Maple leave

International oil majors are exiting Canadian upstream assets at a time when the US oil and gas market is beginning to look more attractive.

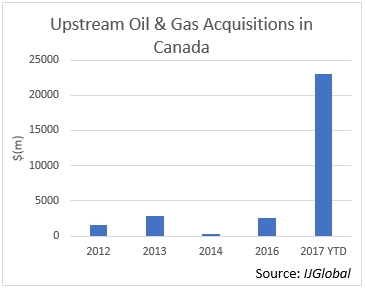

IJGlobal data shows that there were six upstream acquisitions completed in Canada in the first half of 2017, and in each deal foreign owners sold to domestic companies. In the largest of these transactions Cenovus Energy bought out ConocoPhillips from the Foster Creek Christina Sands project and its deep basin gas assets in Alberta and British Columbia for roughly $13 billion, while in another deal Canadian Natural Resources acquired Royal Dutch Shell’s stake in a number of oil sands projects for $8.5 billion.

The six M&A transactions have a total value of more than $23 billion representing considerable international capital moving out of Canada. So why the exodus?

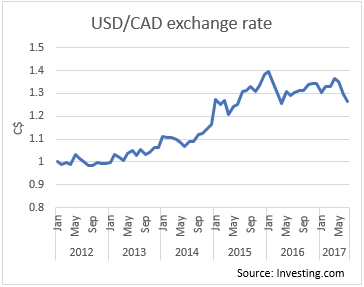

Some speculate that the Trump administration’s pro-energy policies are leading IOC’s to free up capital for potential upcoming opportunities in the US. And if the threatened 20% tax on imports from Canada is implemented, that will make holding Canadian assets that much less attractive.

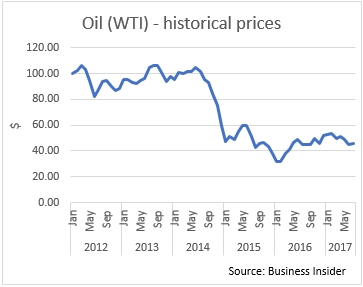

But whether Trump policy becomes a reality or not, there are already reasons to jettison Canadian assets.

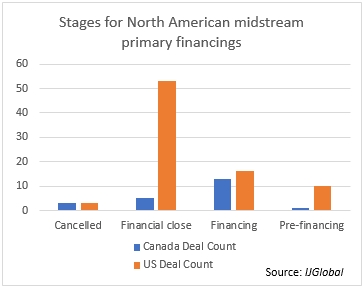

The last couple of years have seen several planned midstream developments in Canada either get stuck in the metaphorical tar sands or sink completely without a trace. The depressed oil price environment has made these capital intensive developments unattractive, and they will remain so while oil hovers around $50 a barrel.

A lack of pipelines means Canada exports are limited. But a lack of refineries mean Canada must sell to the US in order to buy back refined products.

While the Dakota Access Pipeline in the US looks to have been saved from near certain death at the hands of environmental campaigners, the Northern Gateway Project in Canada has not had such a lucky escape.

None of these trends seems to be making it appealing right now to be holding producing assets in Canada.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.