Fund focus switches from Asia Pacific to social infra

As eight unlisted, closed-ended infrastructure funds raised $20.6 billion at final close in the first quarter of 2019, some interesting trends have emerged from the IJInvestor Funds and Investors Q1 2019 report.

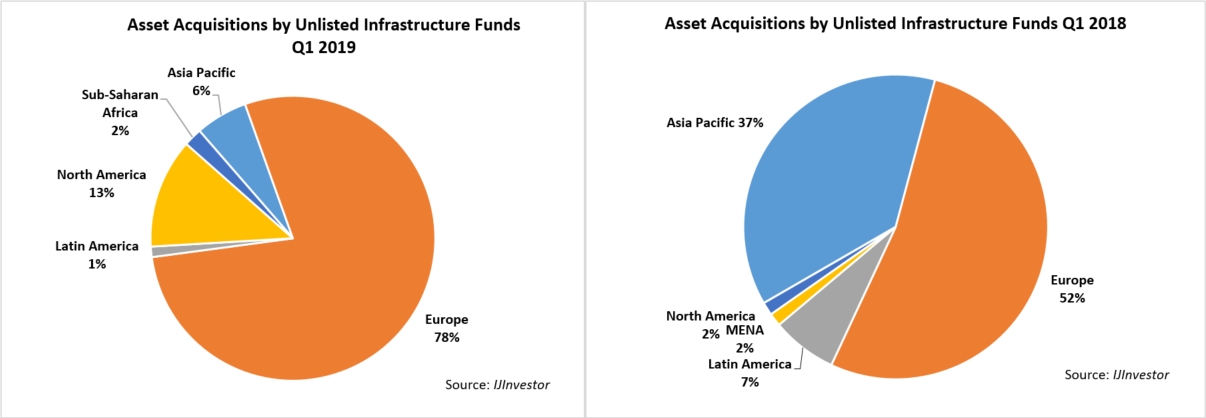

Year-on-year, the proportion of total acquisitions by unlisted infrastructure funds that were of Asia Pacific assets has dropped dramatically. Asia Pacific-based assets accounted for just 6% of total project acquisitions, by number of deals, compared to 37% in Q1 2018.

While Asia Pacific deals dropped off, European and North American assets were the subject of increased attention. European-based projects accounted for 78% of acquisitions by unlisted infrastructure funds (Q1 2018: 52%), and North American-based projects 13% (Q1 2018: 2%).

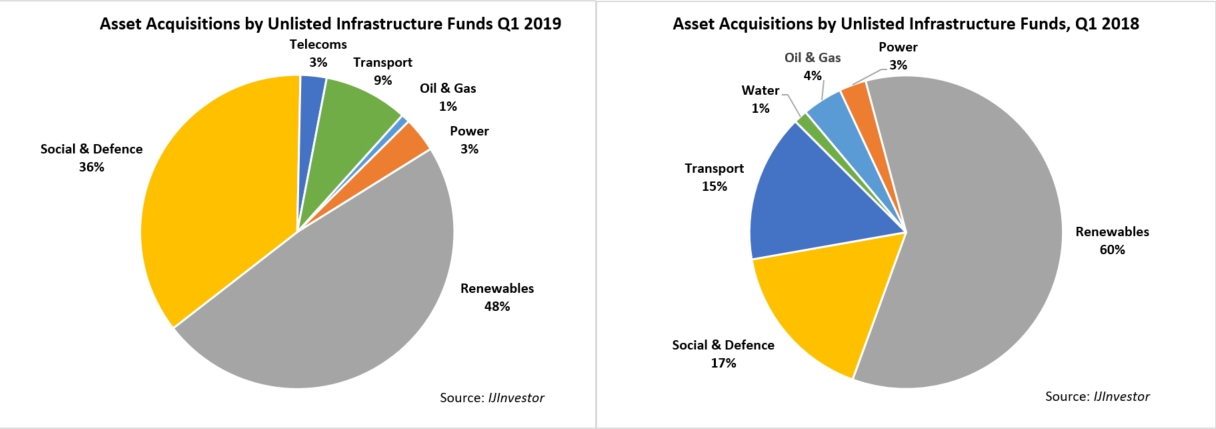

Social & defence and telecoms projects made up a greater percentage of the acquisition pie this year, eroding the dominance of renewables seen in Q1 2018. The social & defence sector saw the biggest spike, rising from 17% to 36% of acquisition deals. There were no acquisitions of telecoms projects made by listed infra funds during the first quarter of last year, whereas they accounted for 3% of activity in Q1 2019.

Renewables project acquisitions still accounted for the greatest share of capital deployed by unlisted infra funds, though this fell from 60% to 48% year-on-year.

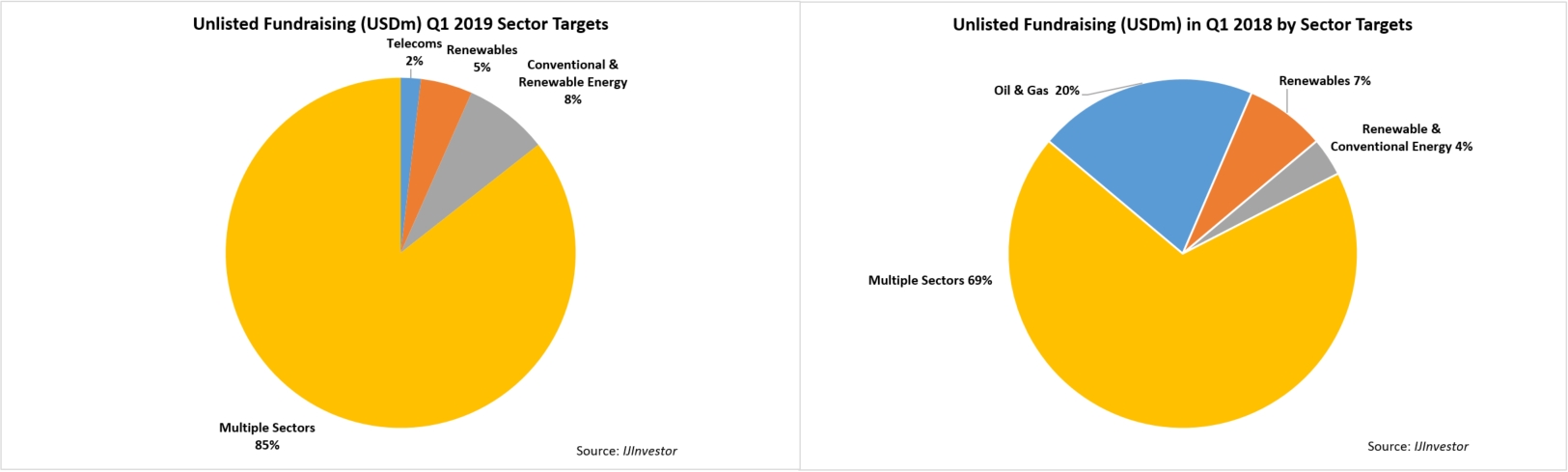

In Q1 2018, 21% of the total $25.4 billion raised was aimed at oil & gas assets alone but no funds focused specifically on this sector reached final close in Q1 2019. Instead fund managers have been keeping mandates broad and options open. Funds raised to target multiple sectors went from 69% to 85% of the total capital raised. Sector-specific funds accounted for just 7% of the total, split between renewables (5%) and telecoms (2%).

IJGlobal – the financial information provider to global energy and infrastructure markets – provides decision-makers with compelling insights from Asia Pacific during H1 2019.

Packed with key stats and insights from industry leaders, this report contains:

- Analyses range from Taiwan’s burgeoning offshore wind market to increasing long-term debt financing options for Australia’s PPPs.

- All discern the driving forces behind projects which have reached financial close and explore industry trends, enabling you to gain market intelligence for your next board or investment committee meeting.

Download your report here.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.