Coal-fired power in Europe

Mizuho Financial Group last month (May 2019) became the latest major Japanese bank to revise its policy framework to impose restriction on its lending to coal-fired power projects. Its announcement followed similar moves from MUFG Bank and SMBC – the two largest lenders to power projects in 2018, according to IJGlobal league tables.

As of 1 July (2019), Mizuho will only lend to greenfield coal-fired developments if they use ultra-supercritical technology. MUFG and SMBC’s rules changes were also not blanket bans, but were introduced to gradually reduce the banks’ exposure to coal-fired generation.

Financing new conventional power plants was already difficult in Europe, with lots of European banks already sworn off coal investments. The direction of travel is in fact in the other direction – with coal-fired capacity set to reduce dramatically across the continent.

At the beginning of 2019 a number of European countries made pledges to phase-out existing coal-fired plants.

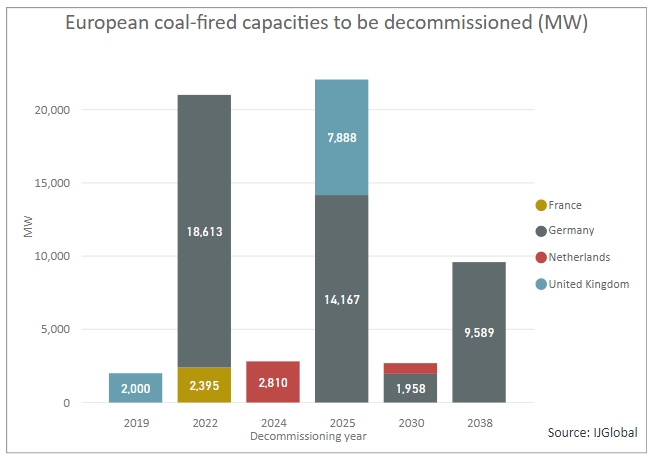

Germany has said it will shut down all of its coal-fired power plants by 2038 at the latest. As reported by IJGlobal that means it intends to close as much as 55GW of coal-fired capacity by this date. Soon afterwards German utility RWE cancelled plans for all future investments in coal, including the 1.1GW BoAplus lignite power plant.

Around the same time the UK said that one of its last seven operational coal power plants – the 2000MW Cottam power station in Retford – would be closed by the end of this year (2019). The remaining six plants are set to cease operations by 2025.

The Netherlands also plans to ban the use of coal by 2030. Two of the plants – RWE’s 600MW Amer 9 coal-fired plant and Vattenfall’s 650MW Hemweg-8 facility – have to switch fuels or close as early as 2024 without compensation for their owners. It is likely that the utilities would explore fuel transition options, particularly to biomass and gas.

The French are also sticking to their plans to shut down the remaining 3GW of operational coal facilities, run by the state-owned EDF and Germany’s Uniper.

Coal plant divestments

Given this regulatory pressure, there have already been a number of significant divestments from operational coal-fired plants since the start of 2018.

|

Transaction name |

Divestor |

Acquirer |

Status |

|

Acquisition of Uniper's French Power and Renewables Portfolio (2,112MW) |

Uniper |

EPH |

Ongoing |

|

Alpiq |

Seven Energy |

Ongoing |

|

|

Acquisition of Engie's European Coal-Fired and Biomass Portfolio (2,350MW) |

Engie |

Riverstone Holdings |

Ongoing |

|

AES |

EPH |

Ongoing |

|

|

Acquisition of Scottish Power Conventional Energy Portfolio (2,556MW) |

ScottishPower (Iberdrola) |

Drax Group |

Completed |

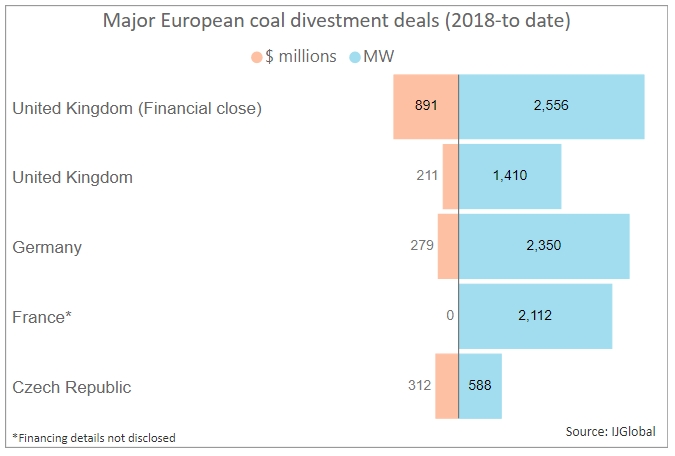

In October 2018, ScottishPower (a subsidiary of Iberdrola) sold its 2.55GW conventional power portfolio in the UK to Drax for £702 million.

Two other European companies, Engie and Alpiq, and US-based AES Corporation have all subsequently announced plans for further divestments of conventional power assets.

Engie has reduced its coal-based generating capacity by around 75% since 2015, and is now divesting a 2.35GW fleet of power plants.

AES Corporation will exit its shareholding in three power plants located in the UK:

- 708MW Ballylumford gas-fired project

- 701MW Kilroot coal- and oil-fired station

- 10MW Kilroot energy storage facility

Swiss utility Alpiq is to sell two power plants in the Czech Republic – the Kladno coal-fired power plant and the Zlin coal-fired power plant.

As shown by IJGlobal data, the ongoing divestments expected to close in 2019 are estimated at a combined €802 million ($899 million), for more than 4GW of coal generating capacity. Financing details regarding the acquisition of Uniper’s French portfolio, which also includes gas-fired and wind assets, are yet to be disclosed, so the total value of coal divestments in Europe will actually be much larger.

Czech companies have been among the buyers of recently divested assets. While Alpiq is offloading two assets to Czech power producer Sev.en Energy, Energeticky a Prumyslovy Holding (EPH) is involved on the other side of in France and the UK with Uniper and AES, marking its first foray into the Northern Irish energy market.

EPH’s purchase of Uniper’s French asset raises questions about the assets future closure. EPH has already embarked on a costly fuel transitioning to biomass at the 420MW Lynemouth coal-fired station in England expected to be completed in 2019. The Czech company also reportedly mulls a new 2.5GW gas-fired plant to replace the 2GW Eggborough coal station which ceased operations in 2018.

Eastern Europe still counting on coal

Eastern Europe is still very reliant on conventional power as a source of energy.

The Bulgarian government has recently relaunched the tender for a private investor in its on-again-off-again 2GW Belene nuclear power station, whilst also trying to keep its 1,456MW Maritsa East 2 TPP open in the face of tightening environmental requirements.

ContourGlobal and the government of Kosovo recently picked GE as EPC for the $1.3 billion 500MW Kosovo e Re coal-fired power plant. The US-based ContourGlobal also owns Bulgaria’s 900MW Maritsa East 3 TPP, previously owned by Italy’s Enel.

So coal opportunities still exist where there is an economic case and political support, creating a niche market for contractors and lenders still brave enough to back these projects.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.