (MIGA) substantial guarantee package added other important facets to the deal.

The London-headquartered investment manager recently established a new $400m gas-fired power generation business called Bridgin Power that will invest in South Asia and Southeast Asia.

Actis Energy Fund 5’s Bridgin Power in June (2022) acquired a 49% equity stake in Nutan Bidyut from Bhola II’s original sponsor Shapoorji Pallonji Infrastructure Capital.

“We believe natural gas is an essential fuel for the medium term offering flexible low emission power as the region gradually transitions to more green energy sources,” said Sanjiv Aggarwal, partner at Actis energy infrastructure. “Investing from our US$6bn Actis Energy 5 Fund, in partnership with Bridgin’s management team, we aim to deliver up to 1.2GW of power capacity by 2028.”

Singapore-based Dennis Foo is group chief executive at Bridgin Power, which targets $1.6 billion AUM. The platform's opportunity set includes gas-fired power plants in Vietnam, Indonesia, Thailand, Philippines, Malaysia, Bangladesh and Sri Lanka. IJGlobal data shows 146 gas-fired assets worth more than $106 billion in those 7 markets.

Shami Nissan, Actis partner and head of sustainability, and Mukundan Srinivasan, managing director for Shapoorji Pallonji Infra, also worked on Bhola II’s recapitalisation.

MIGA’s $407m guarantee package was a critical component of the transaction. The assistance covered non-shareholder loans from the 6 international banks for 18 years against the risks of transfer restriction, expropriation, war and civil disturbance, and breach of contract-arbitral award default.

The World Bank Group member also covered equity investments by Bridgin Power against the risk of breach of contract-arbitral award default for 20 years.

Advisers included:

- Standard Chartered – Shapoorji Pallonji's financial

- Riverstone Capital – financial (local)

- Clifford Chance – Actis' legal (international), led by Melissa Ng, Hans Menski, Paul Landless, and Matthew Buchanan

- Shearman & Sterling – lenders’ legal (international), led by Jean-Louis Neves Mandelli

- Farooq & Associates – sponsors' legal (local)

- DFDL – lenders’ legal (local)

- PMC Treasury

Boosting Bangladesh's renewables capacity

Bangladesh has been vocal about becoming a middle-income country, which requires boosting its energy capacity to support the government’s goal of development.

The power sector has witnessed large investments being made by multilateral agencies, DFIs, and bilateral agreements with strategic investors and commercial lenders, which is evident through the refinancing of Bhola II. The Bhola II recapitalisation serves as an example that displays a consortium of commercial lenders replacing existing DFIs for the refinancing of the plant.

Meanwhile, Bangladesh's development of renewable energy continues to be outpaced by fossil-fueled power projects. The non-renewable forms of energy threaten Bangladesh’s ability to meet its commitment to reduce greenhouse gas emissions under the Paris Agreement and its goal under the UN Sustainable Development Goals.

Despite that, the Bhola IPP project usefully serves as a transitionary deal, with more commercial banks likely appearing in future primary financings. The transaction serves as a pivotal reminder to implement more renewable-friendly energy infrastructure projects in the future and pivot away from non-renewable forms of energy such as coal and gas-fired plants in Bangladesh.

Contact the author

Use the form below to contact the author of this article with any feedback, amendments, or general comments.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.

Related Companies

Related Companies

| Company Name | Company Tracker |

| Another Company | Company Tracker |

| One More Company | Company Tracker |

Snapshots

Bhola Gas-Fired Power Plant (220MW) IPP

- Financial Close:

- 06/12/2018

- SPV:

- Nutan Bidyut (Bangladesh) Ltd

- Value:

- $268.04m USD

- Equity:

- $89.04m

- Debt:

- $179.00m

- Debt/Equity Ratio:

- 67:33

- Concession Period:

- 22.01 years

Acquisition of 49% in Bhola Gas-Fired Power Plant (220MW)

- Financial Close:

- 29/05/2022

- SPV:

- Nutan Bidyut (Bangladesh) Ltd

- Value:

- $105.00m USD

- Equity:

- $0.00m

- Debt:

- $105.00m

- Debt/Equity Ratio:

- 100:0

Bhola Gas-Fired Power Plant (220MW) Refinancing 2022

- Financial Close:

- 02/06/2022

- SPV:

- Nutan Bidyut (Bangladesh) Ltd

- Value:

- $105.00m USD

- Equity:

- $0.00m

- Debt:

- $105.00m

- Debt/Equity Ratio:

- 100:0

Snapshots

Acquisition of Some Company

- Value:

- $9,838.26m USD

- Equity:

- $9,838.26m

- Debt:

- $0.00m

- Debt/Equity Ratio:

- 0:100