Growth in Brazilian wind

Wind power still makes up a slim slice of the total power generated in Brazil, despite excellent resource in the country and decent investment levels in recent years.

Interest from wind developers in an upcoming power generation auction is high, and potential for international investment is significant. If managed properly, the renewable sector could provide some positive headlines in a country still dogged by political and business scandals.

Gathering momentum

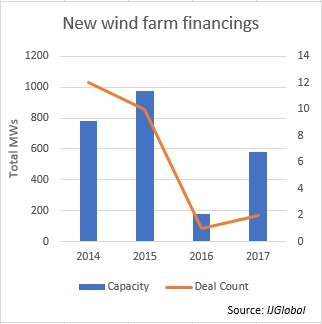

Two new onshore wind farms reached financial close in Brazil in 2017. Deal flow has slowed since a surge of transactions in 2014 and 2015, but the average size of projects is growing. The 358MW Ventos do Araripe 3, being developed by Casa dos Ventos, is the second largest privately financed wind farm in the country, and Rio Energy’s 223MW Serra da Babilona is the third largest. They reached financial close in May and March of this year, respectively.

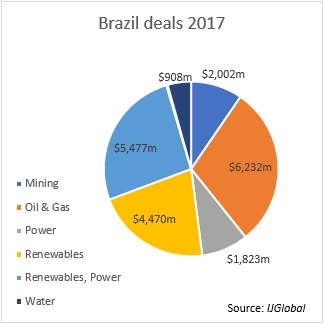

Overall investment in renewables in Brazil has been considerable this year (roughly $4.5 billion), far outweighing that for conventional power ($1.8 billion), according to IJGlobal data. These figures exclude the largest transactions of the year, the roughly $5.5 billion acquisition of 54.64% in CPFL Energia and CPFL Energias Renovaveis by State Grid of China, which included both conventional and renewable generating assets.

Renewables are well established in Brazil, representing 42.8% of all electricity generation, according to data published by the Ministry of Mines and Energy in May 2017. Hydro power is still the dominant renewable energy source, making up 66.2% of all clean energy generation. Wind represents just 6.6%, behind biomass at 8.4%.

Despite this, the country has the ninth largest installed capacity of wind energy in the world at 11,670MW, according to the Global Wind Energy Council, and there is huge potential for growth.

Over-reliance on hydro power has put generation capacity under pressure during times of drought, and the quality of local wind resource makes wind farm roll-outs attractive to government. Brazil’s wind energy association Abeeólica says the average capacity factor of the country’s wind farms is more than 50%, double the global average.

This month regulator ANEEL approved a new generation auction to award PPAs to renewables projects. It attracted 954 proposals for new wind farms representing a total capacity of close to 27GW. The auction is scheduled to kick off on 18 December 2017.

Challenges to investment

The foreign companies already active in Brazil’s wind sector include Actis (UK), Brookfield Energia Renovável (Canada), Enel Green Power (Italy), and Engie (France). However, there are some barriers to entry into the market.

Most developers rely on subsidised loans from development bank BNDES for funding wind projects. But in order to qualify for this support, they must use around 65% local content - not an insignificant hurdle for international companies.

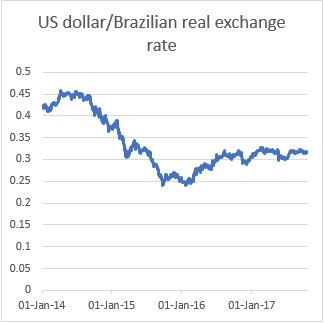

Currency risk is also a concern given that revenues under the PPAs are denominated in local currency. But the Real has been less volatile over the last year and anyway, most power concessions in the country are indexed.

Given the scandals still surrounding President Michel Temer, and the long hangover of the Lava Jato investigation, political risk cannot be discounted either.

But the general outlook for the wind sector looks good. The US International Trade Administration forecasts $24.5 billion of investment in Brazilian wind energy by 2020.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.