Charged with uncertainty - EV charging infra

(Originally published in the Winter 2019 edition of IJGlobal)

The electric vehicle (EV) charging industry is, some say, stuck in a chicken or the egg-type predicament. Does EV charging infrastructure need to grow to encourage wider take-up of electric cars, or will it only be sensible to invest in the infrastructure once EV uptake grows?

Finding an answer to that question is complicated by a lack of data – consumer behaviour forecasts to date have been based on relatively small samples. It is difficult to predict whether future EV drivers will typically charge at home or in public spaces, or what distances they will be willing to travel between charges. Despite the uncertainties it seems an inevitability that EVs will replace internal combustion engine (ICE) vehicles eventually, and many investors are trying to gain a first-mover advantage.

Faster, faster

The largest charging network rollouts will have capital expenditure at infrastructure project scale. As an example, the EU supported Metropolitan Greater Areas Electrified (MEGA-E) initiative has an estimated capex of around €300 million ($341 million), to install 322 ultra-fast chargers at 29 multi-modal charging transport hubs (such as park-and-rides, bus terminals, e-taxi ranks and train stations) across at least 10 European cities.

Jeremy Parkes, business lead for electric vehicles at DNV GL, says: “We have seen capex for the charging equipment range from €1,250 for a 22kW AC charger up to €20,000 for a 50kW DC charger. This is just for the equipment; there would be further costs for the installation works and grid connection. These installation costs vary considerably depending on the location, the electrical capacity and grid connection, and might be of the order of 50% to 150% of the equipment cost.”

EV charging speeds are only increasing with each new model. There is clear obsolescence risk in investing in an evolving industry such as this.

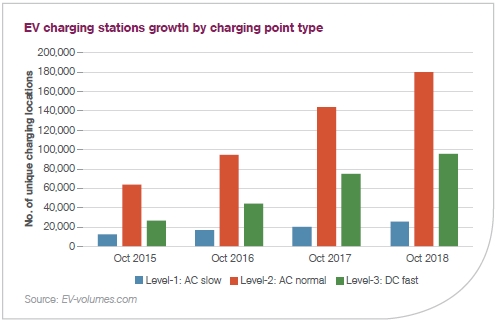

According to Parkes: “We are seeing as a trend that newer vehicles have larger batteries… Speeds are increasing. In the UK [public] networks DC chargers are at the 50kW level, and that is rising. In continental Europe there are some DC chargers at the 150kW level and the latest capability is 350kW. There has been a recent improvement with a DC fast-charger prototype going up to 450kW. These advances can shift the charge anxiety people have. As the network increases and the speed of charging rises, ownership of vehicles becomes easier and the EV transition accelerates.”

Inevitably, different types of shareholders are going to take varied approaches to financing their infrastructure developer’s large-scale rollouts.

Major backers

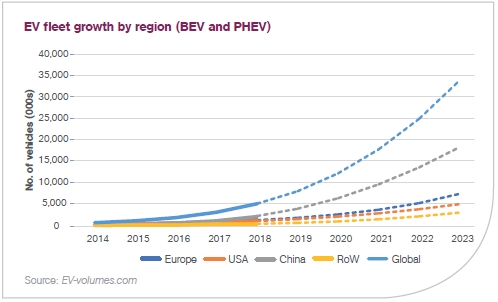

DNV GL’s Energy Transition Outlook 2018 forecasts that by 2033 half of all light vehicle sales will be electric, while by 2047 EVs will start to outnumber ICE heavy vehicles.

Car manufacturers are responding by investing in EV charging infrastructure themselves. Daimler, Ford, BMW and Volkswagen, Audi and Porsche have formed a Germany-based JV named IONITY, which is targeting a pan-European network of 400 charge stations (with six points each) on or close to motorways by 2020, at speeds up to 350kW. It is gaining sites through partnerships, which include teaming up with oil and gas majors Enel and Shell.

Oil companies’ interest in this emerging sector is understandable.

Shell gained a foothold in the EV market by acquiring the Netherlands-based NewMotion, which manages over 30,000 charging points in Western Europe and offers its users access to a public network of 80,000 points through an app.

This complements Shell’s rollout of EV chargers at its petrol stations under the brand Shell Recharge, which is launching across the company’s network of service stations in England, Wales and Scotland. Shell has promised to install super-fast 150kW charging points at selected service stations in 2019 to complement its 50kW rapid chargers, has kept the model open-access for carmakers, and says power is sourced from 100% renewable energy sources.

Meanwhile, BP spent £130 million ($172 million) in June 2018 to buy UK-based charging infrastructure supplier Chargemaster. The company launched in 2008 and offers units for home, work and public charging. In addition to selling chargers to clients, Chargemaster owns and operates public charging points on behalf of hosts, assuming the cost and risk of installation and maintenance. The BP Chargemaster POLAR public EV charging network has 6,500 points, of which 400 are rapid chargers.

In June, BP said it would install charging points at its 1,200 petrol stations in the next 12 months, including ultra-fast 150kW chargers. BP Chargemaster’s chief operating officer David Newton says: “BP Chargemaster differentiates itself from competitors by being vertically integrated in this space, participating and investing in all parts of the value chain to ensure the quality of its product.”

Chevron invested in California-based ChargePoint, by participating in the company’s $240 million Series H fundraise in November. ChargePoint has also brought Total into the fold, having on 25 October formed a partnership with Total Gas & Power. The company is targeting 2.5 million charging points by 2025 globally, which it says is the industry’s most ambitious target.

Total in September acquired equity in G2mobility in France, gaining 10,000 charging points and a 25% market share for serving local governments.

Casey says that, as well as buying EV charging point start-ups, some oil majors have also acquired energy retailers recently. “They are in a unique position to own the customer relationship,” he explains.

“Oil companies are generally big, trusted brands, and they already have significant motorway infrastructure and fundamentally know how people travel and move. They understand how to make money on a commodity…”

The utility play

The oil majors’ interest in utilities come as no surprise, given their natural advantage in the nascent EV sector. Utilities also have existing scale on their side – in many cases they have the resources of the state backing them – and as the energy suppliers to homes and businesses they have stacks of data on electricity consumption patterns.

Utilities could soon be offering an integrated product combining a property’s electricity supply plus vehicle charging power supply, fitted with smart tariffs and smart metering. Such products could incorporate solar panels and batteries in homes.

Jean-Bernard Lévy, chief executive of French state-backed utility EDF, said in October 2018 that he wanted the company to be the largest supplier of EV charging points in Europe by 2022.

Lévy plans to get there through joint ventures, citing carmakers and battery start-up companies as potential partners. EDF has already collaborated with Nissan Europe to explore how to combine recycling of retired Nissan EV batteries with EDF Energy’s demand-side management PowerShift brand.

Meanwhile, German utility E.ON partnered with German motorway service areas operator Tank & Rast and Scandinavia-based charging network operator CLEVER. E.ON is targeting 150kW chargers (easily upgradable to 350kW), domestic chargers combined with rooftop solar and rapid chargers for businesses. CLEVER, meanwhile, is 94.9% owned by Danish energy utility SEAS-NVE.

The level of opportunities and types of challenges facing utilities is different in different markets. BP Chargemaster’s Newton comments: “There are barriers around access to grid connections in the UK, for example with distribution network operators (DNOs) having exclusive visibility of network maps that show where power is available.”

Alex Harrison, London-based energy partner at Hogan Lovells, says: “In the US it’s very different: the expectation is the power utilities will largely be responsible for the rollout of charging infrastructure in their existing regulated asset base. Here [in Europe] it’s a market private players can get really involved in.”

Harrison adds: “In the UK, an interesting question is whether Ofgem will think that road-side charging stations need to be licenced electricity suppliers or can be treated as unlicensed consumers of electricity.” If a licence were required, the charging point companies would face administrative costs, a duty to protect consumers and high demands on technology standards. Of course, the utilities would take this in their stride, compared to other types of shareholders like oil majors and private equity.

Newton says: “BP Chargemaster have an advanced product development process that allows us to quickly update or upgrade our products, for example to meet Office for Low Emission Vehicles (OLEV) or Ofgem’s smart charging specifications, expected to the market this year.”

Fund managers revving up

Quercus Investment Partners is making a bold play into the EV charging space with the launch of what it hails as a first-of-its kind EV infrastructure fund. The move is novel given its former funds have focused exclusively on renewable energy. Quercus co-founder and chief executive Diego Biasi told IJGlobal last year (2018) that the manager hopes that the fund will benefit from a first-mover advantage.

The £500 million Quercus Electric Vehicle Infrastructure fund will invest exclusively in fast charging points using the petrol station model – public access charging with revenues coming from the sales of electricity (estimated costs per full charge are £15-25). While Shell is installing EV charging points at its retail outlets, Quercus sees installation on forecourts as just one of a host of locations.

“You can also put slower EV charging stations where there aren’t forecourts, and in many respects that is easier because the footprint isn’t as large. You can put these points anywhere there is an attraction that people remain for a period of time – they become natural destinations for charging spots. Forecourts are the natural place for fast charging stations, as most of the infrastructure is already in place,” says Asif Rafique managing director of investments at Quercus.

Efforts to install newer charging points may prove shrewd. Market leader Ecotricity has 300 charging points across the UK, but has been criticised for failing to invest in its ageing technology, though it benefits from contracts with important service station groups such as Moto, Welcome Break and RoadChef. Quercus and its partners are speaking directly to landowners and business owners to establish its network. It has made a strategic partnership with The EV Network, which will develop and build the assets that, once operational, will ultimately be acquired by the Quercus vehicle.

Investors in the fund are assuming a risk profile more associated with private equity than infrastructure. Returns are expected to be in the low double digits.

Rafique says: “The type of investors have to be consistent with the risks involved and the kind of rewards that are potentially available for this type of investment. So it may be the same blue chip institutions, but it may not necessarily sit within the infrastructure arm, it’s much more likely to sit in the private equity side, in addition to industrial or other utility companies.”

The UK government is behind the UK Government Charging Infrastructure Investment Fund (CIIF). The Infrastructure and Projects Authority (IPA) launched a tender process in July seeking fundraisers to at least match its £200 million seed capital. Sources suggest that the mandate will be split between a UK-based infrastructure fund manager – Equitix is thought to be in the mix – in addition to one or more private equity players. The hedge will result in a spread of investments in high-risk and low-risk opportunities, a move that suggests the government is keeping an open mind on who is best suited to lead the investment agenda in this space.

A structured finance

If fund managers play a larger role in this market, then debt markets will likely have a vital role to play to support them as they leverage the cost of rollouts.

Dutch EV charging point operator Allego is seeking to raise debt for its MEGA-E project. The European Investment Bank (EIB) has invested €40 million of quasi-equity into the company, while the European Commission is providing a €29 million grant.

Allego’s owner, French infrastructure fund manager Meridiam, is using its projects expertise and recently hired Green Giraffe and Linklaters to work on a structured finance solution. Lenders are invited to provide senior co-financing, while well-established traffic advisers will work on the modelling.

Meridiam claims to have attracted most interest from French and German banks, while talks are also ongoing with the EIB.

Julien Touati, Meridiam’s leadership council chair, says: “The long-term investors are looking to do project finance… You need to think more flexibly, more structured finance than pure PF… MEGA-E will deliver a constellation of projects. The project company will take some traffic risk, but will also establish risk-sharing agreements with key stakeholders such as site providers (e.g. retailers) which would give some visibility on revenues. It implies sharing value over the long-term, but provides the ability to deploy a broader network with reduced risk.”

There are some other models that could be project financeable for the infrastructure rollouts, Touati added.

The German government in 2015 launched a concession model in Berlin to initially provide 220 charging points by September 2016. Under this model, the infrastructure provider (in this case Allego and NewMotion) stands to receive availability-type payments over the long-term, linked to the performance of the assets. The management contracts run to 2020, when the Berlin Senate could increase the project’s scope. The typical period for concessions would be 10 years, according to Touati.

However, tight local authority budgets and nervousness around investing in the wrong type of kits are restraints on the uptake of this model.

Alternatively, rollouts for on-street charging could use a demand-driven model involving a deal with a city to obtain the land for the infrastructure and an information sharing system whereby new purchases of EVs in the area must be registered. The infrastructure provider can then make decisions using that information on how many EVs are in the area and their locations, to reduce the risk profile. “We’ve seen this particularly in Belgium and the Netherlands,” Touati says.

MEGA-E looks set to be the first project finance-like deal to cross the banks’ structured finance desks, and it is due to feature a share of traffic risk.

Stefan Barrow, a director in MUFG’s infrastructure team, says: “From a senior debt perspective one of the biggest areas of focus for us in this developing sector is trying to understand how sticky the revenues are. Clearly the sector is in the very early stages of development. The projects with contracted revenues should find [raising debt] easier. One of the challenges is that there is only a certain amount of EVs on the road and chargers, and it is still hard to get large volumes going through, so people are still road testing the commercial concepts they have… It may be easier if there is some grant money attached or some EU funding, for example, which might offer some support or almost act like a mezzanine layer in the financings.”

Downing-backed Pivot Power has plans to roll out £1.6 billion worth of charging stations combined with grid-scale 50MW batteries at 45 sites across the UK. There is no visibility yet on the “programme of project finance” that Downing has planned for Pivot Power.

Barrow adds: “I think we will see a lot of activity around the sector in 2019. Whether that is projects coming to market requiring debt or projects with a more equity funding flavour is to be determined, but I think at this stage in the cycle it will be more equity funding.”

Hogan Lovells’ Harrison sees a potential structure in which debt finance could fit quite comfortably. “The obvious place for debt to start is providing captive solutions for [vehicle] fleet operators… I think that is the biggest opportunity,” he says.

The fleet operator could agree tariffs with the infrastructure provider over a period of time, ensuring for the operator a stable price and for the provider of infrastructure a stable volume of EV chargers. There are two categories of fleet operators:

- last-mile delivery vehicles (not the HGVs) – such as Amazon, postal services, UPS’ converted fleet, street cleaners

- passenger fleets – such as taxi-services like Uber, ridesharing services and car hire potentially

“It’s a question of, have the fleets reached a point where they are ready to enter the market in a committed way and do they think this is the best way to go about it – to have their own dedicated charging infrastructure. If so, I think that is the way the project finance side takes off,” Harrison says.

Ren Plastina of Investec’s power and infrastructure finance team says: “Though in the US and Canada EV users are mostly charging at home, Investec is looking into the charging space. We see opportunities in contracted revenues from installations of points in residential buildings to hubs for electrified fleets in commercial spaces. We also believe that collocating EV charging points with storage would enable us to tap into multiple revenue streams.”

Quercus has its eyes on this market, too. Of an estimated 1,000-1,500 charging points Quercus is looking to finance, some will be within depots or on routes of, for instance, delivery services. The fund manager is already speaking to a number of clients who could roll out charging points nationwide in order to electrify their fleets in part or fully.

Selling power stored in car batteries back to the grid, for example at long-term parking sites, could be a vital component in the revenue stream structure. Meanwhile, Downing has said Pivot Power’s integrated network with batteries could be a “key resource for National Grid” in the UK.

Harrison says: “The sale of power to the grid or behind the meter offers a huge potential additional revenue source for EV charging providers, but bidirectional power flow through an EV battery has the potential to degrade performance and life-span on the EV battery. It remains to be seen if and how the vehicle or battery owner will be insulated from this risk and rewarded for its role in facilitating the sale of power and power services to third parties.”

Braking momentum?

Yet there remains scepticism around the very possibility of profitability from EV infrastructure, at least at this stage. The current risks may make the space the natural preserve of private equity investors, or industry-at-large players able to comfortably place investments on balance sheet.

One of those less sanguine about the prospects of EV is Michel Debs, portfolio manager and analyst with AMP Capital’s listed infrastructure team. He stresses that though the technology and feasibility is not an issue, profitably selling it to users is. Various regulations, insurances and taxations make the challenge even harder.

“You can market charging points either as a service or simply selling electricity. If you sell as a service you’re going to sell at a fixed price because most customers want visibility on prices, which means as an operator you’ll take the risk on the margin of the electricity you sell. If you’re selling energy, you have the exact same issue: do you have your own sources of energy, or are you buying on the market? How can you ensure you make a margin?”

In addition to the capital-intensive nature of installing the infrastructure, it is an open question of how the entity strengthening local distribution networks will be remunerated for the extra investment: “Network operators tend to be regulated meaning any capex they do needs to be sanctioned by the regulator, to get a rate of return that is regulated. If they do capex that is purely merchant, they need visibility on revenue, which returns to the question of how you ensure you make money.”

Utility companies are under tremendous pressure and operating with margins that makes it hard for them to invest in any potentially loss-making projects. Government budgets are also constrained and politicians are wary of passing costs onto the electorate.

And investing in EV infrastructure is still somewhat of a step into the dark. “Although you are seeing a number of countries launching studies into whether or not they should adapt their networks for electric cars, the projections for the power demand from electric cars are tiny,” says Debs. Instead, he suggests hybrid vehicles may enjoy greater success owing to the requisite infrastructure already existing.

Burns & McDonnell’s Casey says: “In this industry there won’t be a lot of big winners – when I say a lot, I mean maybe 10s of winners… Probably thousands of companies will lose out, because it is a fledgling market…”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.