DFI lending in Rwanda

Since President Paul Kagame launched his country's Vision 2020 development plan in 2000, substantial progress has been made on improving Rwanda's infrastructure.

The country aims to achieve its goals through commercially financed projects, reducing its reliance on the international donor community.

This was evident in 2017, when two landmark PPP projects reached financial close.

Turkey's coal trading firm Hakan Mining and Electricity Generation Company and Quantum Power in February 2017 arranged the financing for the 80MW peat-fired independent power producer (IPP). Then in November, water management company Metito announced that it had reached financial close on the Kigali bulk water supply plant – the first integrated water project (IWP) in Rwanda and the first bulk surface water PPP in Sub-Saharan Africa overall.

The Kigali bulk water PPP project also won IJGlobal's African Water Deal of the Year award.

Both projects were brought to completion through the support of development finance institutions (DFIs). Metito's $80 million Kigali project was backed by multilateral finance institutions including:

- African Development Bank (AfDB)

- Emerging Africa Infrastructure Fund

- PIDG’s Technical Assistance Facility

Meanwhile, Hakan’s peat-fired IPP was financed by a group of DFIs comprising:

- Africa Finance Corporation

- African Export-Import Bank

- Development Bank of Rwanda

- Eastern and Southern African Trade and Development Bank

- Export-Import Bank of India

- Finnfund

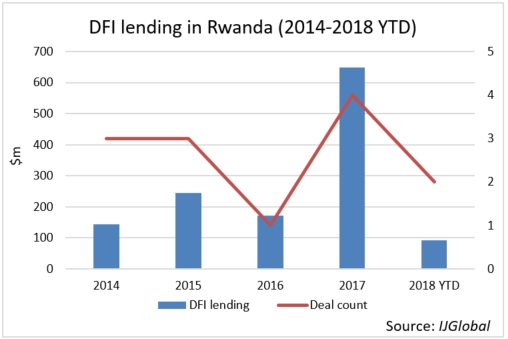

This surge of DFI investment in Rwanda's infrastructure is demonstrated by IJGlobal data, which shows that around $649 million was provided by multilaterals, development banks and export credit agencies last year (2017).

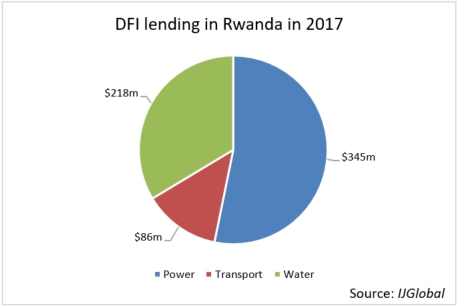

IJGlobal data shows that power and water were the sectors to have received the largest share of DFI support in this period.

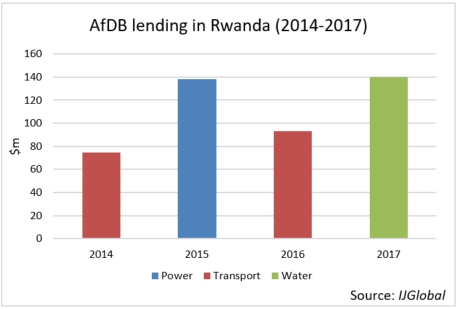

It is no surprise that the AfDB proves to be the biggest DFI lender to Rwandan infrastructure projects, not only for 2017 – but for the last 5 years. The multilateral is one of Rwanda's key development partners and has provided support in multiple sectors.

The AfDB's 2017-2021 Country Strategy Paper for the country, approved in 2016, highlights investment in energy and water infrastructure to enable inclusive and green growth.

The Country Strategy Paper tallies with Rwanda's Vision 2020, which outlines infrastructure development in key sectors such as:

- communication and ICT

- energy

- transport

- waste management

- water

The initiative is crucial for lowering costs of doing business in the country, which is expected to attract both domestic and foreign investment.

And by financing infrastructure projects, DFIs are helping Rwanda to create a favourable environment for private investment, boosting private sector-led growth.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.