Mexican O&G on shaky ground

The beginning of June 2019 marked the turning of the first sod for Mexico’s latest refinery project, which the country hopes will reduce its dependence on US imports and ramp up investments domestically.

Construction at the Dos Bocas Refinery was launched on 2 June, less than a year after President Andres Manuel Lopez Obrador (AMLO) pledged $11 billion to increasing refining capacity.

Dos Bocas will however be 100% owned by state oil company Pemex, representing a complete reverse in the country’s previous energy policy.

AMLO’s predecessor – President Enrique Pena Nieto – had attempted to end the monopoly enjoyed by state-owned companies like Pemex. This strategy reaped some success in increasing production and attracting private foreign investments.

The new administration has other priorities however and looks set to promote Pemex, regardless of costs.

Refinery upgrades

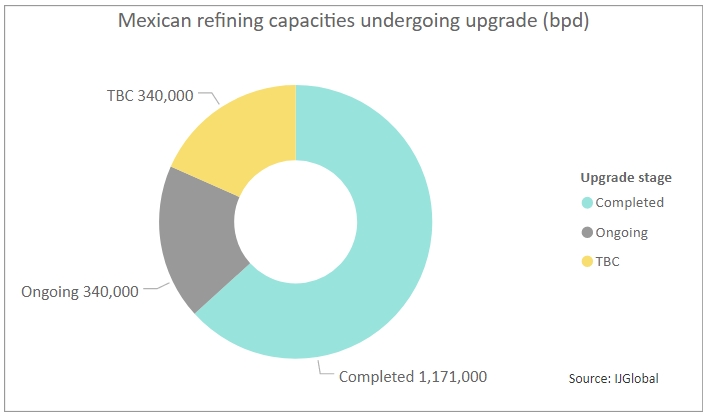

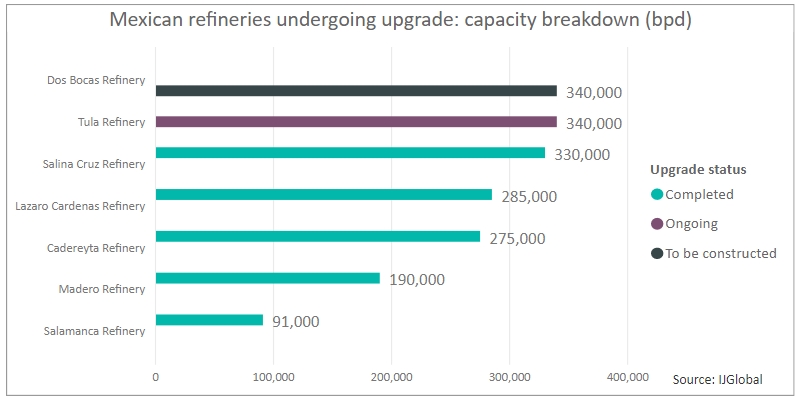

Mexico announced a modernisation programme of its refineries in 2018, with the new $8 billion Dos Bocas development part of these plans. As shown by IJGlobal data, the country has six operational refineries with a total capacity of around 1.5 million barrels per day (bpd), but it was only using around 40% of this capacity last year. The new flagship project – the Dos Bocas Refinery – alone will have a capacity of 340,000 bpd, when completed.

As demonstrated by IJGlobal data, most of the Mexican refineries have undergone some upgrades, and the Tula Refinery upgrade should yield about the same total daily output as Dos Bocas, in line with the government’s aim to boost crude processing enough to halt imports within three years.

All eggs are now being put in the state-owned basket.

In May the Mexican government scrapped previous plans to award Dos Bocas to international companies. The abandoned tender attracted four bids from companies with proven track records in bringing such projects to completion. The government deemed all of the bids too expensive however.

The project was handed over to Pemex instead, despite anticipations that such a costly project would increase the company’s debt and its rating would suffer a serious blow. The government’s optimistic plans state that the facility should be completed by May 2021. Cost have now risen by $2 billion from an initial estimate of $8 billion.

The modernisation of two other facilities – the Tula and Salina Gruz Refineries – is also being carried out by Pemex.

The Tula Refinery Expansion has been delayed due to the incoming administration reviewing previously signed contracts. According to the administration, Tula Refinery will require an additional investment of $2 billion. Pemex expects that the modernization will increase the output of refined products by 40% from 180,000 to 340,000 bpd.

Phase 1 of Tula’s upgrade is to be completed by 2020 but, given the rising cost and political factors, it is likely to take longer. Phase 2, which comprises the construction of an additional processing installation, is slated for 2022.

Meanwhile, the Salina Cruz refinery upgrade is part of the diesel phase of Pemex’s recently announced fuel quality project, which involves a $2.8 billion investment into increasing ultra-low-sulphur diesel (ULSD) production at five of Mexico’s refineries following the country’s recent energy reform.

On-again-off-again offshore

Mexico has awarded more than 100 offshore drilling contracts over multiple rounds since 2014, but this activity ground to a halt once AMLO took office in December 2018. It was announced that new tenders were to be suspended and existing contracts to be reviewed.

This includes contracts from the fourth auction of the Ronda Dos – second round – programme for hydrocarbon exploration and extraction in three deep-water areas in the Gulf of Mexico.

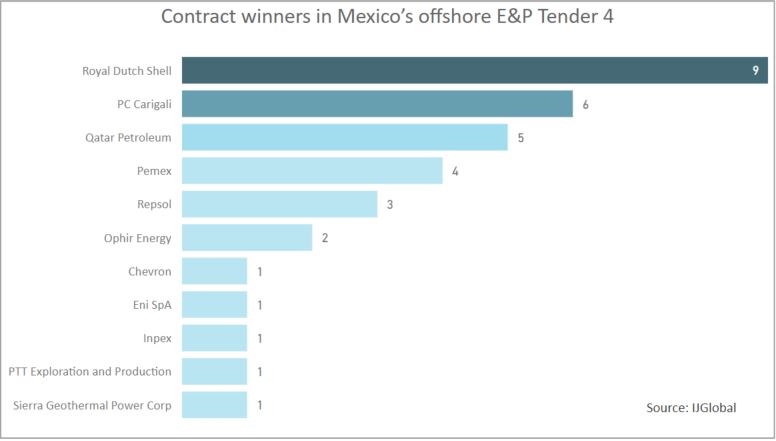

On 7 May 2018, Mexico's National Hydrocarbons Commission (CNH) awarded 19 contracts, 68 having been awarded in the entire Ronda Dos. At the time, CNH estimated a total investment of up to $92.8 billion into exploration and production in these areas, all now being plunged into uncertainty.

As suggested by IJGlobal data, among the participants in Round 4 are several major oil companies. The five companies that won the most contracts in the auction comprise four foreign oil majors and Pemex.

Royal Dutch Shell is involved in nine contracts awarded in Round 4 - four on its own, four in consortium with Qatar Petroleum (QP), and one with Mexico’s Pemex.

Petronas subsidiary PC Carigali (Malaysia) scooped six projects – one on its own and five in teams with Repsol (Spain), Ophir Energy (Indonesia), PTTEP (Thailand) and Sierra Geothermal Power Corp (Canada).

QPI ranks third with five projects – all as part of a consortium with Eni and Royal Dutch Shell. Meanwhile, Chevron (US) had been approved to drill its first deepwater well in Mexico, taking one project in a team with Pemex and Japan's Inpex.

The only one of these developers seemingly not at risk of losing contracts is Pemex.

The energy reform in Mexico, as conceived in the early 2010s, was meant to bring in international participants to step-up local production and has been effective in curbing the monopoly of Mexican incumbents in the energy sector. Production levels are on the rise, even though far from the 2004 peak.

The recent political climate in Mexico however, has placed the success of these reforms on shaky ground. The administration seems to be undermining trust built up with the private sector for the sake of boosting Pemex.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.