Canada's energy diversification in 2019

Canada updated its coal-fired electricity regulations in December (2018), introducing much stricter measures. The country is now targeting 90% of electricity from non-emitting sources by 2030, and decreasing carbon pollution from the electricity sector by 12.8 million tonnes. This would require coal-fired plants to employ carbon capture and storage (CCS) technology if they were to continue operations after 2029.

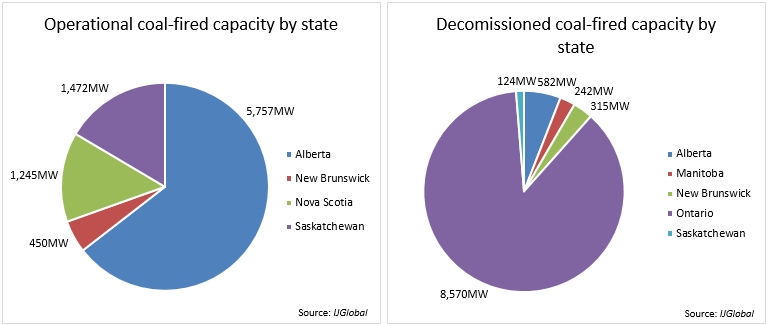

The country’s energy mix contains 15 working coal-fired power plants, with the largest generation capacity being in the Province of Alberta. IJGlobal data shows that Ontario has already retired all of its coal energy generation.

The remaining operational units would need to be upgraded with CCS technology or converted to other fuel sources if they are to remain operational. Among them, only the Boundary Dam facility is using this technology in just one of its five units.

The CCS technology, however, has its shortcomings. SaskPower’s experience provides a sobering example. The owner of the Boundary Dam power station was faced with serious design issues and regular breakdowns of the carbon capture system installed in the facility’s third unit, which ended up being operational only 40% of the time.

In addition, an April 2016 Parliamentary Budget Office report showed that this type of installation doubled the cost of electricity and led to further concerns – diminishing returns and availability of cheaper alternatives. These existing issues look more likely to tip the scales towards the decommissioning of the remaining 14 coal-fired facilities, leaving room for environmentally friendlier alternatives.

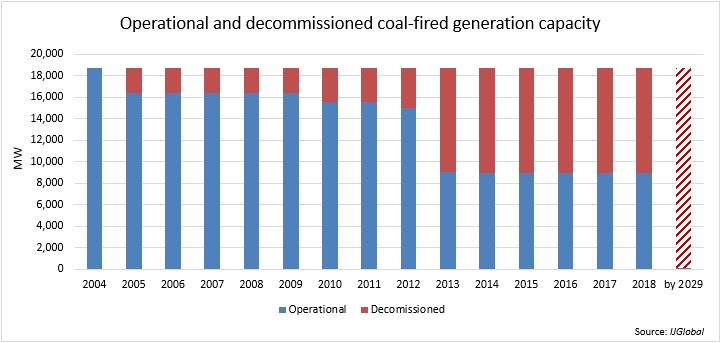

IJGlobal data draws a steep decline in coal-fired plants in 2013 with half of the installed capacity in 2004 now decommissioned.

Canada has long realised the need for a major shift to clean energy generation, in order to combat climate change, but also provide a cheap, steady and predictable supply.

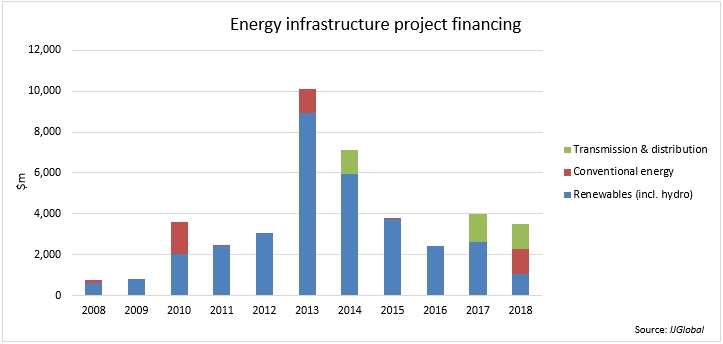

IJGlobal data shows that since 2008, 180 clean energy developments were financed with investment reaching over $33.6 billion, compared to 11 conventional energy developments amounting to $4.2 billion.

In total, as of January (2019), around 66% of the electricity supply in the country comes from renewables, a sizable portion of which is through hydro installations, according to the Canadian government. There are also numerous wind and solar projects operational throughout the country. IJGlobal data shows that 69% of closed financings since 2008 – totaling $23.3 billion – have been for wind and solar assets.

The country’s grid is also well capable of supporting these developments and the introduction of new energy generation technologies. Recent significant investments in the Canadian transmission and distribution sub-sector include:

- $1.25 billion Fort McMurray West transmission line, Alberta

- $1.2 billion Watay transmission line, Ontario

The planned decommissioning of coal plants and the continued growth of energy demand should be considered a sign that in the near term Canada would need renewable energy – beyond hydro – to meet its targets. It is also worth noting that Canada does not shy away from trying out alternative power generation methods either.

Although there are plans for new fossil-fuel generation facilities, they will use the environmentally-friendly source – natural gas.

In December (2018), the Canadian government also announced that it is providing C$25.6 million ($19.3 million) in funding for the country’s first geothermal facility. Once installed, it will have a capacity of 5MW, sufficient for the needs of 5,000 households. Deep Earth Energy Production Corporation is developing the project.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.