Sneak Peek – FY 2020 League Tables: year of the bond

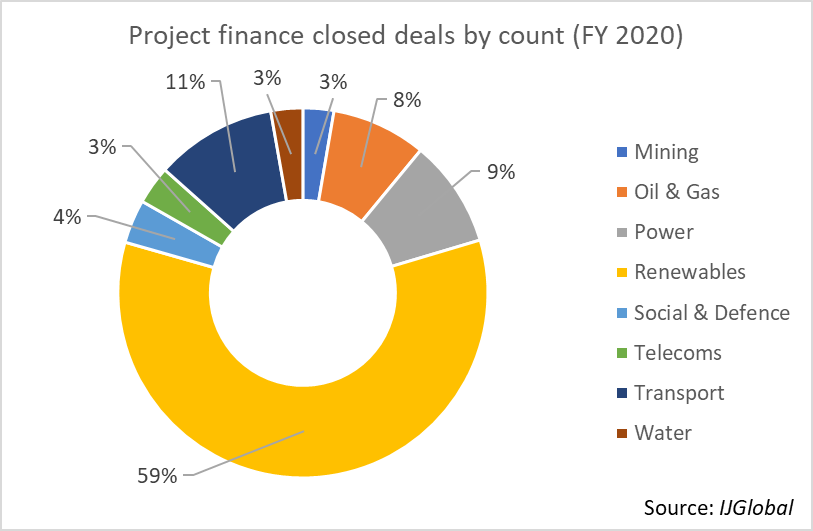

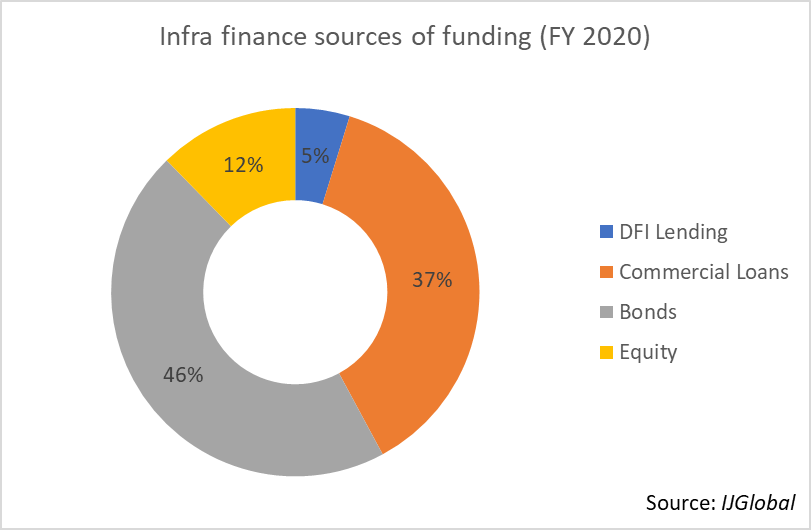

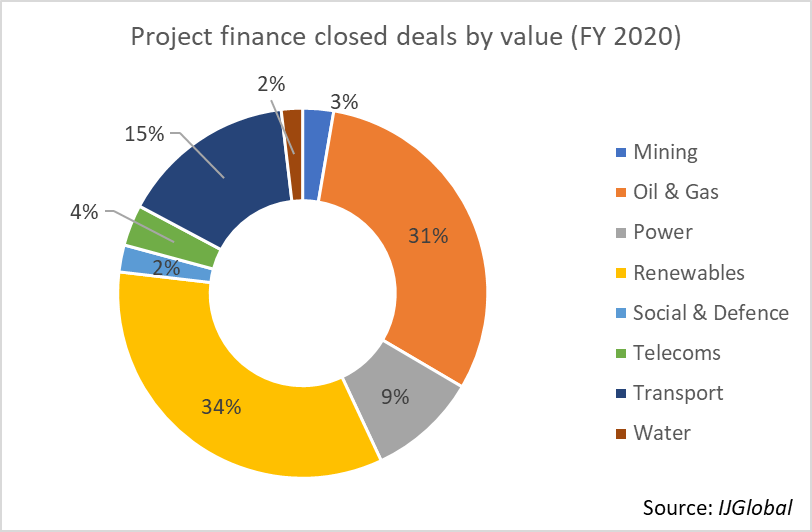

Bonds and renewables… with 76% of client submissions processed, the preliminary data for the IJGlobal Full-Year League Table Report (2020) suggests these two words define infrastructure finance in 2020.

Oil and gas, power and telecom majors from Europe and North America – Chevron, Energy Transfer, Iberdrola, Occidental Petroleum, BP, Altice, Cellnex and O2, to name a few – issued tens of billions worth of corporate bonds in a bid to tap into the capital markets and achieve stability in the Covid-19 crisis.

Beyond security, preliminary data suggests that bonds were also a sort of forward-looking statement, with companies committing to renewable energy.

Power sector giants such as EDF, E.ON, TenneT, EDP and Avangrid went further into that territory, obtaining green project bonds – a strong stance and commitment to renewable pipeline portfolios.

Renewables for the win

The period saw a number of ultra-large scale projects reach financial close, more specifically in the offshore wind sector.

Dogger Bank A and B in the UK, reportedly exceeding $12 billion in value, reached financial close in November, with a complex structured debt provided by some 30 lenders and backed by export credit agencies.

Favourable regulatory regimes and investor appetite for offshore wind were among the factors allowing for the completion of other notable projects – the 1.14GW Seagreen bundle (UK), the 600MW Changfang and Xidao duo (China), and the 500MW Fecamp wind farm (France).

The rush for renewables is also a marker for the rise of environmental consciousness. In 2020, it made its way in mainstream infrastructure financing in the form of green bonds and ESG criteria applied to both corporate and project finance.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.