Flying off the shelves

International private operators are salivating at the prospect of upcoming privatisations of airports in Brazil, and rightly so. Some very attractive assets are being put out to market and the Brazilian government, via its Program of Investment Partnerships (PPI) entity, is in a rush to sell.

On August 24, the government unveiled plans for more than 50 privatisations of public companies, airports, ports and transmission lines. According to the new schedule, the first auctions will be of assets held by state electricity utility Eletrobras (due in late 2017), but the most anticipated are likely to be the stakes held by state-owned operator Infraero in many of the country’s airport assets (set to follow in early 2018).

The privatisation of several airports in the country has been mooted for some time, though the exact nature of the auctions was unclear until recently. That so many assets across several sectors are now coming to market is more surprising, though reflects the government's desire to push on with its reform agenda.

As Vitor Rhein Schirato of local law firm Rhein Schirato Meireles e Caiado Advogados (RSMC) explains “the acceleration of the programme as it has been done recently is due to a need to create ‘good news’ for the government” following the political and business scandals, as well as the economic crisis, which have wounded the country over the last few years. President Michel Temer's administration is trying to push through economic reforms to make the country less state-dependent and more market-based. But time is limited.

Temer survived a vote in congress in early August on whether he should be put on trial for corruption. Charges, however, still hang over him and a presidential election is due in 2018.

Rhein Schirato says: “In an election year it is hard to take such hard measures [announcing privatisations]. I think only the airports and Eletrobras will happen before the election.”

The assets

Earlier this month the government announced three groups of airports to be put up for tender: Cuiabá Airport and a number of small terminals located in the State of Mato Grosso; Recife Airport and six state capital airports in the north east of the country; and Santos Dumont Airport in Rio de Janeiro, the airport of Vitória, and four other terminals located in Rio de Janeiro and Minas Gerais.

Santos Dumont Airport is the prize asset among these groups as the 7th busiest airport in the country, and collectively the sales are expected to raise some $2.13 billion.

The government has since added into the mix Congonhas Airport in São Paulo city, the second busiest in the country and one of Infraero’s most profitable assets.

Bruno Soares, a partner at Allen & Overy in São Paulo, says: “Congonhas is very profitable and creates a surplus of roughly R300 million each year for Infraero – according to available data in the Brazilian press, helping cover for the costs of less profitable airports around the country. This means there was some opposition to it being included in the programme, as it could cause Infraero to start operating at a loss.

"Nevertheless, the privatization plan released by the Brazilian Federal Government on 24 August included the Congonhas Airport in the package of assets to be privatized. I expected it to be the most disputed asset by far."

By including this prized assets in the first set of auctions makes the complete dismantling of Infraero more likely as - were it to become just a holding company for poorly-performing airports - it would require heavy subsidisation from the government.

The most recent round of airport tenders had already proved popular with international companies, with European-based operators snapping up four concessions in March this year. Unlike previous tenders, there will be no requirement for Infraero to retain a stake in the airports now coming to market. Given the reputational damage sustained by Brazilian public bodies in recent years, this change has reportedly gone down well with potential bidders.

The first deal likely to come to market however will be a retender for the Campinas Viracopos Airport which was originally awarded in 2012, as part of a programme to upgrade a number of airports ahead of the 2014 FIFA World Cup and 2016 Olympics. Viracopos was won by a consortium of Triunfo Participacoes e Investimentos, UTC Participacoões and France's Egis.

Passenger traffic forecasts for the airport turned out to be wildly optimistic (only 52% of projections for 2016), meaning the target for that the airport to reach full capacity by 2030 now looks unlikely to be met. The concession has also faced other significant challenges. A direct train connection planned for 2025 has not materialised, the total capex of the project was miscalculated, Triunfo Participacoes e Investimentos is going through a debt restructuring, while UTC was directly implicated in the Lava Jato corruption scandal.

Brazil’s state-owned development bank BNDES is on the hook for a significant loan to the concessionaire, making the government even keener to find new operators for the asset. The consortium has agreed to voluntarily return the concession so a new tender can be launched, though the legal mechanism to enable this has reportedly not yet been finalised. RSMC’s Rhein Schirato thinks the government will prioritise the retender and that it will need to be completed before the end of the year.

Competition

The government may hope that high levels of interest will push up valuations, but bidders should be able to get good deals.

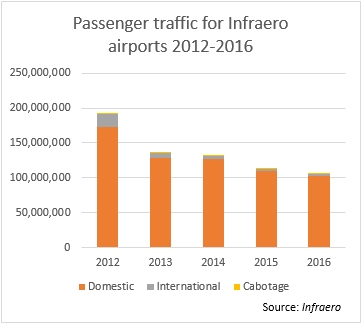

Traffic levels for Infraero airports have been steadily falling since 2012, unsurprisingly given the economic downturn in the country. If bids are based on a modest improvement to the economy in coming years, there could be considerable upside if traffic volumes rebound strongly. Much will depend on the result of next year’s election and the success of Temer’s reform agenda.

Many of the airports up for grabs are ripe for improvement, and if the airline sector is opened up to foreign carriers - as is hoped by many - more competition should reduce fares and increase traffic volumes. Private operators will also expect to run the airports more efficiently, and profitably, than Infraero has.

It is understood that the government intends to sell all of the existing Infraero assets, wrapping up the company by the end of 2018. This means that the first tenders will need to come to market soon, with many others following closely behind.

The success of the whole programme could hinge on the retender of Viracopos. The airport is a large asset in one of Brazil’s major cities and in theory should fly off the shelf and into new private hands. Though Rhein Schirato argues that given the tight timetable the government is working to, “another failure [for Viracopos] could bury any further plans of privatisation of Infraero”.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.