Los Angeles Automated People Mover, US

As a mass-transit solution, California’s $2.5 billion Los Angeles Automated People Mover (APM) breaks new ground for financing in the US, delivering a 2.25 mile elevated electric train system, connecting parking facilities to the international airport.

This is the first time that a DBFOM PPP model has been used for a transport system of this nature at a US airport, making Los Angeles International Airport (LAX) a P3 pathfinder with a challenging bank/bond hybrid model.

The APM will provide a free service to transport 30 million passengers per year between the central terminal area of LAX and off-airport intermodal transport facilities and a consolidated rental car service – currently under tender as a P3 with four bidders in place: Consolidated Rent-A-Car (ConRAC).

The project has an all-in, design/build capex of a shade more than $2 billion and the project is designed to reduce travel times and congestion, while hugely enhancing user experience.

Pre-construction work – utility relocation, geotechnical investigation and surveying – has already started on the project that reached financial close on 8 June (2018) and full operations are slated for early 2023. Most of the construction work will be completed long before 2023, allowing for several months of testing.

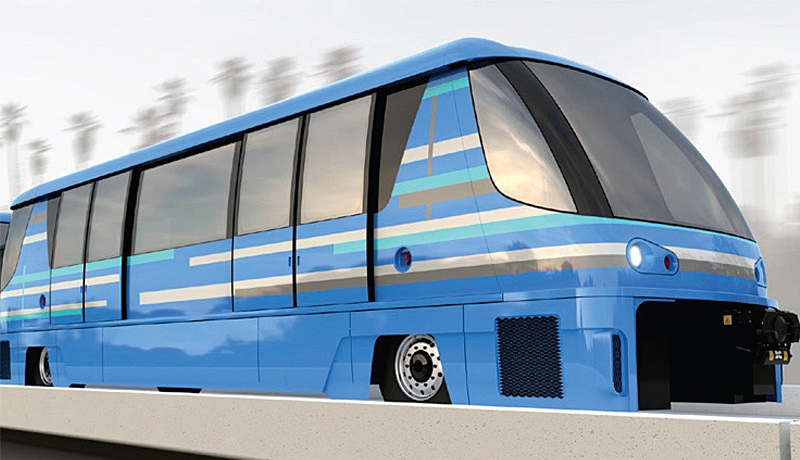

The first of the 44, fully-electric cars (see left) will be delivered in late 2020. To boost green credentials, the vehicles generate a portion of their own power through regenerative breaking, and they are 98% recyclable.

As a further nod to California’s green agenda, the command centre / maintenance facility generates half its power from solar energy and it is designed to be LEED Gold Certified, offsetting the carbon equivalent of 12 million vehicle miles.

The APM will have nine trains with four cars – each of which will carry up to 50 passengers with luggage. There is a maximum ridership of 200 people per train which will arrive at stations every two minutes, with an end-to-end travel time of 10 minutes.

Project procurement

The Los Angeles APM was a hotly-contested project with five teams initially qualifying in August 2016 for the DBFOM project with a 25-year O&M concession.

They were (in alphabetical order):

GatewayConnectors:

- equity providers – Kiewit, Meridiam, Skanska

- lead contractors – Kiewit Infrastructure West, Skanska USA Civil West California District

- lead designers – Mott MacDonald, Gannett Fleming

- lead O&M provider – Johnson Controls

- advisers – Société Générale Americas Securities, Orrick, JP Morgan, Goldman Sachs, Siebert Brandford Shank & Co, BTY Group

LA ConnextPartners:

- equity providers – Ferrovial Airports International, Cintra, Bechtel, John Laing Investments, Bombardier Transportation

- lead contractor – Ferrovial Agroman, Bechtel

- lead designer – Bechtel

- lead O&M provider – Ferrovial Airports International, Cintra, Bombardier, Bechtel

- advisers – Scotiabank, Gibson Dunn & Crutcher, Alvarado Smith, Griffith Company, Royal Bank of Canada, Morgan Stanley, Backstrom McCarley Berry, Latham & Watkins

LAX Connecting Alliance:

- equity providers – OHL Infrastructure, Acciona Concesiones, Star America Fund, Aberdeen Global Infrastructure GP II, Axium Infrastructure, Charles Pankow Builders

- lead contractors – OHL, Acciona, Charles Pankow Builders

- lead designer – Arup North America

- lead O&M providers – OHL, Acciona, Serco

- advisers – Barclays Capital, Squire Patton Boggs, TRC Solutions, PRR

LINXS:

- equity providers – Fluor, Balfour Beatty Investments, Hochtief PPP Solutions, ACS Infrastructure Development

- lead contractors – Fluor, Balfour Beatty Infrastructure, Flatiron West, Dragados

- lead designers – HDR Engineering, HNTB Corporation

- lead O&M providers – Fluor, Balfour Beatty, Hochtief, ACS

- advisers – Allen & Overy, MUFG, Citigroup Global Markets, Bank of America Merrill Lynch, Ramirez & Co

PWA:

- equity providers – Plenary Group, Walsh Investors, AECOM Capital, JLC Infrastructure Fund I, Sumitomo Corporation of Americas

- lead contractors – Walsh Construction Company II, Granite Construction Company, URS Energy & Construction

- lead designers – AECOM Technical Services, TEC Management Consultants

- lead O&M provider – ENGIE Services

- advisers – Fasken, Rutan & Tucker, Sanders Roberts & Jewitt, Ballard Spahr, InTech Risk Management, Wells Fargo Securities, Loop Capital Markets, TDSecurities, Plenary Group

Towards the end of April 2017, this line-up was whittled down to three contenders – Gateway Connectors, LAX Connecting Alliance and LINXS – with the preferred bidder selected towards the end of January this year (2018).

The LINXS team – led by Fluor, Balfour Beatty, Hochtief and ACS – was chosen by Los Angeles World Airports (LAWA) to deliver the automated people mover, allowing the project to progress to financial close in June.

Financing details – LINXS

The LINXS consortium closed financing on the $2.23 billion project with:

- $103 million – equity

- $1.29 billion – private activity bonds (PABs)

- $269 million – short-term bank loan

- $1.032 billion – landmark payments (the last of which is used to retire the construction loan)

The $103 million equity tranche was provided by the primary players in the LINXS consortium:

- Balfour Beatty Investments – 27%

- Fluor Enterprises – 27%

- ACS Infrastructure Development – 18%

- Hochtief PPP Solutions – 18%

- Bombardier – 10%

The California Municipal Finance Authority issued $1.29 billion in 29-year senior lien revenue bonds on behalf of the sponsor consortium. They were rated BBB+ by Fitch Ratings.

The bonds were arranged by Citigroup, Bank of America Merrill Lynch and local player Ramirez & Co, split across two liens – 2018A and 2018B notes. They priced on 5 June (2018) at an all-in cost of 4.1%.

The five-and-a-half-year construction loan of $269 million was provided by a club of five MLAs:

- CIBC

- Korea Development Bank

- Mizuho – administration agent

- SMBC

- TD Bank

Bank debt priced at 380bp all-in – a margin of 80bp over Libor – flat for the duration of the loan. KDB is not able to offer swaps, so that was distributed across four other MLAs.

There is a debt service cover ratio minimum of 1.15, averaging out at 1.18 DSCR over the loan life.

The bank facility does not draw until construction is well advanced – three to four years – as the SPV receives six milestone payments from the airport authority that average out at $172 million, awarded on completion of design/construct work stages.

The bond was deployed immediately, followed by the six milestone payments which amount to $1.032 billion (taking the financing up to the $2.23 billion total, avoiding double-counting). The bank debt is drawn towards the end of construction, and is repaid by the final milestone payments. At financial close, the banks were essentially charging a commitment fee.

LAX will cover availability payments to the concessionaire from rental car customer facility charges and other airport operating revenues.

Non-equity members of the LINXS consortium include:

- Flatiron West – contractor

- Dragados – contractor

- HDR Engineering – designer

- HNTB Corporation – designer

- White & Case – legal adviser

- Ramirez & Co – financial adviser

The rise of hybrid financing

While the market is no stranger to the deployment of the bank/bond hybrid financing model – notably well supported in neighbouring Canada – it is making its first appearance in the US on a deal of this nature.

While it is still in its early days in the US, there are signs that the model – which many claim was first deployed on McGill University Health Centre P3 in Quebec – is gaining considerable traction.

It has been adopted in the US on:

- ConRAC – Los Angeles APM’s sister project

- Pennsylvania Broadband

- I-75 in Michigan

- Howard County Circuit Courthouse P3 in Maryland

Those involved in the APM transaction insist they are not copying the Canadians, and have honed it to suit the US market – but it is not without its issues, principally surrounding milestone payments.

“The tricky thing about milestone payments is that if they are numerous and frequent, what the contractor does at that point is – essentially – take the risk between milestones on balance sheet and bank those payments themselves,” says a source involved in the APM financing.

“When you have big milestone payments that are spread out, then a bank financing becomes much more important because the contractors cannot ‘carry’ that much cost between funding of the milestones.”

He continues: “Another important point is that when you see a municipality putting out milestone payments, they are basically reducing the risk allocation benefit that they get. They are putting money out before they have a completed project.

“Of course, they are doing it to drive down cost, but – in practice – they are eroding the benefit or risk allocation with the more money they are putting out pre-completion.”

Another source adds: “It’s a balance between having the right amount of private capital involved and not having too much expensive private capital.”

A challenging environment

There are divided views on the procurer – LAWA – with some accusing it of being too “demanding” and shifting the goalposts; while others celebrate its vision and drive to push through a deal of this magnitude to financial close in two-and-a-half years.

Given that LAX is now well progressed on the $5.5 billion Landside Access Modernization Program, LAWA will doubtless shoulder many more complaints/congratulations as it procures:

- ConRAC – the P3 consolidated rental car facility

- two intermodal transport facilities

- improvements to roads connecting to the airport

The Tax Cuts and Jobs Act of 2017 did throw a spanner in the works for this project, but it was managed by LAWA and it kept to the timetable, achieving financial close in June (2018).

One area that leaves many involved in the procurement process unhappy was the process adopted by LAX in dual shortlisting developers and rolling stock providers – and then expected them to come together at RFP stage.

Beyond that, any multi-billion dollar infrastructure transaction will throw up more than its fair share of challenges – and they were dealt with capably by the procurer and preferred bidder.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.