Fund analysis: Basalt Infrastructure Partners II

UK-based manager Basalt Infrastructure Partners on 8 February (2018) announced final close for its second infrastructure fund at $1.3 billion.

Basalt Infrastructure Partners II (Basalt II) is a closed-ended, unlisted equity fund with a 10-year life and two extensions of two years each. Target IRR is in the mid-teen region.

The manager launched fundraising for Basalt II in August 2016 following pre-marketing talks in July, with LPs and existing LPs from its first Basalt Fund (Basalt I). Managing partner Rob Gregor headed up the fundraising, which had a $1 billion target and a $1.3 billion hard cap.

Basalt II in December 2016 reached first close above $500 million, and it raised another $150 million in capital in an interim close in the beginning of April 2017. Further interim closings over the following months took Basalt II over the $1 billion mark.

The fund is domiciled in the UK with a Guernsey GP. It takes a core-plus investment approach and has assets under management of $620 million.

Basalt II's advisers are:

- Aztec – administrator

- Credit Suisse – placement agent

- Kirkland & Ellis – legal adviser

- PwC – auditor

Basalt Infrastructure Partners, previously known as Balfour Beatty Infrastructure Partners, is the result of following a management buyout completed on 4 July 2016.

Investor breakdown

Over half of capital in Basalt II originated from investors in its predecessor, who either re-upped or increased commitments to the strategy.

Basalt II has attracted investors from seven countries across North America and Europe, including:

- Canada

- France

- Germany

- Switzerland

- UK

- US

The seventh country has not been disclosed.

Basalt II has received strong support from investors in the US, UK and Germany. Compared to Basalt I, it has seen more capital from German and UK investors – while Canadian investors have committed to the strategy for the first time.

Some of the 33 investors in the fund include:

- A.T. Pensions

- Allstate Insurance Company

- Allstate Life Insurance Company

- Allstate Life Insurance Company of New York

- Allstate Retirement Trust Plan

- BIP II Founder Partner LP

- California State Teachers' Retirement System (CalSTRS)

- IWA–Forest Industry Pension Fund

- Laborers' District Council and Contractors' Pension Fund of Ohio

- NAEV–Infrastruktur SCS Sicav

- New England Carpenters Pension Fund

- New England Carpenters Guaranteed Annuity Fund

- New York State Teamsters Conference Pension and Retirement Fund

- Massachusetts Laborer's Annuity Fund

- Massachusetts Laborer's Pension Fund

- Retirement Income Credit Plan for Employees of Group Health Cooperative

- Swiss Life Fund Global Infrastructure Opportunities – Fund of Funds

Investment breakdown

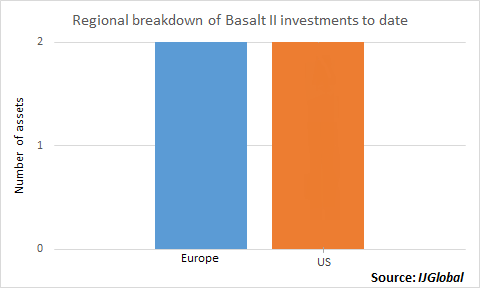

Basalt strategy focuses on equity deals in the OECD Europe and North America – predominantly in the US – across the energy, transport and utilities sectors. It invests in both brownfield and greenfield assets.

Basalt II aims to invest between $75 million and $200 million per asset.

Average deal size so far is just over $100 million, with one-third of the fund invested across four assets:

- DB Energy Assets

- Detroit Renewable Energy (DRE)

- Mareccio Energia

- North Star

Basalt II on 27 July 2017 made its first investment, acquiring power utility DRE in partnership with US-based developer DCO Energy.

A second investment signed in August 2017 in Mareccio Energia – a platform for the aggregation of small-scale operational Italian solar parks.

Basalt II announced in the beginning of November 2017 its third investment with the acquisition of North Star. North Star provides emergency response and rescue services in the UK North Sea.

The fourth investment – announced in January 2018 – was a 50% equity stake in a portfolio of DCO Energy’s district heating and cooling and cogeneration assets. The portfolio has been put into a newly created vehicle named DB Energy Assets which is equally owned by Basalt and DCO.

Basalt II is expecting eight to 10 investments to make it fully deployed, with a strong pipeline in the UK, US and Germany.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.