Saudi's Vision 2030: A slow start

Saudi Arabia’s Vision 2030 plan launched to considerable fanfare in mid-2016. Though it is still early days, this blueprint for modernising and diversifying the country's economy has not led to an increase in closed deals in the energy and infrastructure sectors.

The wide-ranging Vision 2030 aims to reduce Saudi’s reliance on oil revenues and to boost the wider economy. This involves selling a 5% stake in its crown jewel, state oil company Saudi Aramco; privatising swathes of the energy and infrastructure assets; and developing clean energy projects.

Vision 2030’s first phase is the five-year National Transformation Plan, a core component of which is to have 40% of projects taking place over the period to be funded by the private sector.

Deal activity lower in 2017

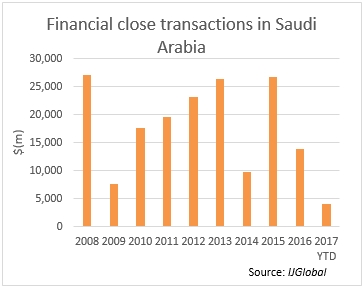

Despite the ambitious procurement and privatisation plans of Vision 2030, the total value of project financings closed in Saudi Arabia through to the end of July 2017 reached just over $4 billion. Even if activity picks up in the remaining five months of the year, it appears 2017 may be one of the country’s quietest for project finance in over a decade.

But given the ambitious 2030 programme is only a year in, the reduced amount of projects reaching financial close can perhaps be forgiven. Plenty has been going on in the background, with advisers being appointed and tenders being launched.

Renewables programme

Saudi Arabia is aiming to procure 3,450MW of renewables capacity by 2020, and a total of 9.5GW by 2023. The Renewable Energy Project Development Office (REDPO), created earlier this year, has recently invited RFQs for the 400MW Dumat Al Jandal wind project and RFPs for the 300MW Sakaka solar project.

The programme has had a couple of false starts however; Al Dumat was only recently chosen to replace the same-sized Midyan wind project due to a lack of bankable wind data being available for the latter. The 80MW and 20MW Al-Jouf and Rafha solar projects were also cancelled shortly after proposals had been received in late February.

REDPO is being advised on its first round of renewable energy tenders by:

- SMBC – financial

- DLA Piper – legal

- Fichtner – technical

Saudi Electricity Company (SEC), as offtaker from Sakaka, is being advised by:

- HSBC – financial

Privatising airports

Saudi’s General Authority for Civil Aviation (GACA) and National Centre for Privatisation (NCP) will work together to privatise all 27 of the country’s airports. Progress has been made, with consortia picked to develop and operate the Taif, Al Qassim and Haif airport PPPs in May this year.

Another deal – the restructuring of Jubail airport – is expected to sign an up to $300 million restructuring deal in early 2018 that will see the airport expanded and operated under a long-term concession agreement.

The NCP will also work to privatise 16 government agencies via IPOs and other transactions. NCP, which began operations in March this year, will also privatise other government-run services such as health, education and municipal services.

Liberalising the electricity market

There are also big plans for the liberalisation of the Saudi electricity market in order to increase competition and efficiency as well as to raise money. The Kingdom has been part-privatising its power generation market through the IPP contracts since the early 2000s – which will be continued with the procurement of the 5,400MW PP15 gas-fired power plant.

Further liberalisation of this market will include splitting the state utility, SEC, into a transmission business and four independent power production firms. SEC had 69,000MW of operational power capacity at the end of 2015.

Schools PPP programme

Government-owned Tatweer Buildings Company is undertaking the country’s schools PPP programme. Tatweer will procure around SR45 billion ($12 billion) of school projects in the coming five years. The contracts are likely to be structured as design, build, finance, operate, transfer projects with an offtake between 20 years and 30 years.

Tatweer previously mandated legal and financial advisers:

- HSBC – financial

- Aecom – technical

- King & Spalding – legal

Aramco IPO

The Kingdom is privatising chunks of its energy and infrastructure industries through the sale of existing assets and by procuring projects from the private sector via long-term contracts. The largest of these sales is the IPO of a 5% interest of Saudi Aramco. The $2 trillion offering is expected to take place in 2018.

Advisers on the Aramco IPO include:

- HSBC

- Morgan Stanley

- JPMorgan Chase

- Moelis & Co.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.