Norway – Alt for Norge

In a European infrastructure market that has been dominated in recent times by refinancing and acquisitions, it seems counter-intuitive to focus on greenfield PPP developments, but hopes springs eternal at IJGlobal and the desire to celebrate opportunity is strong.

Having last week bemoaned the demise of the Spanish greenfield and brownfield transport sector, it seems only fair to balance discussion by taking a closer look at a pipeline that brings a glimmer of hope to the beleaguered sector.

And so we turn to Norway where we have already seen one deal close this year – the NOK2.6 billion ($316m) Rv3/Rv25 – with Skanska (shocker) winning the 25km road connecting Løten and Elverum in the county of Hedmark.

At the moment, we sit with two chunky PPP projects in the National Transport Plan for 2018-29 – one in procurement and the other in planning:

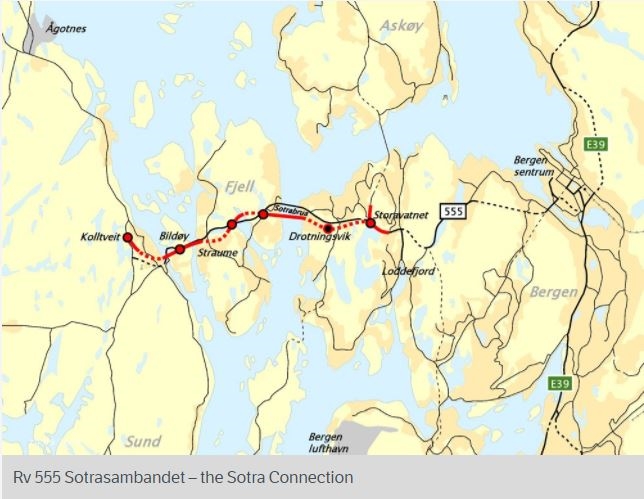

- Sotra Connection – the 59km section of Rv555 between Sotra and Bergen. It has an estimated investment of NOK7.5 to NOK8.5 billion ($931m to $1.1bn)

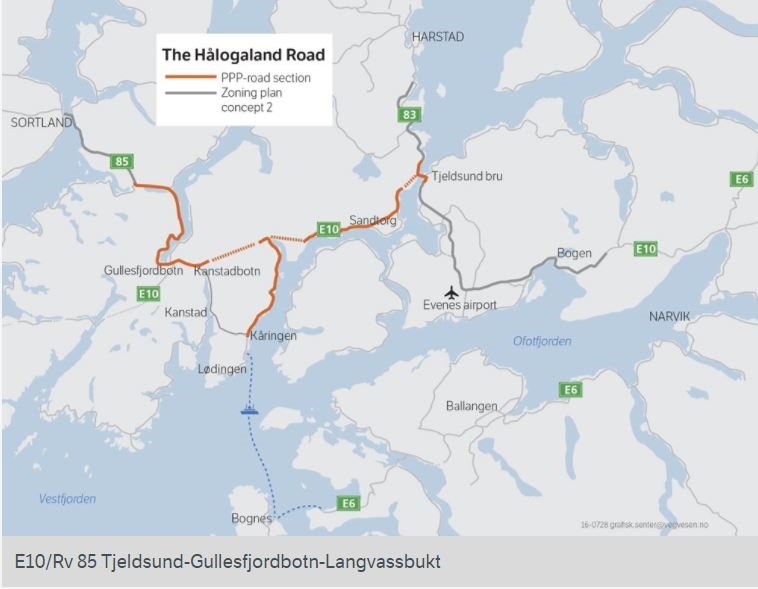

- E10/Rv85 – 80km road linking Tjeldsund to Gullesfjordbotn, running on to Langvassbukt (Nordland and Troms County), with an expected investment of NOK6-7 billion ($745-869m)

Beyond that, there are a good number of opportunities for developers, but it looks unlikely – at this stage – that they will be procured as PPPs:

- E16 – section connecting Oppheim and Skulestadmoen in Hordaland County

- E134 Haukelitunnelene – 5.7km Haukeli Tunnel in Telemark and Hordaland County

- E6 – stretch of road between Åsen and Steinkjer in Trøndelag County

- E6 Sørfoldtunnelene – Sorfold Tunnel in Nordland County

- E6 – road between Megården and Mørsvikbotn in Nordland County

Looking at what the market can realistically expect in the near future in Norway, you have two projects. So let’s drill down...

Sotra Connection

This road – Rv555 – has been brought to market to improve connectivity between Sotra/Øygarden and Bergen linking urban centres to the main road network, rail connections, airport and port. It will cater for growing traffic levels and has been given priority status.

Beyond laying tarmac and the inevitable pedestrian/cycle paths, its greatest challenges is a 954m bridge (in addition to a further 19 bridges) and a whole swathe of tunnels, the longest ones being:

- Kolltveit Tunnel – 950m

- Straume Tunnel – 850m

- Knarrvika Tunnel – 750m

PwC is advising the procurer: Statens Vegvesen.

This project is at an early stage in procurement with a meeting held at the end of May to drum up interest.

E10/Rv85

This project is at an earlier stage of procurement with plans for it to progress significantly this year. However, with an operations start date scheduled for 2025, it’s unlikely to reach financial close before the end of 2020.

Located in Central Hålogaland, it crosses two counties and passes through seven municipalities. The key motivation for this project is to improve mobility and reduce travel time on roads between the towns of Sortland, Harstad and Evenes in Northern Norway. It will slash travel time between Tjeldsund Bridge (Tjeldsundbrua) and Sortland by more than half-an-hour.

Again PwC is acting for the procurer – Statens Vegvesen. Nice one, looks like you’ve got the public side sewn up.

But you’d better take a sandwich if you’re expecting any developments on this project in the next few months.

A bridge too far…

So that’s a pipeline of… one. It’s at times like this that a little clarity is needed around use of the term “pipeline”. Does that that definition embrace one project in the market and another on the horizon?

Probably not, but it’s a sign of the times and something is definitely better than nothing – and bodes well for the future.

However, before consulting the crystal ball, prior to financial close earlier this year on Rv3/Rv25, only three motorway PPPs made it over the line in the early days of the Norwegian market (2003-06):

- E18 Grimstad-Kristiansand – Skanska with John Laing

- E39 Lyngdal-Flekkefjord – Veidekke Group with Sundt

- E39 Klett-Bardshaug – Skanska with John Laing

With Skanska winning Rv3/Rv25, that’s a 75% hit rate for the local player… which comes as little surprise as the Sweden-based construction giant has the Nordic market pretty buttoned up.

The Sotra Connection – weighing in at the best part of €1 billion – is too big for a Norwegian developer to take on alone and sources on the ground reckon that the European heavyweights will wade in.

Two bidding teams that are almost certain to bid are the ones that withdrew from Rv3/Rv25 process before the three-strong shortlist was announced. Many believe they bid on the first project (a fairly simple deal) to serve as a test-run for the big deal to follow.

The two bidders were:

- Vinci with Swedish developer NCC

- Hochtief with Porr and BBGI

Beyond that, it seems fair to expect the European construction giants to turn up in force, with bids likely to come from the likes of:

- Acciona

- Astaldi

- Bouygues

- Strabag

“In my view, this project would be perfect for European consortia,” says one source close to the deal. “I think they used the first project just to learn about the Norwegian PPP structure.”

However, sources are divided on Sotra given that so much of the project involves bridge construction – one large suspension bridge, a smattering of smaller bridges and four tunnels.

One sources goes as far as to say: “Nobody has made any money in Norway on bridge building for the last 10 years.” He continues: “The local market is very wary of it [Sotra]. Whereas the first project was relatively straightforward road-building, this next one is materially more complicated.”

A pipeline…?

One project closed and in construction, another in early-stage procurement and one more in planning – as pipelines go, that’s pretty narrow… but something’s better than nothing.

And on a positive front, with the next election not due until September 2021, Norway has a good run at getting them delivered.

It remains a sad reflection of the current European market that we celebrate puny deal flow (though it should be noted the next Norwegian project is pretty chunky) in a market that will continue to be constrained for some time to come.

Time to take a summer holiday…

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.