Mexico: The more renewables, the better

Mexico has seen a rapid rise in renewables development over the last five years, with the Mexican Secretariat of Energy (Sener) in October (2018) reporting a 35% increase in installed renewable energy capacity.

The Mexican government help accelerate the adoption of renewable power through the introduction of energy reforms in 2013 under President Enrique Pena Nieto. The unbundling of state-run Comision Federal de Electricidad (CFE) and partial liberalisation of the market – along with the introduction of competitive tenders for renewable capacities, green certificates and other trading instruments – have all contributed to the recent spike in Mexican renewables.

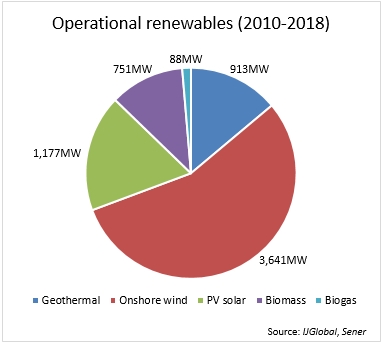

Data compiled by IJGlobal shows that Mexico's renewables capacity – excluding hydropower – stands at 6,600MW, comprising:

- 3,700MW wind

- 1,200MW solar PV

- 1,752MW biogas, biomass and geothermal

According to the latest data released by Sener, in June 2017 renewables (including hydro) accounted for 25% of the country's total installed capacity of around 7,500MW. Sener expects it to reach 30% by 2021.

Future is green

Mexico has an ambitious target of having 50% of its installed energy capacity covered by renewables by the year 2050.

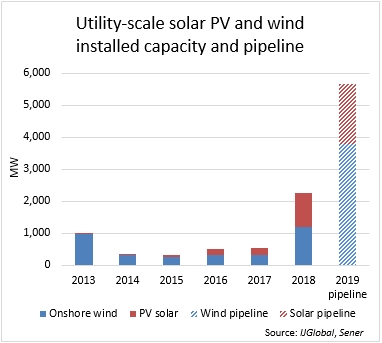

According to IJGlobal data, nearly 2GW of solar and 3.8GW of wind are expected to come online in 2019 alone, following the successful energy auctions held in November 2015, April 2016 and April 2017. Power purchase agreements (PPAs) and green certificate trading also helped to seal these deals. According to the Mexican government, the average price achieved in its third long-term auction of 2017 was $20.57 per MWh.

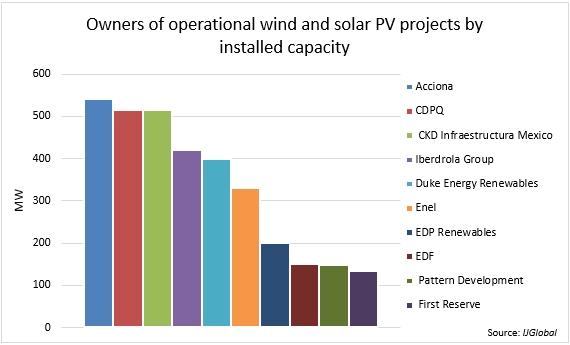

These tenders have attracted a number of major international developers of utility-scale projects.

According to IJGlobal data, the largest renewable energy owners by installed capacity are Spanish majors Acciona and Iberdrola, France's EDF, Italy's Enel and Portugal's EDP, alongside the CKD Infraestructura consortium of Mexican pension funds.

At the beginning of last year (2017), Acciona Energia announced the start of the construction of the 317.5MW Puerto Libertad PV complex, developed in a 50:50 joint venture with Biofields Group's Tuto Energy, in the state of Sonora. The project was awarded in the second energy auction in 2016.

Puerto Libertad is expected to commence partial operations before the end of 2018, and the whole solar complex is slated to be up and running in Q1 2019.

Acciona is also developing the 168MW El Cortijo wind farm in Tamaulipas, scheduled to come online by the end of the year (2018).

Meanwhile, Italian energy giant Enel in September (2018) reached financial close on two solar projects in Mexico:

- 828MW Villanueva located in the northwestern state of Coahuila

- 260MW Don Jose located in the state of Guanajuato

Enel last month (October 2018) sold a majority stake in a portfolio of eight Mexican solar and wind assets – including the Villanueva and Don Jose solar farms – to Caisse de dépot et placement du Québec (CDPQ) and CKD Infraestructura México (CKD IM) for $1.4 billion. CDPQ and CKD IM acquired an 80% shareholding in the portfolio shortly after the primary financing reached financial close.

Mexico's short-term pipeline of projects also includes two solar projects totalling 141MW – the 100MW Tepezala II and 41MW Rumorosa PV plants. Both are expected to be operational in H1 2019.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.