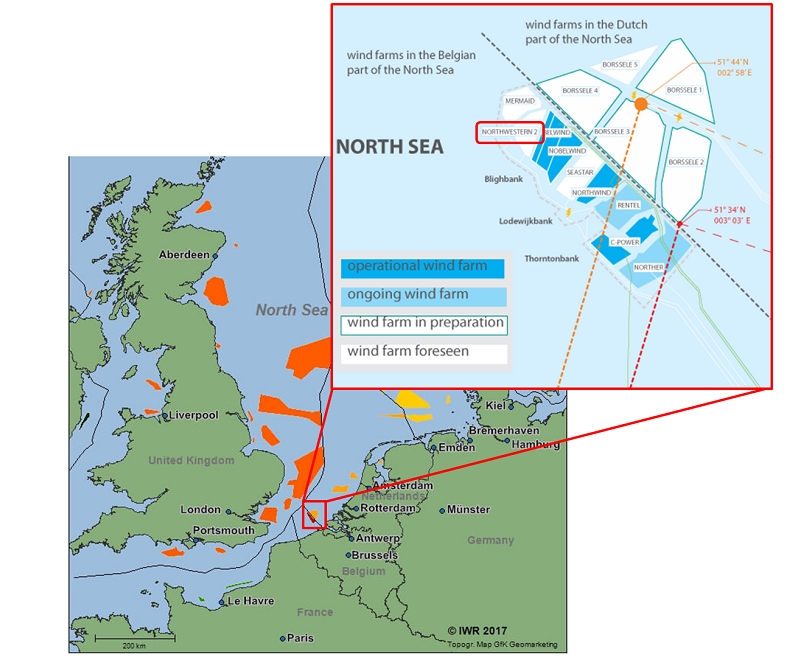

Northwester 2 offshore wind, Belgium

As Belgium looks ahead to the next round of offshore wind auctions scheduled for 2020, hoping to emulate Germany and the Netherlands by attracting zero-subsidy bids, a Japanese-Belgian consortium reached financial close on Northwester 2 – which could be one of the last subsidised offshore wind projects in Belgium.

A reshuffled sponsor team of Sumitomo Corporation and Parkwind reached financial close on the project in early October (2018), but the road to getting there was anything but straightforward.

Northwester 2 was one of five Belgian offshore wind projects put under review by the European Commission (EC) in July 2016 after DONG Energy (now Orsted) won the Dutch tender for Borssele I and II with a bid almost half of the level of subsidy support enjoyed by the Belgian projects.

Following DONG Energy’s €72.70 ($80.42) per MWh bid, Belgium’s Energy Minister Marie Christine Marghem and State Secretary for the North Sea minister Philippe De Backer asked the EC to review the Belgian €138 per MWh offshore wind subsidy for:

- 309MW Rentel, which reached financial close in October 2016

- 270MW Norther, which reached financial close in December 2016

- 219MW Northwester 2, which reached financial close in October (2018)

- 246MW Seastar and 300MW Mermaid, which in July merged to form 487MW Seamade due to reach financial close at the end of the year (2018)

The review concluded that Rentel and Norther, which at the time were in advanced stages of financing, would receive revised tariffs of €124 per MWh and €129.8 per MWh, respectively, with the subsidy support period reduced from 20 to 19 years.

In April 2017, De Backer suggested that the government should revoke the concessions given to Northwester 2, Seastar and Mermaid. He proposed retendering the projects via a competitive tendering process to reduce tariff prices.

These plans eventually fell through, however, due to mounting pressure from the EU for Belgium to decommission its Del and Tihange nuclear plants by 2025 and meet its 2020 emissions targets. Instead, a new tariff price of €79 per MWh was negotiated with the developers of the Northwester 2, Seastar and Mermaid projects.

The project

Offshore wind developer Parkwind led an all-Belgian consortium of Colruyt, InControl Group and TTR Energy which in October 2017 agreed the new tariff price with the Belgian government, allowing the project to accelerate its development activities.

The sponsors of project began discussions with lenders at the end of September 2017 with the RFP process launched at the start of May (2018). Construction agreements were signed this summer (2018) and work on the site is scheduled to begin May next year (2019) with first energy produced towards the end of that year and full operations in Q1 2020.

Northwester 2 is located 52km off the coast of Zeebrugge in northern Belgium. It will consist of 23 MHI Vestas V164 units. Each turbine will generate 9.5MW of power and will together deliver the full 219MW of capacity.

The main construction contracts have been awarded to:

- Bladt Industries – offshore high voltage substation (OHVS) design, supply and installation

- Jan de Nul – design, fabrication, supply and installation of foundations and scour protection, as well as installation of IAC, wind turbine generators (WTGs) and export cable

- MHI Vestas – WTG supply, installation and commission

- Nexans – export cable design, supply and termination

- NSW – inter-array cable (IAC) design, supply and termination

Equity

Around two months before financial close (August 2018), Sumitomo bought into the deal through subsidiary Summit Tailwind Belgium, acquiring a 30% stake in the project from Colruyt for €18 million.

Parkwind, meanwhile, bought back InControl and TTR’s shareholdings taking its ownership of the project to 70%.

At financial close, the equity split on Northwester 2 was:

- Parkwind – 70%

- Sumitomo – 30%

Prior to the equity sell-down, the ownership structure had been:

- Parkwind – 46%

- Colruyt – 30%

- InControl – 14%

- TTR – 10%

Parkwind and Sumitomo will put forward €219 million equity to fund the €700 million project, with the remainder funded through debt provided from a total of 10 lenders.

Debt

The €481 million debt consists of one tranche from the European Investment Bank (EIB) and a second tranche from a club of nine commercial banks.

The EIB will provide a €210 million loan to the construction of Northwester 2, with over half of the debt (€110 million) guaranteed under the European Fund for Strategic Investments (EFSI) and the other €100 million guaranteed by Danish export credit agency EKF.

Northwester 2 is the fourth offshore wind project in Belgium to be supported under the EFSI guarantee.

The commercial debt, which equates to €271 million, will be provided by a club of banks which each will put forward €30.1 million:

- ASN Bank

- Belfius Bank

- BNP Paribas Fortis

- ING Bank

- KBC

- SMBC

- Société Générale

- Triodos Bank

- Rabobank

The tenor on the debt from both the EIB and the commercial debt is 16 years, with pricing on the commercial debt coming in at around 160bp over Libor.

A source close to the deal has additionally confirmed there is a tranche of subordinated debt on the project.

Northwester 2 has as of yet no PPA in place. If a PPA is not achieved, then the commercial loans will default.

However a source close to the deal claims the project is in late stages of talks for a 17-year PPA that is awaiting approval from the Belgium government.

Advisers to the project sponsors were:

- Parkwind – financial

- Loyens & Loeff – legal

- Marsh / Profin – insurance

- BDO – model audit

- DNV GL – due diligence

Advisers to the lenders were:

- Jones Day – legal

- Mott MacDonald – technical

- JLT – insurance

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.