Safeguarding Europe’s infra profits

The Spanish renewable energy market serves as a prime example of the dangers of failing to factor in political and regulatory risks over the lifecycles of projects when procuring projects.

Spain stands as a cautionary tale for all markets – the ideal example of a worst-case scenario when a government makes sweeping changes that impact projects procured in good faith with reasonable expectations from contractually-set feed-in tariffs.

However, cash flow projections did not adequately price in political and regulatory risks over the lifecycles of these projects, caused by the 2013 reform of Spanish electricity regulation that resulted in retroactive cuts to green energy subsidies.

An immediate result of this was an estimated 30% of the photovoltaic investors were likely to suffer a cut of 40% of their anticipated cash flows.

The Spanish Royal Decree 413/2014 went into effect on 11 June 2014, capping returns from renewables projects at roughly 7.5%, which was based on the 10 bond rate plus 300 basis points.

Sadly, this rate was up for review every three years, and with ECB interest rates plummeting, returns became even more insecure. Worse again, the decree was retroactive from July 2013.

UNEF director general José Donoso at the time said: "The Royal Decree approved by the Council of Ministers penalizes not only the past, but also the future. With the legal uncertainty that has been created for our country, it will be very difficult in the future to convince investors to come to this area, or only do so with a risk premium that will hurt the competitiveness of technology.”

The end result of this policy was that the following year – 2015 – Spain did not install a single megawatt of wind energy.

This fairly common case illustrates at least three points:

- political and regulatory risks are substantial and can turn a profitable and "secure" infrastructure project into a cash cow

- these risks need to be priced in from the beginning in order for investors to meet debt payments and equity investors to achieve returns above their cost of capital

- political and regulatory risks are high and often underestimated in Western Europe

Europe can be risky for infra investors

European political risks have dramatically increased for infrastructure investors, fueled by changes to environmental policies.

On the other hand, with current Libor rates in negative territory, returns on debt in Europe often do not exceed 1.5%. And these normally do not even sufficiently consider political and regulatory risks.

While European governments are under pressure to meet ambitious energy goals in light of public pressure, investors are put off by a sea of political and regulatory risks which seem to be constantly shifting.

Yet infrastructure is arguably the world´s biggest non-military sector and a necessity for investors. European infrastructure is estimated to need $15 trillion in investments, according to the Global Infrastructure Hub (2019).

Present risk approaches are confined to pricing credit risk and technical project completion risks. However, factoring in maturing technology risks in renewables, for example, these risks are likely to come lower down the scale than the likes of political/regulatory risks.

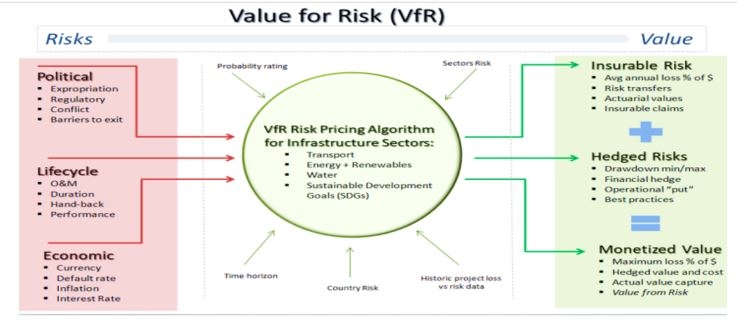

Management & Excellence Global Inc. has created a model for analyzing Value for Risk (VfR*), pricing 150+ political and regulatory risks both in the CAPEX and OPEX phases of infrastructure projects.

Investors can now calculate a realistic and risk-adjusted rate of return for their projects from the beginning, reducing their risk of getting into ventures which are more risky than they anticipated, allowing them to allocate sufficient resources to these projects to see them through their lifecycles.

Uniquely, VfR prices all risks individually in basis points, which allows for an accurate and detailed discounting of future project cash flows.

Early warning system for lifecycle

In the OPEX phase, the detailed approach of VfR acts as an early warning mechanism for impending political shifts, essential given that risks constantly change during a project´s lifecycle.

VfR monitors these changing political and regulatory risks throughout the lifecycle, detecting initial "tremors" before major risks set in allowing investors and operators to undertake measures to hedge and reduce exposure to upcoming risks.

Applied to the Spanish renewable energy case (as above), VfR would have anticipated new legislation.

Spanish renewable energy schemes were based on subsidising energy prices, which cost the country $7.3 billion in 2012 alone, and 2.2 jobs lost for every new job created in the sector (according to blue&greentomorrow, 2017).

VfR´s detailed risk monitoring would have caught these financial pressures and connected them with political processes likely to react in some way.

Spain´s government had to react sooner or later and VfR would have priced the risk of likely new regulations, and hedged or insured it well before regulations became realities.

*VfR is a service jointly offered by IJGlobal and Management & Excellence Global Inc., a company owned by the authors of this article

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.