Climate chaos

In an unprecedented and deeply unpopular move US President Donald Trump pulled out of the Paris Agreement last week.

The Paris Agreement, adopted in December 2015, committed to: keeping global temperatures below 2.0C, and limiting them further to 1.5C; limiting greenhouse gases emitted by human activity beginning 2050, and reviewing each country’s contribution to cutting emissions every five years. The agreement also stated that wealthier countries should provide climate finance to poorer nations to develop renewables projects and adapt to climate change.

Renewables has been a fast-growing sector for development and investment, but how much progress have we made worldwide in moving towards low-carbon energy production?

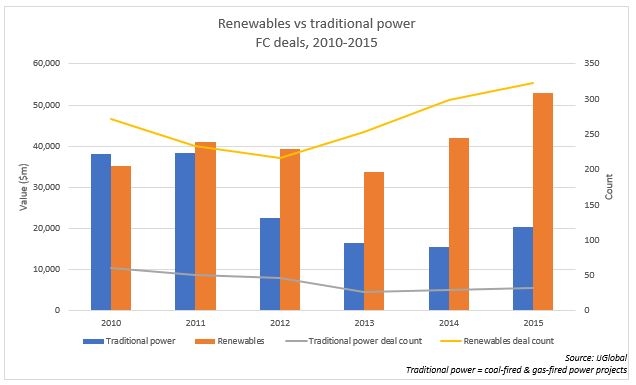

According to IJGlobal data, in the five years leading up to Paris Agreement there was a decline in the financing of traditional power projects globally, with 61 coal-fired and gas-fired power projects reaching financial close in 2010, compared to 33 in 2015.

Many of the deals that reached financial close in the time period would have come to market years before, when coal was the favoured fuel for major developers. In the same period the total investment in renewables remained consistent, while the number of projects to reach financial close rose sharply between 2012 and 2015 as technology advanced and there was a worldwide push towards renewables development.

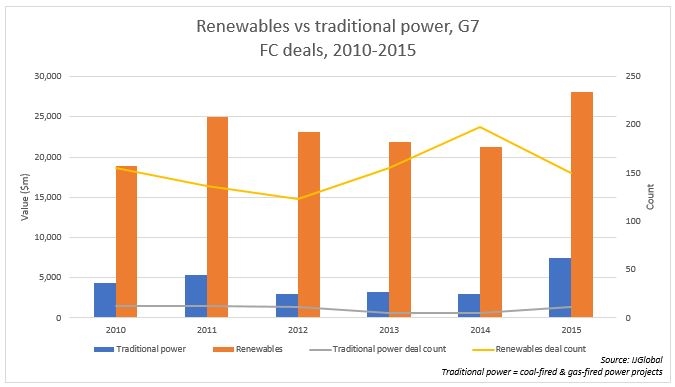

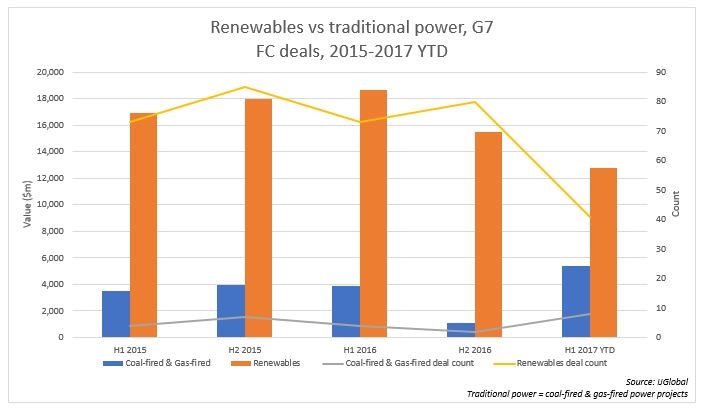

When looking specifically at the G7 group of countries, the group arguably at the forefront of leading the charge on carbon reduction, investment in traditional power projects remained relatively consistent over the time period, even while renewables development prospered. In 2010, 12 traditional power projects reached financial close. Five years later in 2015 that figure had only fallen to 11.

This may be explained by the fact that there remains a requirement for baseload power from fossil fuels. Advances in battery technology may change that in the future, but it will be some time before we see this technology at grid scale. Until that time there will continue to be a steady pipeline of traditional power projects.

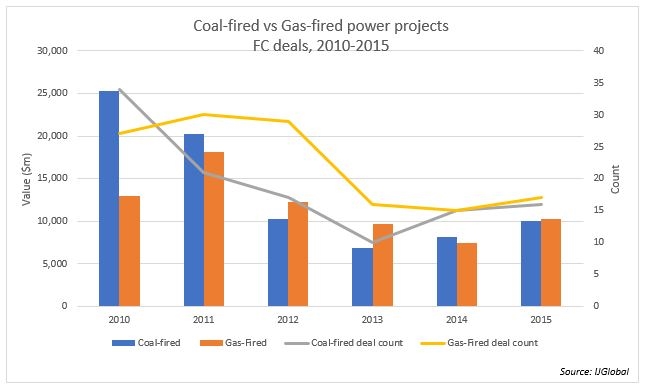

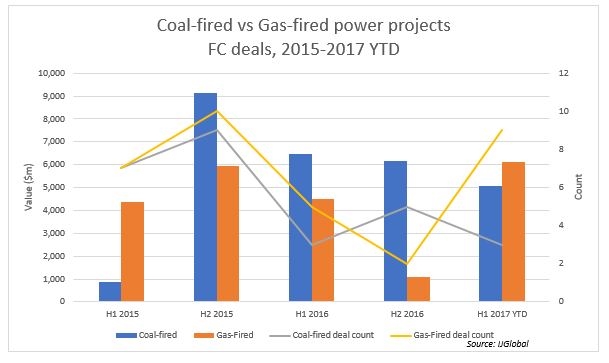

There has been a worldwide effort to reduce the development of coal-fired power plants in favour of gas-fired power and nuclear. The UK saw its first coal-free day since the industrial revolution on the 21 April 2017.

The shift towards gas-fired power is a sign that both the private and public sector are moving towards a renewables-led future. Gas-fired power stations allow a more seamless switch between renewables power and baseload power in times of intermittency.

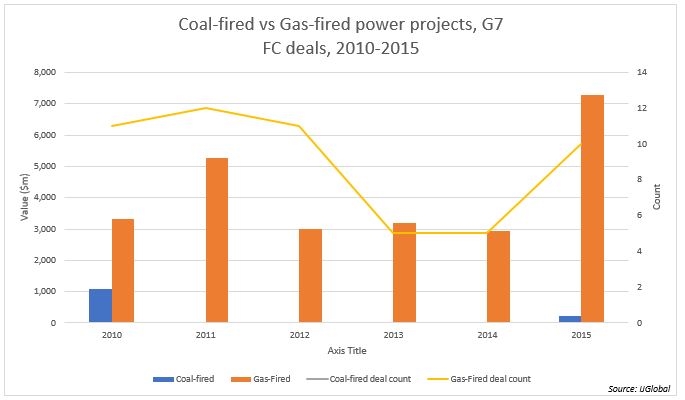

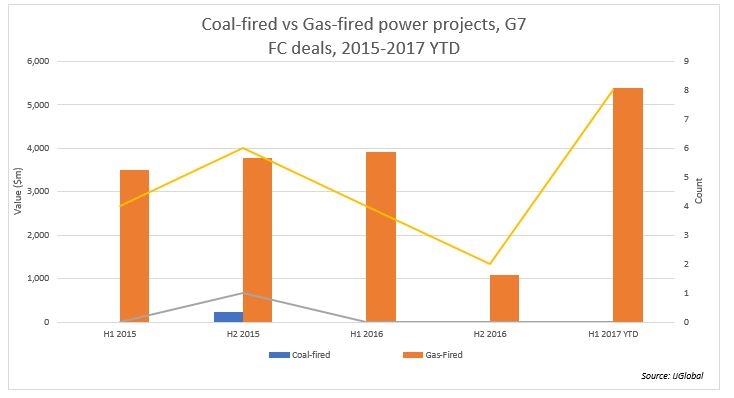

According to data from IJGlobal in the G7 group of countries almost all traditional power projects to reach financial close between 2012 and 2015 were gas-fired, with the exception of one coal-fired project in 2015; the Soma Coal-Fired Thermal Power Plant in Japan.

Since the Paris Agreement was adopted in 2015 have we seen a marked shift to renewables, and gas-fired power as baseload?

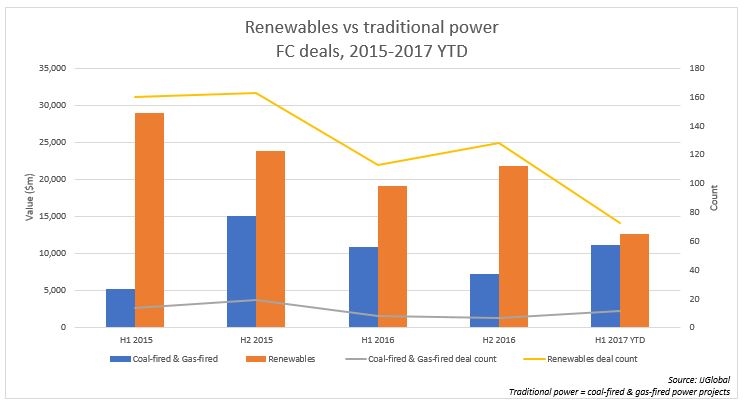

According to IJGlobal data the momentum of renewables investment seen in the run up to 2015 continued, with $106.5 billion invested in renewables projects between 2015-2017YTD globally. But it’s important to note than many of these projects would have come to market in the years before the Paris Agreement.

The first half of 2017 has seen a decline in the number of renewables deals to reach financial close globally. This might be explained by the impact of cuts to subsidies and scaling back of renewables investment in much of the developed world in the last couple of years.

Considering the global drive to reduce reliance on coal-fired power, the investment in coal-fired power projects globally between 2015-2017 YTD has not declined as much as one would expect. The total investment in coal-fired power projects to reach financial close was similar to investment in gas-fired projects. This is largely driven by large-scale, coal-fired power project financings in developing countries, mainly in Asia, where coal is plentiful.

The G7 has led by example. Traditional power development has remained well below renewables investment in 2015-2017 and coal-fired power investment is almost non-existent.

Taking into the consideration procurement time and new developments in the energy sector, it is only now and in the coming years that we will start to see new projects come through to financing. But with cuts in subsidies from some G7 nations, and now the retreat by the US from the climate accord altogether, momentum could wane. Perhaps we can find hope in US state leaders being proactive in continuing their commitment to the Paris Agreement, and a drive to reduce emissions towards a renewable future.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.