The Fitch Interview

Fitch had an outstanding 2020, with its global infrastructure & project finance team consolidating its market leader position by actively monitoring the performance of 900 transactions globally and adding 60 new issuers to its portfolio.

But what made Fitch really stand out in 2020 was its response to the pandemic and its ESG leadership:

- in infrastructure, Fitch had 569 investor interactions globally, including 102 investor roundtables, 73 Fitch-hosted webinars, 9 conference presentations and 244 one-on-one investor meetings;

- it was the only ratings agency to provide complimentary access to a dedicated Coronavirus website featuring research, multi-media content and webinars on Fitch’s perspective on the credit and economic impact of the pandemic.

Cherian George (pictured), global head of infrastructure & project finance at Fitch, said: “Our response to Covid-19 has been excellent. We reviewed our 900 ratings globally in 2020, and multiple times with more than 50% in the transport space. Given that this was the sector most impacted, from March 2020 onwards we systemically went through the entire portfolio and provided credit views.”

- This interview first appeared in IJGlobal Magazine, to access click here...

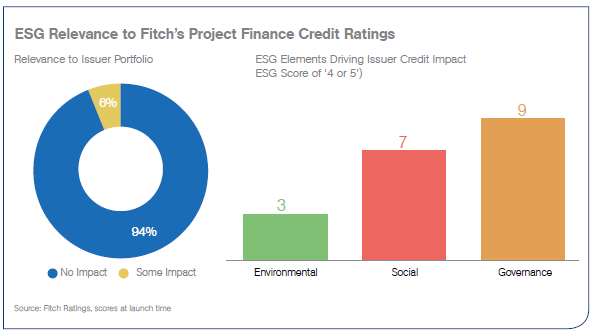

With ESG, Fitch is currently the only ratings agency with an integrated, comprehensive, systematic and credit-focused approach showing how ESG factors affect credit ratings from the sector to entity and transaction level.

In the global infrastructure sector, Fitch has 4,550 unique data points capturing the impact of ESG factors in its credit views.

ESG leadership

Given the importance of ESG in investing and to governments and society at large, Fitch has enhanced transparency in this space over the last few years. “Our ratings criteria incorporate all the major aspects of the risks associated with transactions in project finance and within each risk are ESG elements such as building in sensitive areas, the carbon footprint of projects and the importance of governance”, says George.

Fitch has created a system of providing relevance scores where investors can connect ratings criteria to ESG elements and risk associated with it. “We score them on a scale of 1 to 5, where 1 has little relevance and 3 has relevance but won’t have a material impact meaning it won’t affect the rating. But the moment there is an issue – whether positive or negative – where the ESG related factor is affecting our rating, it gets a 4. And if it results in a change in the rating, it gets a 5.”

What Fitch provides is an ‘ESG Navigator’ that offers investors the tools to make a judgement. “A rating tells you what the credit risk is, the ESG navigator tells you that if you have an ESG focus, these are the parts of the credit that are being affected”, says George.

Stress-testing

The focus for Fitch in 2020 was to improve the quality of its products, increase transparency, continue with ESG leadership and build out the team further.

“The pandemic and the shutdown of the global economic threw a curveball at us”, says George. “However we have such an experienced team that they were able to respond very quickly with strong analytics. A great example of this was in March 2020 when we knew we had a problem, we scanned all the areas we cover quickly, and commented publicly to the market, concluding that transport would be the most impacted and that contracted projects would be less so because of the stability of counterparties.”

Fitch then began looking sector by sector, and came up with stress tests. It was the only ratings agency to publicly disclose coronavirus stress tests across transport, in every region and in every sector. “To this day, I haven’t seen any other agency do that”, says George.

George added that a year later, Fitch’s views have “stood the test of time”.

“Fitch doesn’t make blanket decisions, every market is different, every region is different, and you need to make selective decisions based on the conditions there. Airports unsurprisingly had a negative outlook with some downgraded and toll roads to a lesser degree. Seaports surprised us all. They outperformed any historical benchmark because coronavirus does not affect goods.”

Fitch also put in place quarterly global Covid-19 trackers to show traffic trends, region by region relative to infection rates.

“The market found these macro and micro perspectives throughout the year very valuable”, says George.

Digital Infrastructure

While digital infrastructure is not a new sector, Covid-19 has highlighted the importance of this asset class, particularly for governments to equip the population with access to networks.

One notable transaction Fitch worked in this sector was SummitIG’s high capacity network of fibre optic cable assets in Virginia. Fitch assigned A-, BBB- and BB ratings to 4 series of notes, totalling $225 million. The transaction, which replicates structures that have been used for cell tower and data centre financings, was a landmark first financing of its kind of fibre assets.

Fibre remains an emerging infrastructure asset class with the SummitIG transaction being the first North American non-recourse fibre bond financing since Fitch rated the Kentucky Wired Infrastructure Company P3 in 2016.

Kentucky Wired and SummitIG transactions were very different in that Kentucky Wired was an availability-based P3 project that didn’t feature market or re-contracting risk while SummitIG transaction did, albeit largely mitigated by its strong position in an important market and high barriers to entry.

Staying one-step ahead

George believes that infrastructure, energy and digital investments are growing at a tremendous pace with not just new construction, but M&A activity, refinancing and restructurings.

“2021 has been a continuation of 2020, with a focus on even better products, enhancing the quality of our research and asset performance information to provide value-added analysis to the market. There are legacy sectors that we continue to focus on but in our space people are always innovating and coming up with new ways of doing things which requires us to be one step ahead in our thinking.

“We say what we do, and then do what we say - both are important.” George says that Fitch will continue to focus heavily on renewables, an area of tremendous strength globally as we rate transactions in every region; in developed and developing markets.

“Other area of focus for us are emerging technologies and sustainable fuels in the energy transition mix. Batteries and green hydrogen technologies and cost considerations are evolving as we speak, and consequently are areas we seek to improve on,” says George.

“The Middle East is also growing significantly with energy, transport, social infra and sports transactions emerging.”

George adds: “We are a global company with global presence but we are very conscious of the fact that local considerations make a difference and having people on the ground who understand that better allows us to provide the market with a complete and transparent view of credit risk.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.