A bright year for UK renewables portfolio M&A

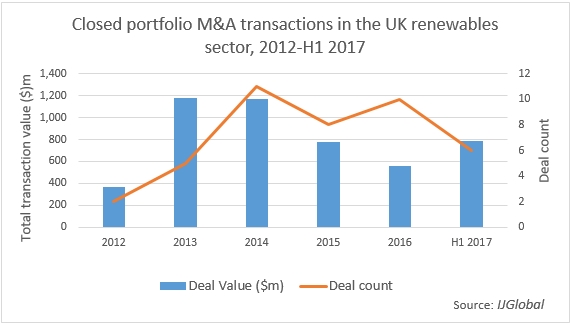

With six portfolios of renewable energy assets sold already in the UK this year, at this pace 2017 could see the highest number change hands since 2014, according to IJGlobal’s data.

Looking only at M&A portfolio transactions (whereby more than one asset was acquired) in the UK, the total value of deals in H1 2017 totalled $782.73 million. Already this is roughly 40% higher than the total for the 2016 full year, where IJGlobal data recorded $559.1 million of renewables portfolio acquisitions. Looking at deal count, 10 portfolio deals were completed in 2016, while in H1 2017 six reached financial close.

Many of the earliest commercial-scale onshore wind projects are reaching the end of their first financings, with owners now looking either to refinance or seeking to recycle equity capital, leading to the recent wave of portfolio M&A.

Meanwhile projects in operations that have met the Renewable Obligation Scheme final deadlines for onshore wind and solar PV are highly attractive acquisition targets for their generous long-term fixed tariffs. The qualification deadlines fell in 2015 and 2016 for these technologies, though the grace period for onshore wind runs to 31 January 2019.

The total deal value took a slight dip in 2016 and 2015 on IJGlobal’s figures from 2014, when 11 portfolio sales amounted to a total of $1.17 billion. However, if looking at the deal count on closes, 2016 was a strong year with 10 acquisitions of UK renewables portfolios transacted.

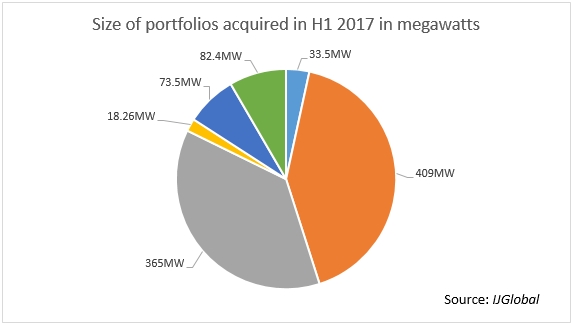

Two very large portfolio acquisitions have already closed this year. Vortex completed its £470 million acquisition of TerraForm Power’s 24 operational solar PV farms with 365MW capacity in May. Vortex’s owners are Egyptian bank EFG Hermes and Malaysian utility Tenaga Nasional, though soon a newly-unannounced equity partner is expected to take 45%.

Also in May, JP Morgan Asset Management acquired the 409MW Infinis operational UK wind portfolio from Terra Firma. At the time a deal participant told IJGlobal they would not expect to see another portfolio sale of this size in UK renewables space for a while, though consolidation would continue.

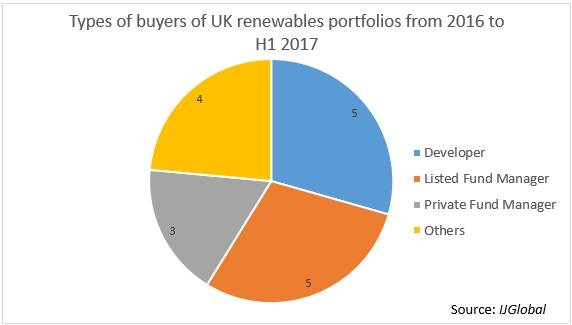

Developers and listed fund managers are neck-and-neck in terms of the number of portfolio acquisitions made since the start of 2016.

British Solar Renewables acquired an 18.26MW solar PV portfolio in March 2017, while Chinese developer United Photovoltaics was one of the buyers of an 82.4MW portfolio sold early this year.

Meanwhile, listed fund managers John Laing Environmental Assets (JLEN) and Greencoat UK Wind also closed portfolio acquisitions. JLEN’s capital raise of £40 million during July 2017 was oversubscribed, showing investor confidence in the sector and the fund manager’s strong pipeline of deals.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.