US LNG glut

Investing in US LNG export projects looks increasingly risky, as a flooded market forces sponsors to accept more flexible and shorter-term sales contracts. This is quite a change of direction for a market more or less still in its infancy.

Since the start of the US natural gas boom, there has been an explosion of new LNG projects proposed, but are we now on the verge of a bust?

First the boom

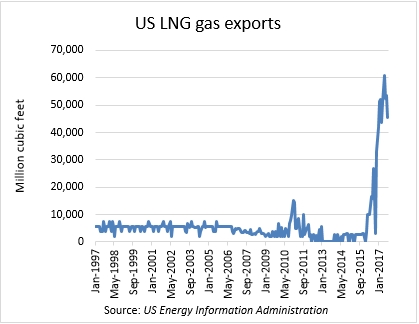

A huge increase in LNG exports from the US (see chart) began when shipments commenced from first trains of Cheniere Energy’s Sabine Pass LNG Terminal in Louisiana in early 2016.

The facility has since been expanded, with a fourth train contracted under a 20-year agreement with India’s GAIL and a fifth train FERC-approved and under construction.

Other project financed LNG projects, either already exporting or under development, include the Freeport LNG Terminal, Sempra’s Cameron LNG, Dominion Questar Gas’ Dominion Cove Point LNG, Kinder Morgan’s Elba Liquefaction Facility and Cheniere’s Corpus Christi Facility.

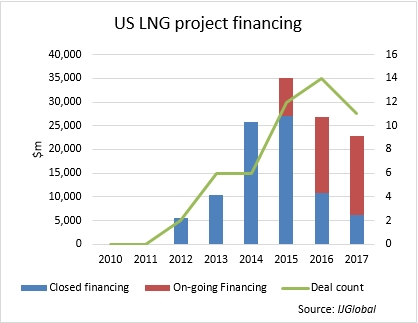

From 2014 to 2017, there has been about $110 billion in project financing in the US LNG sector. But with changing market conditions and increasingly lengthy FERC approval processes, have prospective sponsors bitten off more than they can chew?

Dampened demand

Back in the early days of US LNG exports, Asian buyers were desperate to buy, pushing up spot prices. This gave US LNG a clear competitive advantage. In 2013, US price post-liquefaction and delivery was $7 MMBtu compared to $17 MMBtu on the Asia Pacific spot market.

Four years later and spot prices are around $6 MMBtu and at times less than the US export price. If low prices persist in the 2020s, existing planned LNG facilities in the US may become less interesting to investors and at risk of not achieving final investment decision.

A market flooded with LNG has given more bargaining power to buyers. Last month, India’s GAIL called for a renegotiation on LNG purchase contracts from 2013 with Dominion’s Cove Point LNG facility. Buyers are unwilling to enter into typical 20-year term contracts, exposing project developers to greater risk with no guaranteed steady stream of revenue. Importers are seeking less obligation and more flexibility with shorter-term offtake contracts and spot LNG trading.

US LNG exporters are also facing competition from Australia and Qatar with rivaling LNG export capabilities on the Asia market. Despite the first US LNG cargoes being delivered into northern Europe in June 2017, US LNG cannot currently compete with Russia’s Gazprom gas prices and its more flexible contract system.

Future uncertainty

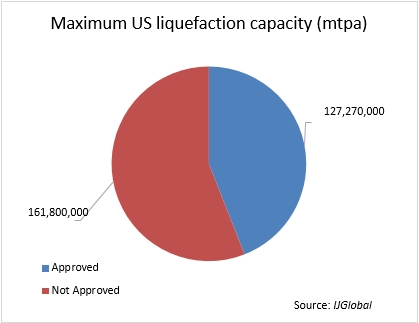

According to IJGlobal’s asset data there are currently 21 LNG liquefaction and export facilities at different stages of development. A second wave of LNG infrastructure is fighting for FERC approvals to export to FTA and non-FTA countries.

The more than 127 million metric tonnes per annum of potential liquefaction capacity currently approved is yet to be contracted fully.

It is entirely likely that some of the 12 facilities pending approval might be scrapped. As one banker active in the market said: "Now is not the easiest time to be trying to reach FID on a US LNG export project".

The future of US LNG will largely depend on increasing flexibility on contract conditions to attract buyers, reliance on spot LNG trading and lowering production costs. Increased uncertainty is difficult to stomach when costs are so high - according to IJGlobal data, average capex for an LNG project is $7.4 billion.

Developers in future might have to focus on smaller LNG facilities, exporting on shorter-term, more flexible contracts.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.