Offshore wind - big business

Though 2017 has so far been a quiet year for offshore wind financings, the horizon is littered with turbines out at sea.

The offshore wind market is booming, with prices falling faster than shares in Spanish banks after the Catalan independence vote, and turbine sizes growing at the speed of fungus on a forgotten bowl of fruit.

The recent offshore wind auctions in the UK and Germany have set new standards. While the UK’s most recent Contracts for Difference auction rightly grabbed headlines due to strike prices being cut in half compared to the last round of bids in 2015, perhaps more dramatic were the zero subsidy bids made by DONG Energy and EnBW for German projects in July.

As reported in the November/December edition of IJGlobal, in just a few years offshore wind has gone from risky business to a safe bet for lenders. Meanwhile the small group of developers with enough capital to play in the space keep pushing the limits of what is possible in terms of scale.

And it is the economies that come from such scale that have allowed tariff prices to fall so fast.

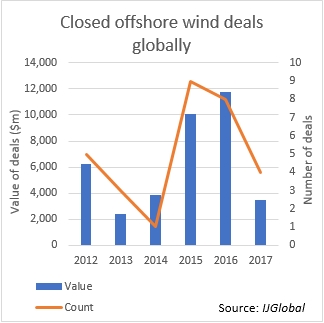

Last year saw the highest ever total value of closed transactions in the sector, according to IJGlobal data. In 2015, nine offshore wind deals reached close for a total value of just over $10 billion. In 2016, eight deals closed but their total value was $11.8 billion.

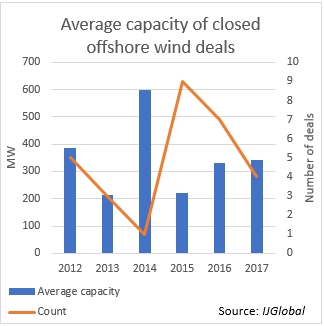

Despite an increasingly competitive market, investment levels are going up because the turbines are getting larger. The early years of offshore wind saw some large developments, such as London Array (630MW) which reached close in 2012 and Gemini (600MW) in the Netherlands in 2014.

But both these projects used turbines of 4MW or 3.7MW, while the largest turbines operating today are 8MW beasts with 262 foot blades standing more than 640 feet above sea level. Earlier this year DONG said that operating turbine sizes will double again within the next seven years.

Meanwhile, the average total generating capacity size of wind farms has been creeping up again, following a spike in 2014. The biggest offshore wind farm to reach close in 2015 was the 400MW Veja Mate in Germany, while the following year saw the financing of the 588MW Beatrice project in the UK.

As we enter the final quarter of the calendar year, it seems the market is slumping with only four projects closing, but there is still potential for 2017 to be a bumper year. According to IJGlobal data, there are 41 greenfield projects at financing stage, including some larger than 1,000MW in size.

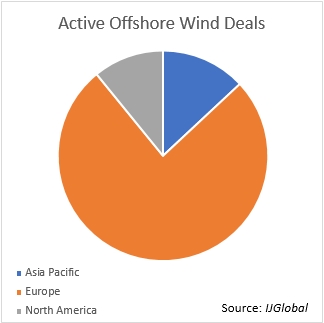

And while Europe has been the nursery for the sector, offshore wind is travelling further afield as it comes of age. Japan, China, Taiwan, South Korea, Canada and the US all have offshore wind financings in the market. If floating offshore wind technology progresses as expected, markets like the US and Japan will only become more important, as deeper waters become viable development sites.

Offshore wind is already big business, but it looks set to get even bigger.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.