IJ Survey – Digital Infra to re-boot economies

Investors are poised to commit heavily to digital infrastructure, according to a new worldwide investor survey and study conducted by IJGlobal and M&E Global.

The global survey reveals that 63% of respondents – all of whom are actively involved in the financing or delivery of digital infrastructure – believe that the Covid-19 pandemic will give digital infrastructure a significant push, as people become increasingly dependent on digital connectivity.

Key data points:

- 63% – coronavirus to give digital infrastructure big push

- 50.7% – digital infrastructure is key to re-booting economies post Corona

- 69.6% – Europe, Asia and Asia-Pacific to benefit most from digital infra

- 63% – actively involved in financing/delivery of digital infrastructure

- 52.7% – already integrating digital infra into their current projects

- 22.2% – digital infra will support resilience of current infrastructure

- 59.2% – failure to invest in digital infra will drive down countries’ competitiveness

- 32.4% – government support is key to unblocking digital infra investment

- 29.8% – PPP structures need to be re-structured to allow for digital infra investments

- 18.1% – lack of technical skills will hold back digital infra progress

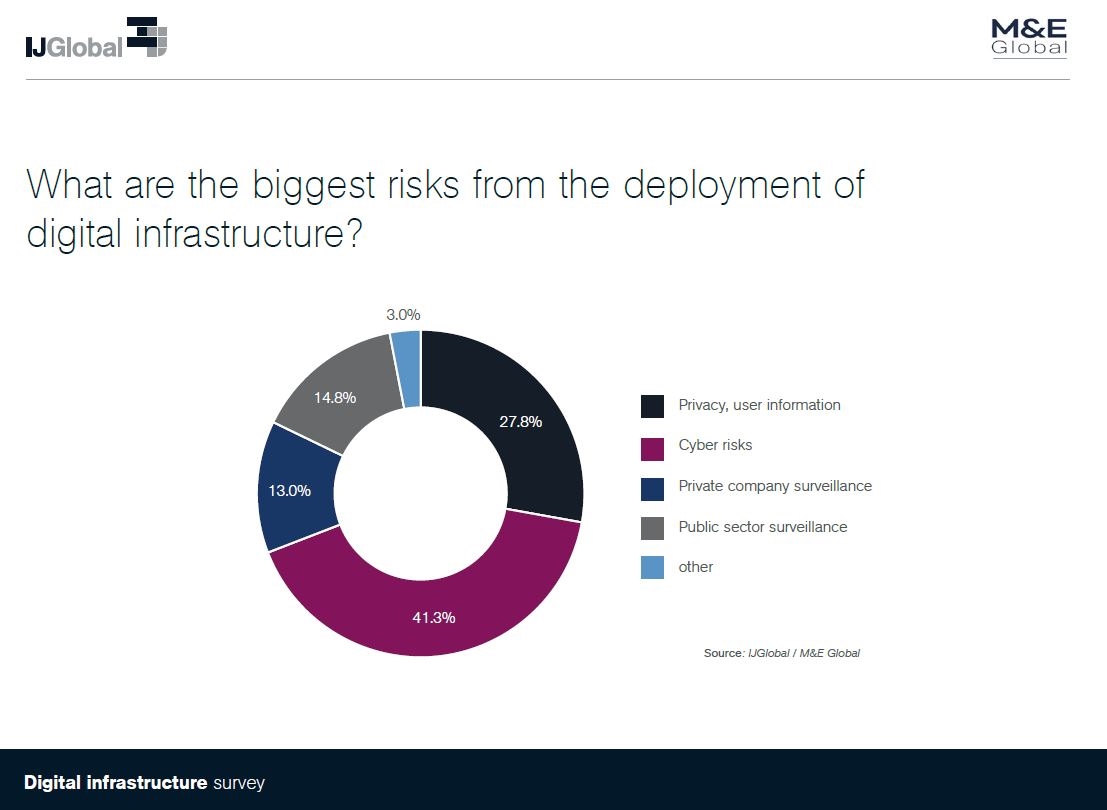

- 41.3% – cyber security is greatest concern in deployment of digital infra

- 63.6% – benefits of digital infra outweigh risks

A PDF of the full survey findings can be FOUND HERE...

These results are in line with Asian Infrastructure Investment Bank (AIIB) research which shows digital infrastructure needs an injection of more than $1 trillion in the near future to meet demand for 5G, data centers and digital applications such as smart cities and intelligent transportation, with 50% of that attributable to Asia. This is all the more urgent given that the United Nations estimates 4 billion people are not even connected to the internet, while only 2.5 billion are.

The urgency of this investment is underlined by World Economic Forum (WEF) research that identifies the global digital economy in 2018 was valued at $11.5 trillion, or 15.3% of global GDP. By 2028, WEF estimates the digital economy will make up 25% of global GDP, more than any other sector. Worldwide, the digital economy is growing at more than 10% annually – 12-25% in emerging markets, according to WEF research this year (2020).

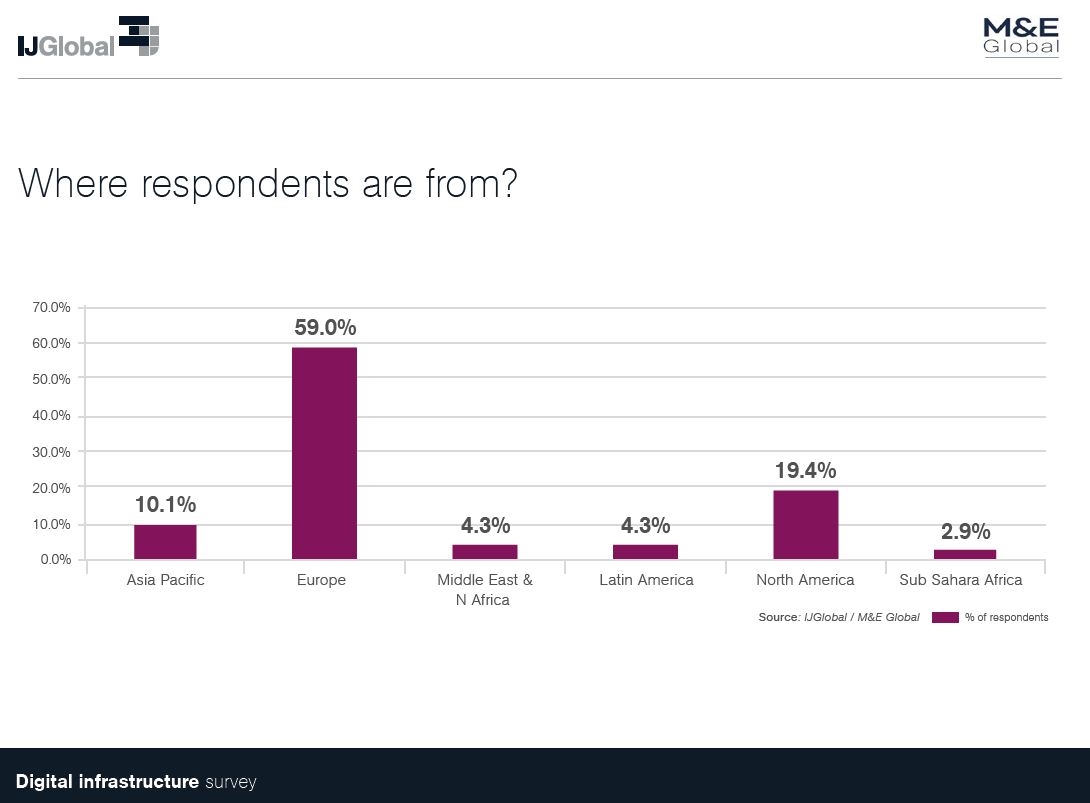

"Europe, North America and Asia-Pacific are most likely to benefit from digital infrastructure investments and resulting growth," says Mathew Garver, managing partner of M&E Global, IJGlobal’s partner on the international digital infrastructure survey to gauge current investor appetite for digital infrastructure, an area widely considered to be key to future economic development.

Digital infra supplanting traditional infrastructure & renewables

While governments have previously used traditional infrastructure projects to re-boot economies, twice as many respondents to the IJGlobal / M&E survey believe – in this market – that digital infrastructure is a better investment than bridges, roads, ports and even renewables.

Before Covid-19, renewable energy – including solar and wind energy generation – was for many markets the primary focus for future-oriented infrastructure investment. Now, survey respondents think that digital infrastructure will grow faster than roads, social infrastructure and renewables.

This is a particularly strong statement considering that the largest respondent group are investors in renewables.

"Investors have done an about face, favouring digital infrastructure 4:1 over renewables as a growth area," says William Cox, managing partner at M&E Global.

Digital infrastructure to impact all industries

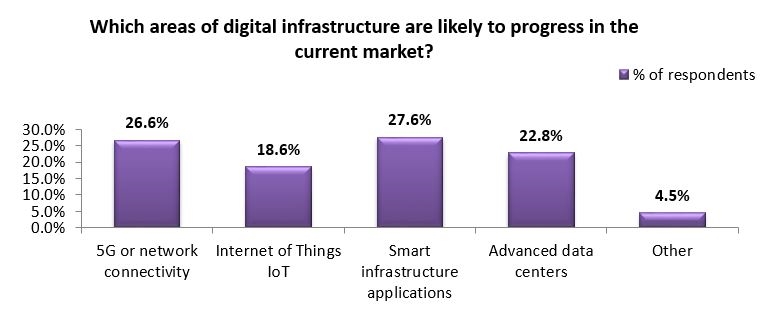

Respondents believe that digital applications such as smart transportation, 5G connectivity and advanced data centers are likely to progress most in the immediate future. "These areas are easiest to invest in because they largely depend on a straightforward capital commitment by telcos and investors," says M&E Global´s Garver.

These findings are in line with a report by South Korean government think tank KISDI that predicts growth in 5G related applications will be 43.3% annually and that the resulting value added worldwide will be $965 billion by 2045. In a 2018 report, the World Economic Forum concluded that "5G will impact every industry – autos, health care, manufacturing and distribution and energy services, among others”.

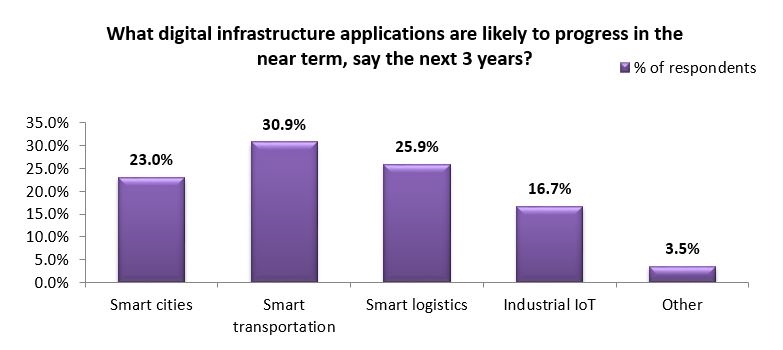

Smart transportation, logistics & cities lead digital applications

Among the digital applications, smart transportation, logistics and cities will lead the list of preferred practical applications from digital infrastructure as the three areas are strongly intertwined.

Smart logistics helps optimize supply chain and transportation flows to get more goods between their origins and destinations more quickly and efficiently.

Meanwhile, Smart Cities have been estimated to be growing at a compounded annual growth rate (CAGR) in excess of 34% worldwide by 2025. Smart transportation has an even larger growth rate target.

Immediate commitment

The majority (52.7%) of respondents to the IJGlobal/M&E Global survey say they are already integrating digital infrastructure in their current projects with 20.6% considering doing so in the future. Only 6.9% appear not to be including digital infrastructure short term.

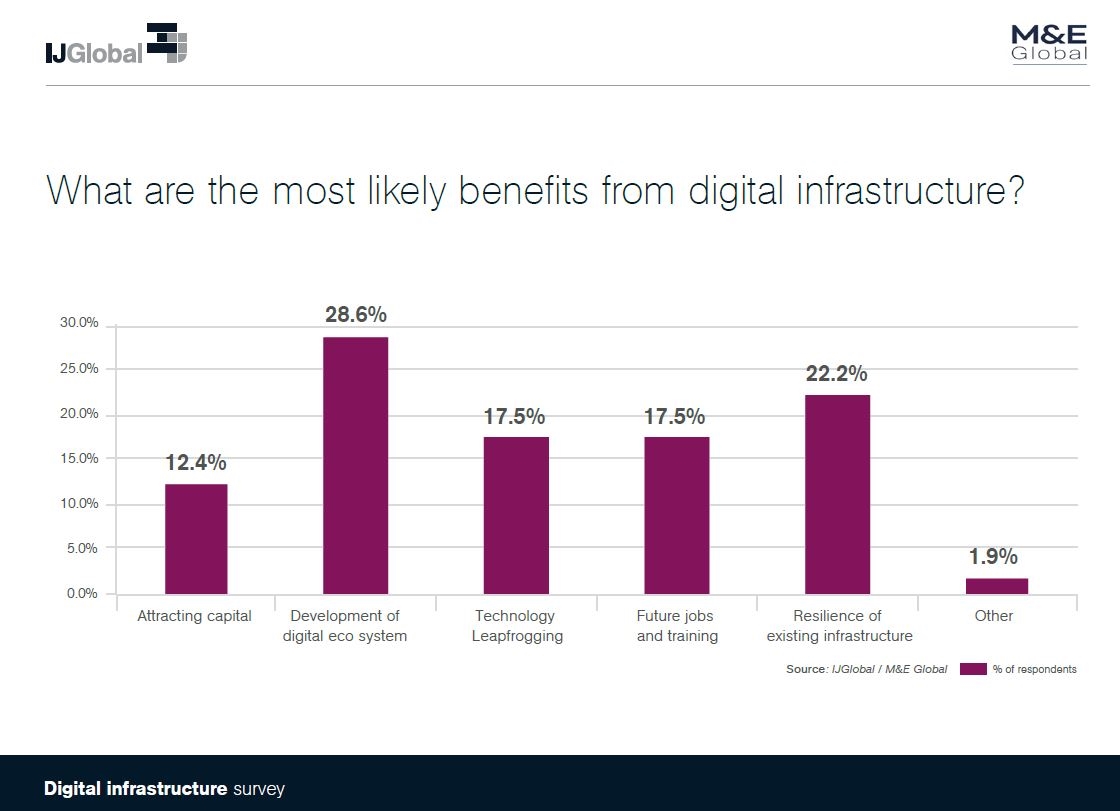

Digital infrastructure makes existing infrastructure smart

Unlike traditional infrastructure, which temporarily creates low-level construction jobs, digital infrastructure helps create jobs with a future, which creates a need for training and supports the development of knowledge economies.

Digital infrastructure investments needed to uphold competitiveness

Investing in digital infrastructure is a necessity, according to respondents of the global survey. Nations that fail to invest in digital infrastructure risk losing their competitiveness and will be left behind, according to nearly 60% of the study respondents (59.2%). Another quarter (24.7%) of respondents thought that laggards would miss out on building a knowledge-based economy and jobs that flow from this strategy.

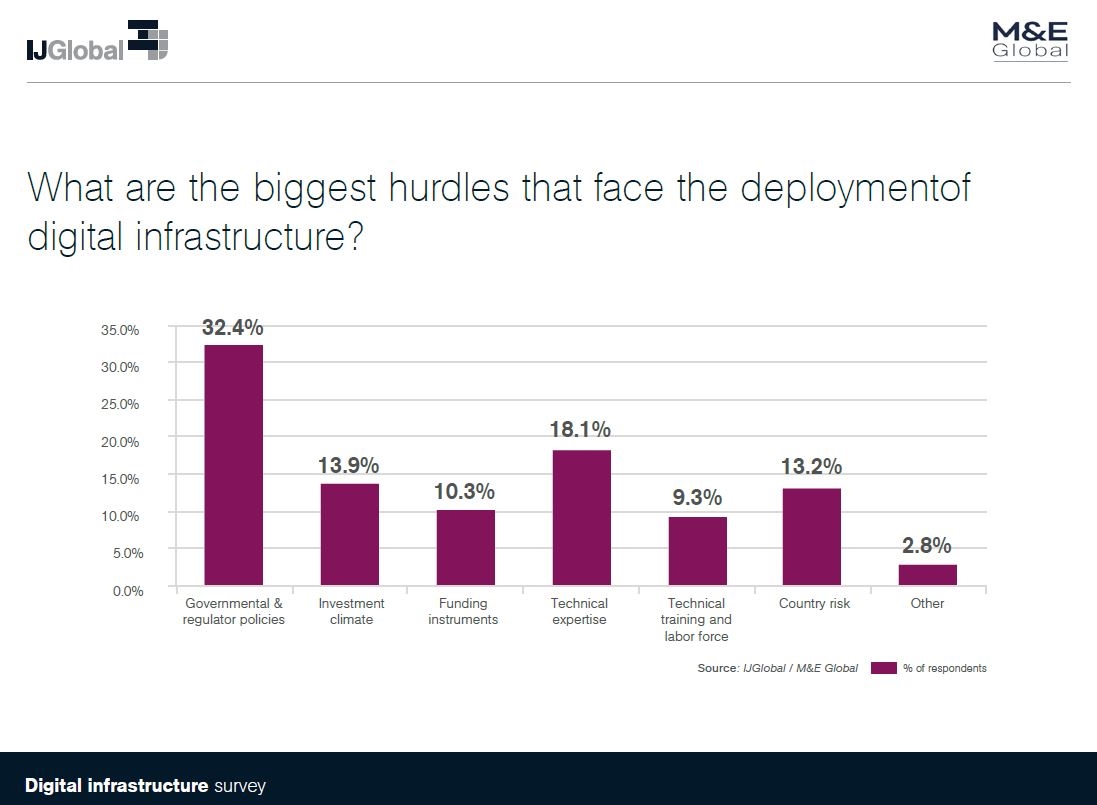

Governments – biggest hurdle

Not surprisingly, study respondents claim that governments and their policies are the biggest hurdle to developing digital infrastructure (32.4%). This is to be expected given that governments formulate policies, are regulators and (broadly) infrastructure owners. They define such important areas as taxation, asset depreciation and they award licenses, while leading decision-making on incentives and deterrents.

Governments are also investors in infrastructure. This year, The State Grid – China´s state electrical distributor – pledged to invest an extra $3.5 billion in digital infrastructure in 2020 "to support tech-based projects". The government of New South Wales also announced in June (2020) its intention to invest an addition A$1.6 billion in digital infrastructure, a record amount for the region.

In April, China’s National Development and Reform Commission (NDRC) – the country’s top economic planner – defined “new infrastructure” as including information-based infra such as 5G and the Internet of Things (IoT), convergent infrastructure supported by the application of the internet, big data and AI; and innovative infrastructure that supports scientific research, technology development and product development.

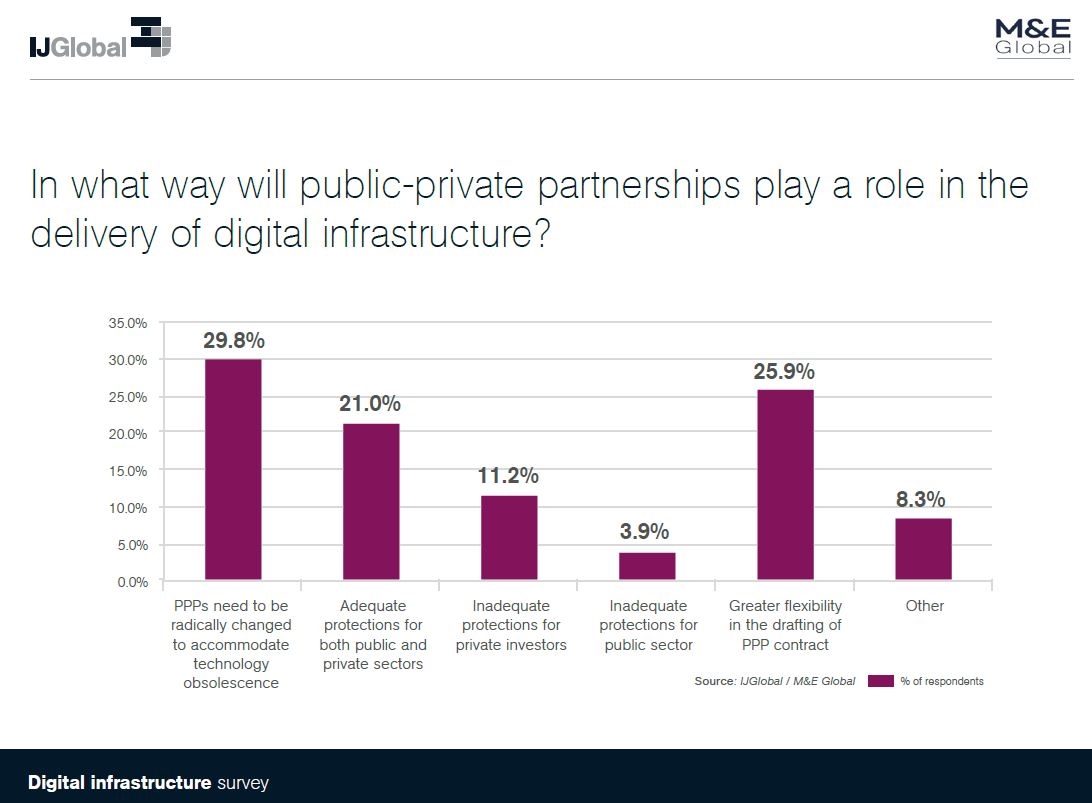

How to finance a digital infrastructure investment

However, the structure of digital infrastructure is more complex and current PPP models will not serve as a template for its delivery through them – without significant levels of flexibility, which is rarely seen in such contracts. Hence 29.8% of respondents believe that if digital infrastructure is to be procured by government through PPP, the delivery model will require a significant overhaul to accommodate technology obsolescence.

On a more mundane level – though cutting edge for most infrastructure investors – data centres and investments in 5G are deemed to be more straightforward… by comparison. Other areas, such as the Internet of Things (IoT), are less clear-cut because they permeate all industries.

The digital skills gap

Lack of qualified personnel is also a challenge for digital infrastructure. The "digital skills gap" in the field is significant, reports Matt Garver of M&E Global. A 2016 study by the European Union found that 22% of all employees across all sectors and jobs in the EU were at risk of a digital skills gap.

Cyber security considered main risk

The value at risk due to cyber attacks is currently estimated at $5.2 trillion over the coming five years (Accenture: 2019). In the Accenture study, utilities – a major infrastructure sector – and software are ranked second and third most impacted by cyber crime.

Even so, 63.6% say that the benefits of digital infrastructure outweigh the risks. Only 5.6% think that the risks overshadow the benefits.

Study method

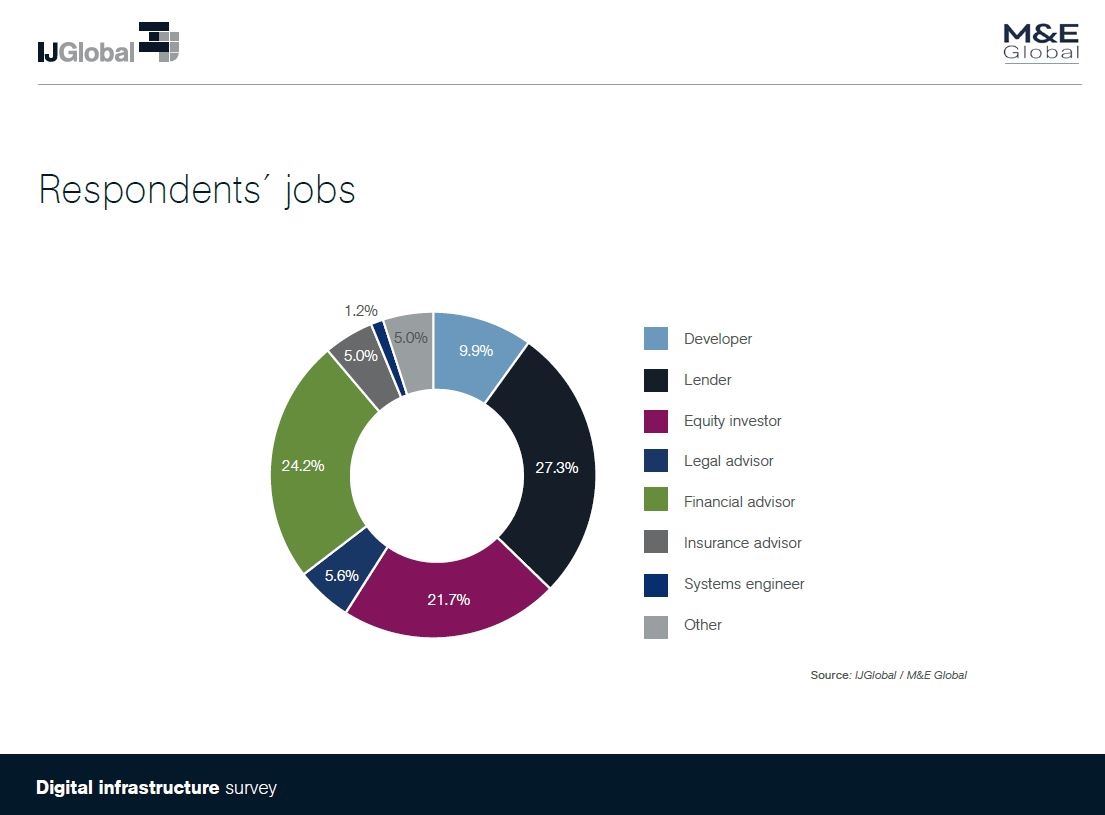

The digital infrastructure survey was jointly conducted by IJGlobal and M&E Global in June/July 2020. The 242 study interviewees encompassed senior executives at banks, financial institutions, developers and engineering companies from Europe, North America, Asia-Pacific, Latin America, Africa and the Middle East.

Respondent profiles

Contact M&E Global Inc:

- william@meg-digital.com (+34 675 13 76 91)

- mathew@meg-digital.com (+1 202 656 1820)

Source for all charts in this document: IJGlobal and M&E Global, 2020

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.