Local bank decline in MENA

Local bank lending to infrastructure projects in the MENA region has reached its lowest level since 2007, according to IJGlobal data.

Many banks in the region, particularly those based in GCC countries, are very exposed to the oil and gas sector and have seen their lending capabilities squeezed by depressed global oil prices.

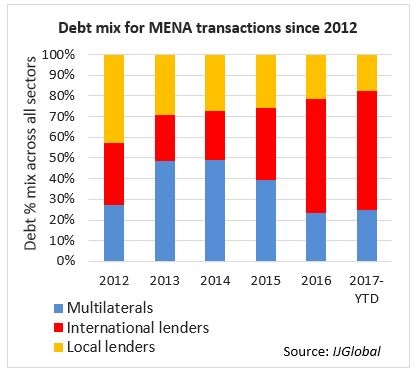

International lenders, on the other hand, are taking a larger chunk of the lending market than at any time in the last decade.

Local banks represent just 18% of all infrastructure and energy lending in MENA in the year-to-date, a 10-year low, while international banks have provided 58% of all debt to projects so far in 2017. The decline in local lending has been gradual, with regional banks' share of the market decreasing each year since 2012.

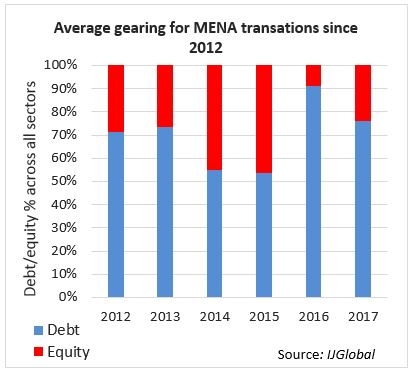

But the dominance of international banks has only emerged over the last two years, at the same time as transactions have become more highly leveraged. The average debt-to-equity ratio for transactions this year is close to 80:20, while last year’s average was even more tilted towards debt.

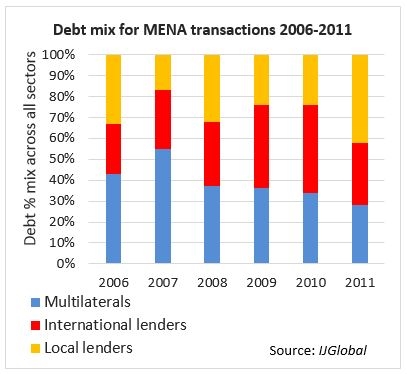

Local bank lending peaked around 2011 and 2012, just as international banks’ share of the market started to fall off. International banks grew in importance in the immediate aftermath of the financial crisis but started to recede again as subsequent banking regulations started to blunt their appetite for the region.

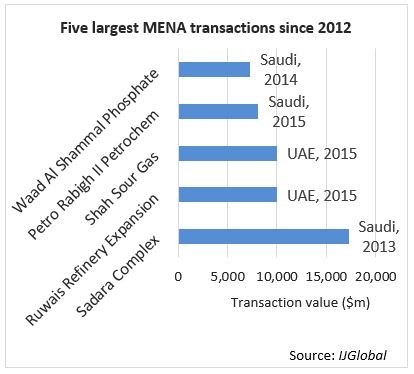

Between 2013 and 2015, borrowers increasingly turned to multilaterals for funding support. Export credit agencies in particular became very active, with the stand out transaction being the Sadara petrochemicals project in Saudi Arabia which featured the largest ever project loan from US Exim.

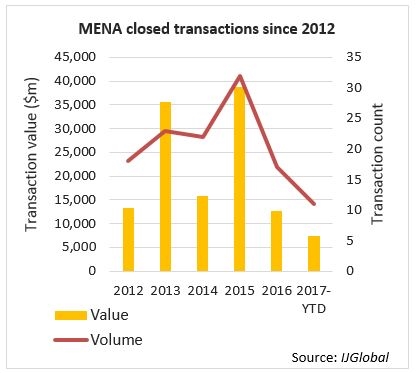

Although international banks are now enjoying their largest ever share, the pie has got much smaller in recent years. This year could yet see the lowest total value of transactions since 2012. This trend for less and smaller valued deals seems to be caused by two factors.

Firstly, there are simply not as many deals in the market. With low oil prices constraining government budgets, the appetite for supporting numerous project finance transactions is limited. The latest cycle of major downstream developments in Saudi Arabia came to an end a couple of years ago, and though that country has a long pipeline of new water and power developments, most of these projects are still at an early stage.

The frequency of major power projects has been lower in the last couple of years too, while a splurge of development had seen three or four conventional power deals in the market each year, one big transaction has been the norm in recent years.

The second trend impacting total investment levels is the move towards renewable energy. The region may have been a slow adopter of renewable power, but it is now home to significant activity in that sector. An increasing proportion of deals in the market are for solar power. These tend to require less capital expenditure and consequently less debt investment.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.