Germany: walking on cooling coals

A German government-appointed commission announced on 26 January (2019) that the country should shut down all of its coal-fired power plants by 2030 at the latest. The German government and 16 regional states must now implement the roadmap proposals.

The decision follows Germany admitting that it was on track to fail its 2020 emissions targets, and the plans put forward by the commission are at the center of Germany's strategy to shift to renewables. Berlin is looking to reduce carbon dioxide emissions from the energy sector by over 60% by 2030, compared to 1990 levels.

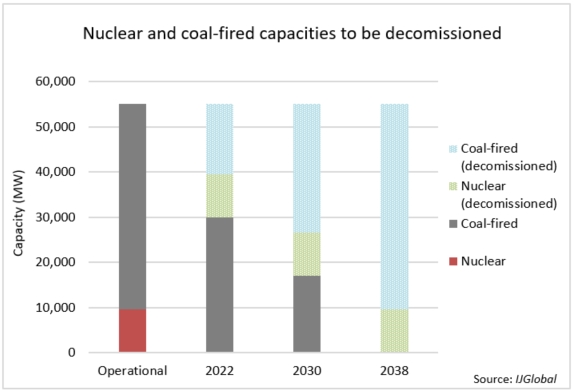

Under the proposed multi-billion plan, Germany's coal-fired capacity would be reduced to 30GW by the end of 2022 and then 17GW by the end of 2030, as shown by IJGlobal data. Currently, coal-fired power plants account for some 42GW of the country's installed capacity.

Nuclear reaction

In addition to shutting down coal-fired, Germany remains committed to its pledge – following the Fukushima disaster in 2011 – to phase out its nuclear power programme by 2022.

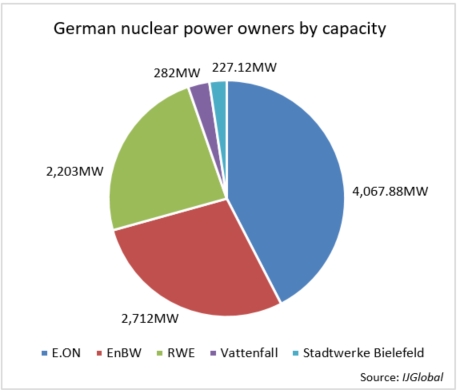

IJGlobal data shows that nuclear power plant operators in Germany – including RWE, E.ON, EnBW and Vattenfall – will have to shut down around 10GW of nuclear power distributed across seven facilities by the 2022 deadline. E.ON is due to take the hardest hit, followed by EnBW, RWE and Vattenfall.

As of January (2019), nuclear plants slated for decommissioning are:

| Asset name | Capacity (MW) | Owner(s) | Operational date | Planned shutdown year |

| Brokdorf | 1,410 | E.ON (80%), Vattenfall (20%) | 31/10/1986 | 2021 |

| Gundremmingen C | 1,288 | RWE (75%), E.ON (25%) | 10/10/1984 | 2021 |

| Grohnde | 1,360 | E.ON (83.3%), Stadtwerke Bielefeld (16.7%) | 04/09/1984 | 2021 |

| Emsland | 1,336 | RWE (100%) | 20/06/1982 | 2022 |

| Philippsburg | 1,392 | EnBW (100%) | 07/05/1979 | 2019 |

| Isar 2 | 1,485 | E.ON (100%) | 21/03/1979 | 2022 |

| Neckarwestheim | 1,320 | EnBW (100%) | 26/05/1979 | 2022 |

Powering on

This shift away from nuclear – and now also coal-fired power generation – has sent ripples through the German energy sector, pushing E.ON and RWE to separate its renewable energy businesses from their coal and nuclear operations due to anticipated dwindling margins. The German powerhouses unveiled in March 2018 a complex assets exchange deal which will see E.ON merge its renewables operations with RWE subsidiary Innogy – with the combined business to be subsumed into RWE, greatly boosting its renewable energy offering.

E.ON in turn gains Innogy's regulated energy networks and customer operations. The merger, which has a total value of €43 billion ($56.6 billion), is expected to close no earlier than mid-2019.

Sweden's Vattenfall, meanwhile, had as early as 2016 completely divested its German brown coal portfolio of assets to Polish energy group EPH.

While Germany decision to exit coal comes as no surprise, the phase-out policy means that even the most modern, newly-build coal-fired power plants – such as Uniper's €1.5 million ($1.7 million), 1.1GW power plant in Datteln – risk not to be connected to the grid.

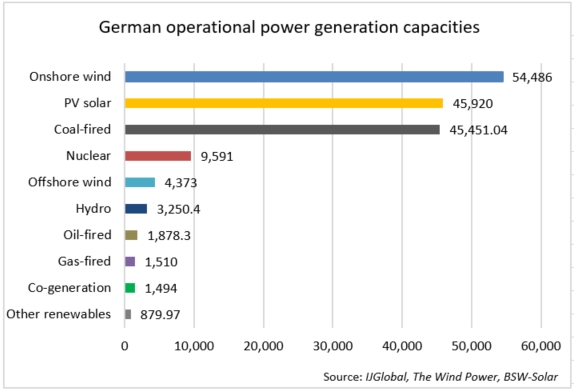

However, despite the political will to cut coal from the national energy mix, it represents a significant portion of Germany's power generation capacity. Data compiled by IJGlobal shows that coal-fired power plants account for nearly 46GW of installed capacity, only behind onshore wind and solar. Trade unions and politicians alike have raised concerns over job losses, especially across the east of the country, where coal mining is still a key sector in the local economies.

The government-appointed commission is proposing a total of at least €40 billion in aid to regions affected by the coal phase-out, alongside around €2 billion per year in compensation for companies and households facing higher power bills.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.