Ecuadorian PPPs – some progress

Latin America is increasingly looking at the PPP model as a way of facilitating private investment in new infrastructure. Ecuador is no exception to this trend.

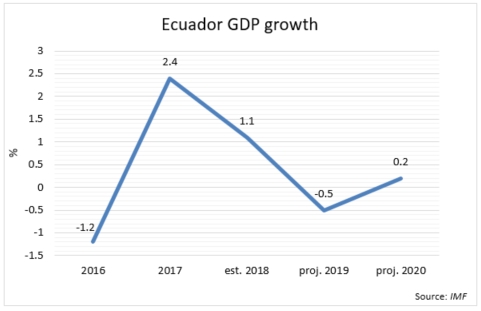

The Ecuadorian economy has been getting weaker in recent years. The IMF forecasts the country’s GDP to contract by 0.5% this year (2019) and to expand by just 0.2% in 2020.

This performance is a pale shadow of its commodities-boom-era economy, and the country is having to adapt and reform. S&P Global estimated Ecuador’s financing needs for 2019 at $9 billion and in March this year the IMF agreed on a $4.2 billion credit arrangement to support its fiscal consolidation.

With this fiscal backdrop it is little wonder why the Ecuadorian government is eager to turn to the private sector for infrastructure funding, and attempt to catch up with the likes of Chile and Colombia on PPPs.

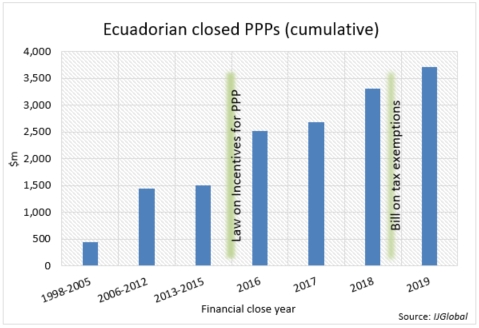

Systematic legislative changes, the first set of which were passed at the end of 2015, started to gradually ease the way for private infrastructure investors.

In a move to strengthen the country's credibility and image as a business-friendly jurisdiction, Ecuador passed a Law on Incentives for Public-Private Partnerships and Foreign Investment in December 2015. It contained a series of tax benefits for undertaking public projects and introduced rules on structuring PPPs, along with specific features for private initiatives, systems or mechanisms for compensation in the event of early termination, deferred payments, and financing guarantees.

In just one year, these measures led to a spur in PPP activity in the country, as illustrated by IJGlobal data. In 2016, two PPP agreements signed in the ports sector:

With Yilport aboard, Puerto Bolivar became the biggest investment by a Turkish infrastructure company in Ecuador, while the latter project attracted global port operator DP World.

In June 2018, President Lenín Moreno passed a bill to exempt the business community from paying income tax for an eight-year period when investing in Guayaquil and Quito, and for 10 years when investing in the rest of the country. It also exempted new micro companies created during the next three years from paying income taxes and proposed a guarantee fund that would ease credit access.

These moves prompted further successes. Financial close of the $100 million Guayaquil Channel Access and $540 million Posorja Port PPPs occurred in 2018, and the $400 million Quito International Airport Expansion followed early in 2019.

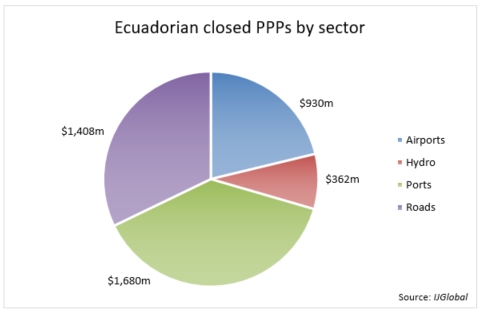

IJGlobal data shows that ports and roads have been prioritised. This comes as no surprise, with transport links being the backbone of any economy.

This trend is here to stay: according to a statement by Ecuador's public works minister, Aurelio Hidalgo, made earlier this year, around 30% of the country's road network will have private participation in the form of a PPP by 2021 with an investment estimated at $2 billion.

Quito is also looking to build on the reforms passed last year, paving the way for new PPP developments expected to exceed $3 billion in value. This comes in the form of four freshly launched projects:

|

Tender launched |

Project name |

Current stage |

Stage entered |

Value ($m) |

|

N/A |

RFP |

Oct-18 |

1,300 |

|

|

Oct-18 |

Tendering |

Oct-18 |

1,158 |

|

|

Aug-18 |

Tendering |

Aug-18 |

259 |

|

|

Aug-18 |

Tendering |

Aug-18 |

305 |

Despite progress, Ecuador is still in a precarious situation: wider economic challenges look set to persist for the time being.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.