A rocky road ahead for Argentina's PPPs

The recent award of six toll roads in Argentina should have been a moment of triumph for President Mauricio Macri's government, which has made increased infrastructure investment a priority. But the country's macroeconomic situation limited interest in the auction and has cast a shadow over the future of the projects.

This was the first round of planned PPP project auctions which are expected to total $26.5 billion in investments through to 2022, with transport and energy projects as main pillars. Argentina has suffered decades of under-investment in infrastructure – not least because of the long aftermath of the 2001 economic crisis which required a bailout from the International Monetary Fund (IMF). The crisis, and the economic policies that followed, crashed investor confidence in the country.

| Project name | Length (km) | Investment ($m) | Winning bidders |

| Road Corridor A | 707 | 1,330 | Paolini, Vial Agro |

| Road Corridor B | 538 | 1,090 | China Construction America, Green |

| Road Corridor C | 538 | 1,090 | Jose Cartellone Construcciones Civiles |

| Road Corridor E | 390 | 1,710 | Helport, Panedile, Eleprint, Copasa |

| Road Corridor F | 635 | 1,490 | Helport, Panedile, Eleprint, Copasa |

| Road Corridor South | 247 | 1,210 | Rovella Carranza, JCR, Mota-Engil |

Macri’s administration has been slowly rebuilding investor confidence since it came to power in 2015. The government had aimed to cut its gaping fiscal deficit to 2.2% of GDP in 2019, therefore PPPs and private investment would be essential in meeting its infrastructure targets. Cautious interest in the country's substantial PPP pipeline started to grow.

And then Macri announced in May (2018) that Argentina would again be seeking aid from the IMF, following a series of interest rate rises failed to halt a plummeting peso. Now that PPP pipeline looks precarious – even the projects awarded in June face a challenge to reach financial close.

A missed opportunity

Argentina approved a highly ambitious national transport infrastructure plan in September 2016.

A PPP law was passed in November of the same year, establishing a legal framework to regulate the essential aspects of PPP contracts. According to the framework, the government would issue companies quarterly certificates entitling them to US dollar payments based on construction progress, which companies could then use as collateral to raise funds. The government also issued a decree exempting PPP operators from value-added tax and allowing the operators to collect tolls.

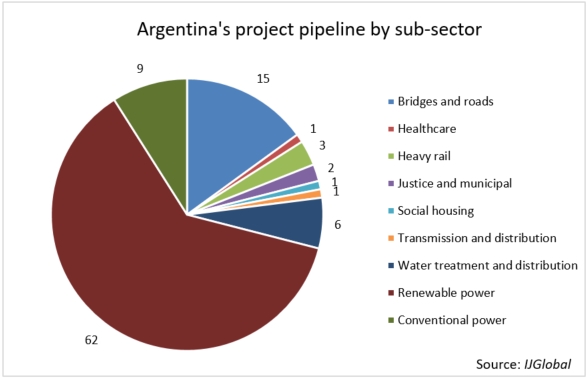

Argentina's PPP programme not only includes transport projects, but also energy, healthcare, social infrastructure and water schemes.

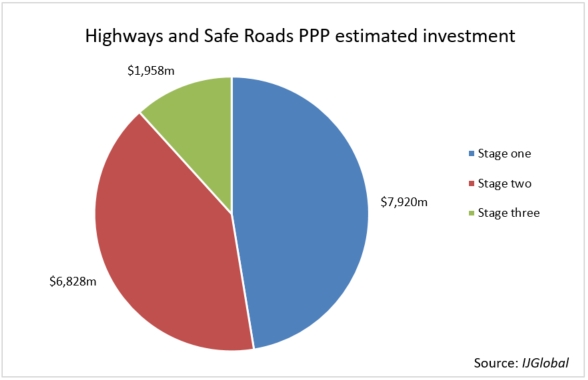

One important focus of the programme is the roads sector. The Argentine Highways and Safe Roads PPP initiative is designed to comprise three phases – with a target of 7,000km of roads built or renovated for a total investment of $16.7 billion over 15 years. The roadworks will be financed through a tax on diesel and income from tolls.

The six roads projects of the first stage of the programme comprise over 3,000km, requiring $7.9 billion in investment. The second and third phases of the roads’ concessions have been planned to follow later this year with investments of $6.8 billion and $1.9 billion, respectively.

Another important focal point of the Macri government is the renewable energy bidding process. Launched in 2016, the RenovAr programme has had three rounds – RenovAr 1, Renovar 1.5 and RenovAr 2 – in which over 5GW of capacity was awarded.

Funding challenges

Given the instability of the Argentine economy, project sponsors will have to rely on debt from DFIs with commercial banks unlikely to get comfortable with the government as a counterparty.

The Inter-American Development Bank (IDB) approved in March (2018) a $500 million investment guarantee facility, which should help to attract private investment. Under the programme, the IDB will issue partial risk guarantees and political risk guarantees to investors taking part in PPP projects in Argentina who meet the programme’s requirements.

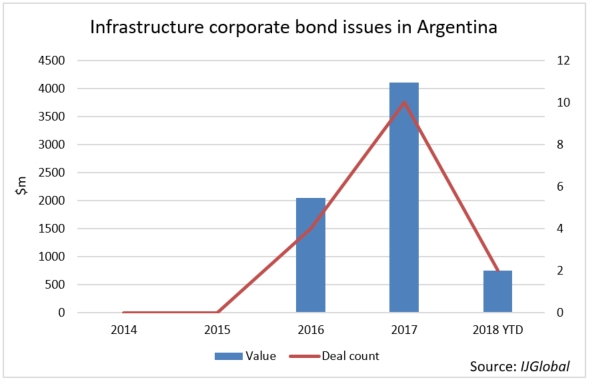

One significant consequence from the $50 billion IMF bailout agreed in June may be any resultant impact on the country’s credit rating. Argentina’s sovereign credit rating had been improving steadily over the last few years, which had led to a rise in corporate bond issuance. It was hoped that corporate bonds could cover some of the funding requirement for the country’s hefty road infrastructure pipeline.

IJGlobal data shows that $4.1 billion of bonds were issued last year by corporate entities which are being used, at least in part, to support infrastructure projects. Favorable market conditions led to this spur in bond issuances.

However, there haven’t been any recent issuances of infrastructure project bonds in the country and the market remains underdeveloped for foreign and local currency bonds.

Market observers suggest the underlying projects in Argentina’s infrastructure pipeline are attractive, but even with the best PPP framework in the world a highly volatile economy will scare off most investors.

Though the government successfully tendered six roads in June, the makeup of the winning consortia was telling. Few major international road operators were among the successful bidders.

No one is quite sure where this road is heading and many investors, at least for now, seem keen to take another route.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.