Fund analysis: CIP III

Copenhagen Infrastructure Partners’ (CIP) third fund – Copenhagen Infrastructure III (CI III) – reached final close on 23 March 2018.

It closed at the €3.5 billion hard cap – exceeding its final close target by €500 million.

CI III is a 20-year unlisted fund, investing in North America, Northern and Western Europe, and Asia Pacific, in primarily greenfield energy and utilities in the following sectors:

- biomass/waste-to-energy

- geothermal

- offshore wind

- onshore wind

- reserve capacity

- solar PV

It has a target IRR of 7-8% although it is likely to exceed this, in line with previous funds. It is a build-and-hold fund – focusing on greenfield investments, expecting to hold the investments throughout the entire commercial lifetime of the assets.

IJGlobal speculated that the fund was nearing at the end of 2016 before fundraising was launched was in March 2017. It raised capital for 12 months and reached six closes – with the €2.8 billion sixth close on 2 January 2018 – before achieving final close in March 2018.

The fund’s advisers are:

- Bruun & Hjejle – legal

- Deloitte – auditor

- Eaton Partners – placement agent

- Selinus Capital – placement agent

- Danske Bank – placement agent

- CFJC – placement agent

Investor breakdown

The fund’s predecessor – Copenhagen Infrastructure Fund II – attracted 19 European investors. Of these, only two were from outside the Nordics – the EIB and an unnamed British pension fund investing via Townsend. Of the 19 investors in the previous fund, 17 invested in CI III.

Compared to its predecessor, CIP’s third fund has a more diverse investor base. This was part of the manager’s strategy, as it wanted to increase the investor base as well as the target size of the vehicle.

First close attracted investors from the Nordics and UK, while international investors from Australia and Israel entered later in the process, at sixth close.

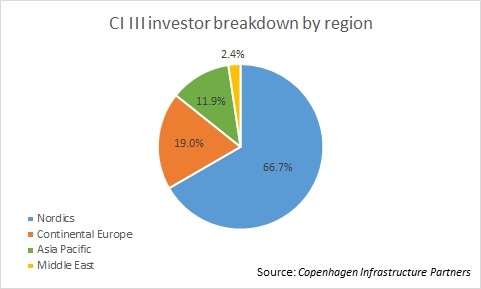

The fund attracted 42 investors from the Nordics, continental Europe, Asia Pacific and one investor from Israel. More than two-thirds of the investors were from the Nordics, with over 75% from Europe:

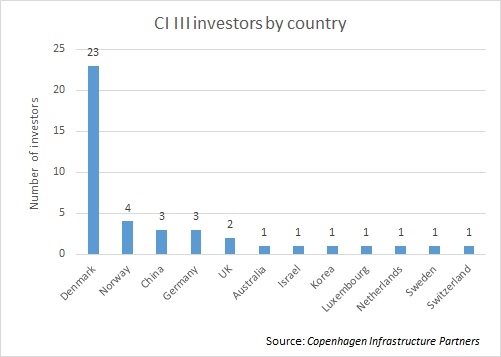

The fund's investors come from 12 countries. Of the 42 investors, more than half were from the fund’s home country, Denmark:

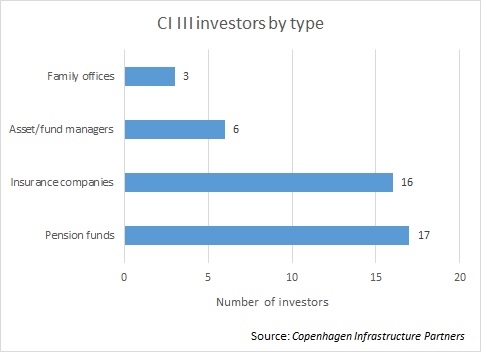

The majority of investors were either pension funds or insurance companies, but the fund also interested family offices, and asset/fund managers:

The full list of CI III investors is:

- PensionDanmark

- Lægernes Pension

- PBU

- JØP (Juristernes og Økonomernes Pernsionskasse)

- DIP (Danske civil- og akademiIngeniørers Pensionskasse)

- Nordea Fonden

- PFA

- AP Pension

- SEB Pension DK

- SEB Pension SE

- Lærernes Pension

- Oslo Pensjonsforsikring

- KLP (Kommunal Landspensjonskasse)

- Townsend on behalf of a UK pension fund

- Widex

- LB Forsikring

- EIB

- a Swiss pension scheme

- Haringey London

- Lív (Føroya Lívstrygging)

- ISP

- K Alternativ Infrastruktur I

- Lind Invest

- Zhinfra

- DNB Liv

- Pensjonskassen for Helseforetakene

- PME

- Migdal

- Catholic Superannuation Fund

- Climate Delta K/S (MP Pension)

- Arbejdernes Landsbank

- Kapitalforeningen Nykredit Alpha

- Fagligt Fælles Forbund

- Fødevareforbundet NNF

- Länsförsäkringar Skåne

- Taiwan Life Insurance

- Fubon Life Insurance

- a Taiwanese life insurance company

- Mirae Asset Daewoo

- VSW Rechtsanwälte NRW

- W&W Group

- R+V

Capital commitments

Around 90% of the capital committed came from the Nordics and Europe, with 10% coming from Asia, Australia and Israel combined.

The largest capital commitments came from the Nordics, followed by Europe and then Migdal, an Israeli insurance company.

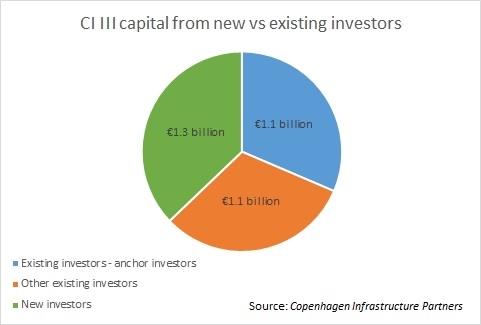

Nearly two-thirds of the capital was from existing investors from CI II. Of the €3.5 billion raised, CI III’s anchor investors invested €1.1 billion at first close. The anchor investors also invested in the previous fund, and are:

- PensionDanmark

- KLP

- Lægernes Pension

- JØP

- DIP

The anchor investors, together with the other 12 existing investors from CI II, committed a total of €2.2 billion.

PensionDanmark is the largest investor with an investment of €540 million. The smallest commitment comes from an unnamed investor and is around €20 million. The EIB signed an €100.8 million investment on 16 October 2017.

Deploying capital

The fund expects to deploy around 40% of its capital through European investments, and expects to make 18-20 investments in total.

Sectors such as offshore wind off the US east coast and Taiwanese waters are particularly interesting to the fund. Other attractive sectors in the US include solar and onshore wind.

CI III has signed agreements for three projects:

- German geothermal projects – March 2018

- Australian offshore wind – November 2017

- Taiwan offshore wind – October 2017

The vehicle has a pipeline of around 20 deals in the US, Taiwan, Germany and UK, worth at least €3 billion. It expects to close its first transaction in summer 2018.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.