European renewables on the infra fund radar

Early January this year (2018) saw the European Parliament approve a new renewable energy target of 35% by 2030, topping the existing agreement between member states on a 27% target by the same year.

The message sent to prospective investors looking at greenfield and brownfield projects could not be clearer – or more inviting. And this is for a sector that hardly needs encouragement.

Renewable energy projects form a seemingly ever-growing investment target for funds looking to invest in Europe. As technologies get cheaper from one year to the next, and with steady national energy policies across Europe, it is no surprise that 2017 saw a number of leading infrastructure funds commit sizable investment to this particular sector. And investment looks to stay strong in 2018 – and beyond.

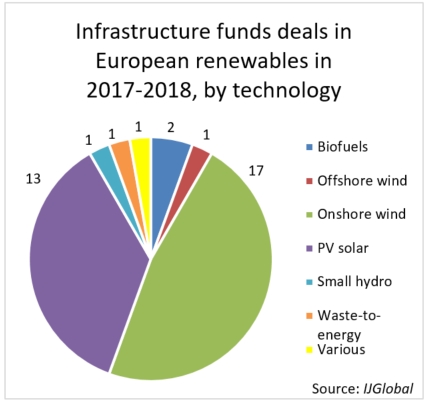

According to IJGlobal data, onshore wind and photovoltaic (PV) solar projects made up the top investment targets for infrastructure funds in 2017-2018, followed by biofuels, offshore wind, waste-to-energy and small hydropower projects.

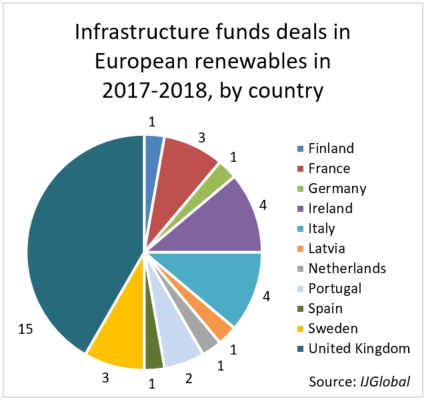

In terms of attractive markets, IJGlobal data reveals that infrastructure funds appear to favour the UK when it comes to investing in renewables, having closed 15 deals in the country in 2017-2018.

Stand-out deals in 2017 and 2018

As reported by IJGlobal in early 2017, London-listed green fund The Renewable Infrastructure Group (TRIG) has been monitoring investment opportunities in Germany, the Benelux countries and Scandinavia.

The fund – which had a market capitalisation of £997.69 million ($1.35 billion) as of 4 May 2018 – has invested in 58 assets in the onshore wind and solar PV sectors in the UK, Ireland and France. The fund has a 50% minimum cap for UK investment, and started targeting investments outside that remit in 2016.

In early 2018, TRIG completed the €72 million acquisition of a 41.2MW Irish wind farm comprising Clahane 1 – an operational wind farm – and its 13.8MW extension which is currently under construction.

Infrastructure funds have also been targeting entire European renewables portfolios, often disposed by big players. One such example is Greencoat UK Wind’s acquisition of EDF Energy Renewables' UK Wind Portfolio (96.4MW).

The £98 million purchase, which closed on 1 November 2017, took the generating capacity of Greencoat UK Wind’s portfolio of assets to 694MW.

2017 also saw Allianz Renewables Energy Fund II (AREF II) break Dutch ground with the purchase of the 44MW Koegorspolder wind park. AREF II’s 350MW wind portfolio grew by a further 94MW following the acquisition of German utility company STEAG’s wind farms in France for a €150 million ($179.7 million) consideration.

Both deals reached close in early this year (2018).

Meanwhile, Mirova’s €350 million Eurofideme 3 fund in March (2018) purchased Hyperion Renewables’ 28.8MW solar PV plant in Portugal. The project is Mirova's second renewable energy asset in the country. Mirova Eurofideme 3 previously partnered with RP Global to invest in a recently commissioned 10MW hydroelectric plant.

Gaining investment momentum in Europe

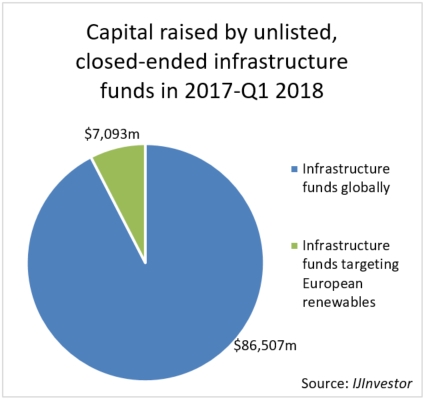

According to IJInvestor data, funds targeting investments in European renewables raised around 8% of the total capital collected by unlisted, closed-ended infrastructure funds in 2017 and Q1 2018.

Among the funds that reached final close in Q1 2018 is the $40 million Green Return Fund – Core, which targets equity investments in onshore wind and solar plants across core European Union countries.

Meanwhile, Helios Energy Investments in March (2018) finished fundraising for its Helios III Energy Fund. The Israeli firm manages €150 million in multiple funds with investments in over 200MW of solar PV, waste-to-energy, bio-mass and bio-gas power plants.

Recent infrastructure fund activity is suggesting a trend among pension funds, insurers and – to a lesser degree – certain private investors and foundations, to look into secure investments in diversified portfolios of European renewable assets.

With pipelines targeting ownership of renewable projects approaching financial close within the next two to three years, it seems that funds are sticking with this particular European sector.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.