Sparks of life in Brazilian transmission

The Brazilian government sees investment in transmission assets as a key tool in boosting the country’s economy. After a number of years of limited interest in development auctions, improved returns for investors in 2016 revealed an increased appetite for transmission projects.

In the following year, Brazil’s National Electric Energy Agency (ANEEL) undertook two transmission auctions.

Launched in April 2017, the first auction resulted in Aneel awarding 31 of 35 lots to add 7,068km of transmission lines and substations with 13,132 mega-volt-amperes (MVA) of power capacity for a total investment of R12.7 billion ($3.82 billion).

The national power agency then auctioned 11 groups of projects in December, comprising 4,919km of transmission lines and substations with the capacity of transforming 10,416 MVA. The total investment for Aneel’s second auction was estimated at R8.7 billion.

Global players – such as France’s Engie, India’s Sterlite Technologies and Neoenergia, owned by Spain’s Iberdrola – were among the winners to the tenders to build transmission lines at prices averaging 40% below ceiling values set by regulators.

In contrast to a succession of poorly received auctions before 2016 – hampered by several delays due to a lack of bids – the 2017 auctions hinted at the growing investor confidence showed in recent tenders.

Power surge

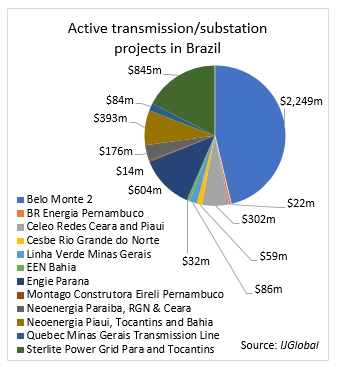

IJGlobal data shows a significant number of active transmission transactions in Brazil, which is hardly surprising given the number of lots awarded in recent times.

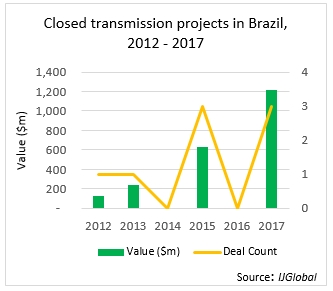

In addition to a growing interest in the auctions, there has also been an increase in the number of transactions are reaching financial close in the country. While no deals closed in 2016, IJGlobal data reveals that 2017 saw a spike in completed transactions.

The Brazilian government clearly seeks to accelerate construction, launching the Time to Move Forward - Partnerships programme in 2017 to ensure works that were previously stalled can resume. Earlier this month (March 2018), over 30 projects were included in the initiative.

The package includes 24 transmission line lots to be granted under concession – comprising a total of 60 projects across 18 states – to be auctioned by Aneel on 28 June. The 24 lots combined add 3,954km of transmission lines and substations with a total capacity of 13,866 MVA.

BNDES blockage

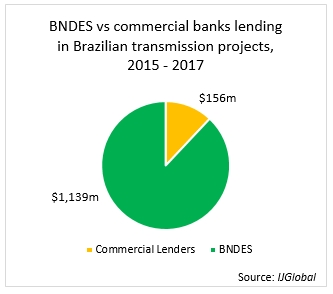

Despite the abundance of investment opportunities, commercial lenders have found it difficult to tap into the Brazilian market.

BNDES is a very active lender in the market, and commercial banks in the country have long complained that BNDES’s subsidized interest rates leave little room for them.

BNDES recently announced that it expects a 16% growth in its infrastructure credit disbursements in 2018 – contradicting its stated goal of reducing its presence in financing infrastructure to open up the market to commercial lenders.

There is long-term hope for commercial banks, however. The TJLP rate that BNDES previously used for its loans – which was several percentage points lower than the Brazilian Central Bank’s basic rate – was replaced in January 2018 by the new TLP.

Although the TLP debuted at a rate equivalent to the TJLP, it will gradually converge with the rate of Brazil’s sovereign notes over the next five years.

And in an effort to reduce its reach as a lender – and to boost participation by commercial banks in project finance – BNDES announced in March 2018 that it intends to reduce its disbursements by 6% relative to 2017.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.