Peruvian broadband: Get connected

Telecoms projects are on the rise across Latin America, including Peru, where ProInversión in January (2019) awarded six broadband network PPP projects for a total investment of $358 million.

Peru, which is lagging behind its LatAm neighbours such as Brazil and Mexico, introduced a broadband adoption law in 2012 to close this gap and increase the number of Peruvians with access to high-speed broadband internet. In 2012, 38.2% of Peruvian population had access to the internet. However, only 4.784% had fixed broadband subscriptions, according to World Bank data.

Peru’s government conceived the ambitious National Fibre Optical Backbone Network (RDNFO) PPP programme as a way to incentivize operators to invest in extending their networks into low-density areas and challenging terrain, bringing down high-speed internet prices and reaching more users.

Peru’s investment fund in telecommunications (FITEL), an entity of the transport and communications ministry (MTC) with the goal of promoting universal access to essential telecommunications, will help finance the recently awarded projects. FITEL will provide non-reimbursable financing of up to $632 million.

Gaining momentum

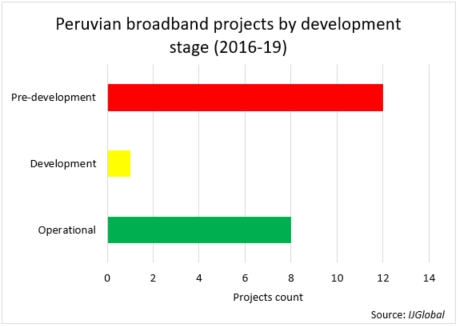

IJGlobal data demonstrates that the number of Peruvian broadband projects has been on the rise since 2016.

Lima-based private investment promotion agency ProInversión has in recent years awarded a number of broadband network PPPs under the RDNFO plan. The programme envisions these projects being rolled out in district capitals and then extended to surrounding towns, also reaching state and social institutions.

Peru has a total of 21 regional projects in different stages of development, which are located in the following regions:

- Amazonas

- Áncash

- Apurimac – operational

- Arequipa

- Ayacucho – operational

- Cajamarca – operational

- Cusco – operational

- Huancavelica – operational

- Huánuco

- Ica

- Junín

- La Libertad

- Lambayeque – operational

- Lima

- Moquegua

- Pasco

- Piura – operational

- Puno

- San Martín

- Tacna

- Tumbes – operational

Expectations are that the expansion of the broadband network will largely improve services provided by state-owned institutions on a national level in areas that require greater social action – as is the case in rural and remote locations.

Palpable results are expected post 2020, as IJGlobal data shows that some in-development broadband networks are scheduled to be completed in H1 2020.

These latest broadband tenders, which represent an impressive pipeline of nearly 10,000km fibre optic across some 2,300 localities, have attracted a mix of regional and international players. Hong Kong’s Yangtze Optical Fibre and Cable Company teamed up with local Yachay Telecomunicaciones to win the Áncash, La Libertad, Arequipa and San Martín bundle. Peruvian DHMONT, Telkom and Bantel, meanwhile, snatched the Huánuco and Pasco projects.

FITEL develops yearly plans for the development of new projects. According to the most recent data, from mid-2018, there are 41 proposed projects of public telecoms services:

- 6 regional projects awarded by ProInversión

- 2 financing contracts pending subscription, awarded in December 2017

- 2 projects in the FONIE area that have a feasibility declaration

- 1 viable investment program with financing from a multilateral entity

- 7 projects in the formulation stage from FITEL, to be commissioned by the MTC

- 10 financing contracts in the closing phase

- 2 financing contracts in the operation and maintenance period

- 11 financing contracts corresponding to 13 projects in the investment period

LatAm telecoms

Peru has joined other countries in the region that have turned to project financing – and private investors – to build out their fibre optic networks.

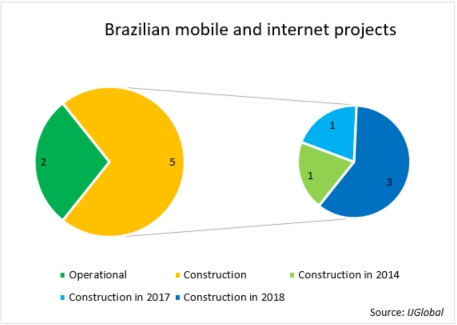

Оne of these countries is Brazil – the largest single market in the region and a benchmark yet to be reached by Peru. The Brazilian market boasted 28.7 million broadband subscribers at end of 2017, with fibre optic networks being mostly developed in the south and central parts of the country.

Brazil has long been a preferred landing point for undersea internet cables. Stand-out projects include:

- Santos-Fortaleza-Boca Raton fibre optic broadband – connecting the cities of Santos and Fortaleza in Brazil to Boca Raton, Florida in the US

- Seabras 1 Submarine fibre optic broadband – linking New York and Sao Paulo, with an additional landing point in Fortaleza

According to IGlobal data, Brazil has managed to pick up the pace on developing internet projects following a slump after the FIFA World Cup 2014, which brought about a massive investment surge across the entire infrastructure spectrum and transport in particular. What is more, Brazil has managed to stay at the top of the telecoms deals in the region.

| Transaction | Value ($m) | Financial close date | Country |

| Acquisition of a majority stake in Ascenty | 1,800 | 20/12/2018 | Brazil |

| AT&T Comunicaciones Digitales refinancing | 1,227 | 21/03/2018 | Mexico |

| VTR Comunicaciones corporate facility | 485 | 24/05/2018 | Chile |

| Ascenty Data Center facilities | 350 | 08/01/2018 | Brazil |

| Sixsigma Networks Mexico bond facility | 300 | 26/04/2018 | Mexico |

As shown by IJGlobal data, Brazil dominated the regional telecoms deals by total value in 2018, with the other top five regional deals taking place in Mexico and Chile.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.