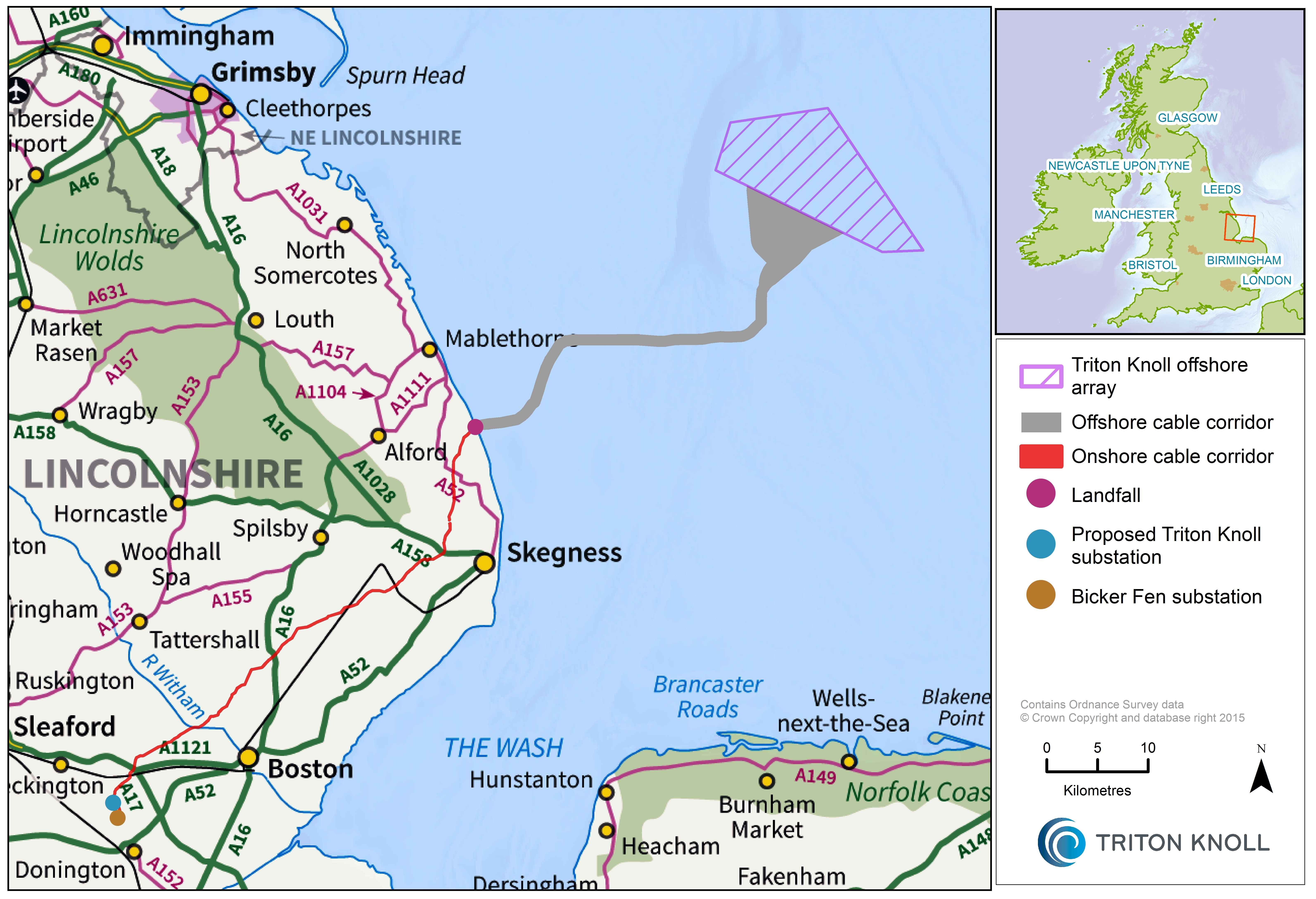

Triton Knoll offshore wind farm, UK

A consortium of Japanese investors turned heads in August (2018) when it won an auction to acquire 41% of the 860MW Triton Knoll offshore wind project with a bid understood to be 30-40% higher than that of second-placed Omers. A few weeks later, main sponsor Innogy reached financial close on the £2 billion ($2.6 billion) project.

The high bid from J-Power and Kansai Electric Power allows them to take a stake in a major European offshore wind project and bolster their sector knowledge and experience.

J-Power, which now owns 26% of Triton Knoll, has announced that it is aiming to build an offshore wind farm off Kitakyushu City, Japan of a similar size. Kansai Electric Power, which took 16% of Triton Knoll, has similar plans to be involved in offshore wind in its home market.

Some sources expect to see more high bids from Asian investors in offshore wind auctions, such as state-owned China Resources purchase of 30% Dudgeon offshore wind for £555 million ($742.5 million) in 2017.The Taiwanese market is set to see roughly 3.5GW of offshore wind developed this decade if all projects are to be complete by 2025, and other opportunities in the sector in Asia are vast.

However, other sources suggest these projects will prove exceptions rather than the rule. J-Power recently signed a memorandum of understanding (MoU) with Engie to start developing large-scale commercial projects in Japan and Europe. Asian developers may see this as a more logical, and less risk, way of developing expertise.

The valuation of the Triton Knoll stake may seem irrational to European investors, but for J-Power and Kansai Electric Power the deal provides them highly valuable first-hand experience of the latest turbine technology and construction techniques.

Equity

The then UK Secretary of State for Energy and Climate Change awarded final development consent to Innogy in 2013 to develop a 1.2GW offshore wind project, at a cost £3.6 billion ($5.4 billion), at the Triton Knoll site.

Innogy reduced the total capacity of the proposed project to 900MW in 2014. Statkraft bought 50% of the project in 2015 but later sold it back to Innogy in 2017 due to its decision to withdraw from the offshore wind sector.

Innogy then looked for an equity investor to replace Statkraft and finally sold down equity in August (2018).

Various North American and European infrastructure funds also submitted offers for the asset, though a full list of equity bidders has not been revealed.

Kansai Electric Power purchased its 16% stake through its subsidiary KPIC Netherlands, while J-Power bought its 25% stake through its subsidiary JP Renewable Europe Company (JPREC).

The Development Bank of Japan funded a part of J-Power’s investment by means of the preferred equity.

At the same time as putting together the equity side of the deal, Innogy had been lining up the debt package with 15 banks.

The £2 billion deal reached financial close two weeks later with £1.71 billion of debt.

Debt

The debt priced at a little above 150bp over Libor with step ups to 200bp over the duration of the loan. It carries a tenor of 15 years plus two years of construction. Sources close to the deal claim that the process was three times oversubscribed.

Lenders were grouped into two equally weighted tiers with higher lenders putting forward around £150 million and others lending £75 million.

The lenders are:

- ABN AMRO

- BayernLB

- BNP Paribas

- Commerzbank

- ING Bank

- KfW IPEX

- Landesbank Hessen Thuringen Girozentrale

- LBBW

- Lloyds

- MUFG Bank

- Natixis

- NatWest

- Santander

- SEB

- SMBC

Norton Rose Fulbright advised the lenders, while MUFG Bank and Linklaters were financial and legal adviser, respectively, to the sponsors.

Construction

The project is underpinned by a 15-year power purchase agreement (PPA) that Innogy has signed with Ørsted under which the Danish energy giant will offtake 100% of the wind farm’s output.

Ørsted has a strategy of using its competencies in balancing power into the grid for third parties and is turning it into a lucrative business model. The firm signed a similar deal with Banks Renewables in February 2017, though the Triton Knoll PPA is much bigger.

The PPA compliments the CfD awarded to Triton Knoll, signed in September 2017 at a strike price of £74.75 MWh over 15 years.

The wind farm is due to feature 90 MHI Vestas V164 9.5MW turbines and is going to be developed over two separate construction packages. Package 1 – the offshore array – includes wind turbines, meteorological masts, offshore substations and the cables that link the wind turbines to the offshore substation. Package 2 – the electrical system – includes the substation, underground cables and the offshore export cables and the electrical compound along the onshore cable route.

Construction for the onshore element of the transmission project is due to start later in 2018, while offshore construction would begin in 2020. The wind farm is expected to commence commercial operations in 2021 or 2022.

Consultant K2 Management won the construction and monitoring contract for the project along with multiple contractors and suppliers:

- Flexible (previously VBMS)

- GeoSea

- J Murphy & Sons

- MHI Vestas

- NKT and Boskalis Subsea Cables

- Seaway Heavy Lifting

- Siemens Transmission and Distribution

- 3SF (Sif Nertherlands and Smulders Projects Belgium)

MHI Vestas will establish a full-scale turbine pre-assembly operation at Able UK’s Seaton Port in Teesside, from enabling works to loadout. It is anticipated that, in total the port activity involving all partners could unlock a further £16 million investment in new infrastructure and equipment.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.